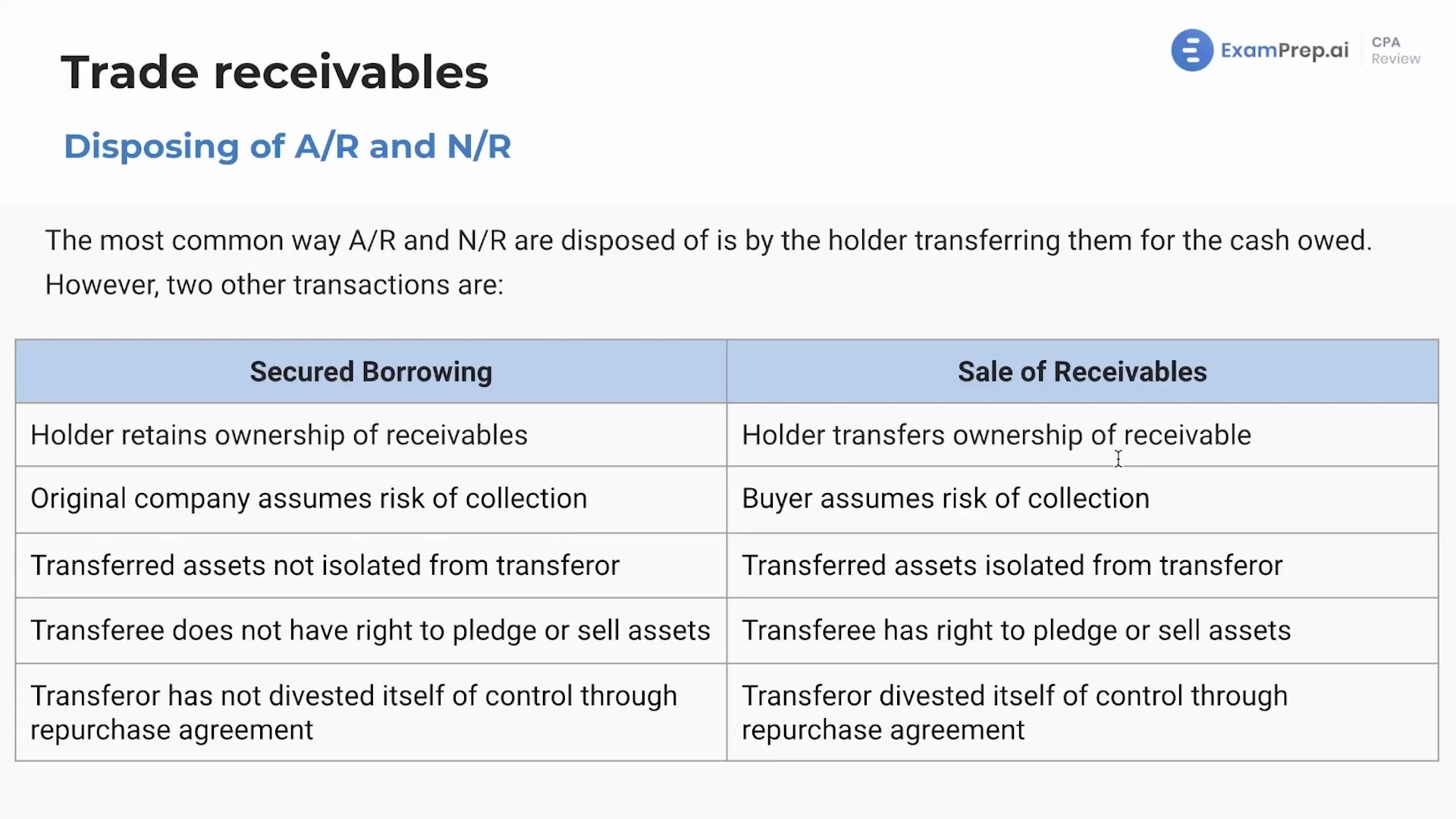

In this lesson, Nick Palazzolo, CPA, dives into the nuances of disposing Accounts Receivable (AR) and Notes Receivable, emphasizing various methods companies can use to remove these items from their balance sheet. Nick breaks down the processes of collecting cash owed, secured borrowing, and the selling of receivables, including interactions with factoring companies. He simplifies the concepts by comparing secured borrowing to obtaining a low-interest loan by leveraging a house, as opposed to the high-interest rates associated with unsecured credit card debt. Further clarifying the accounting implications of each method, Nick explains the differences between retaining ownership of receivables in secured lending versus transferring ownership in the sale to a factoring company. This lesson untangles the complexities behind these financial strategies and outlines their respective risks and control considerations, including the accounting treatments such as recording finance charges, interest expenses, and potential loss on sale of receivables.

This video and the rest on this topic are available with any paid plan.

See Pricing