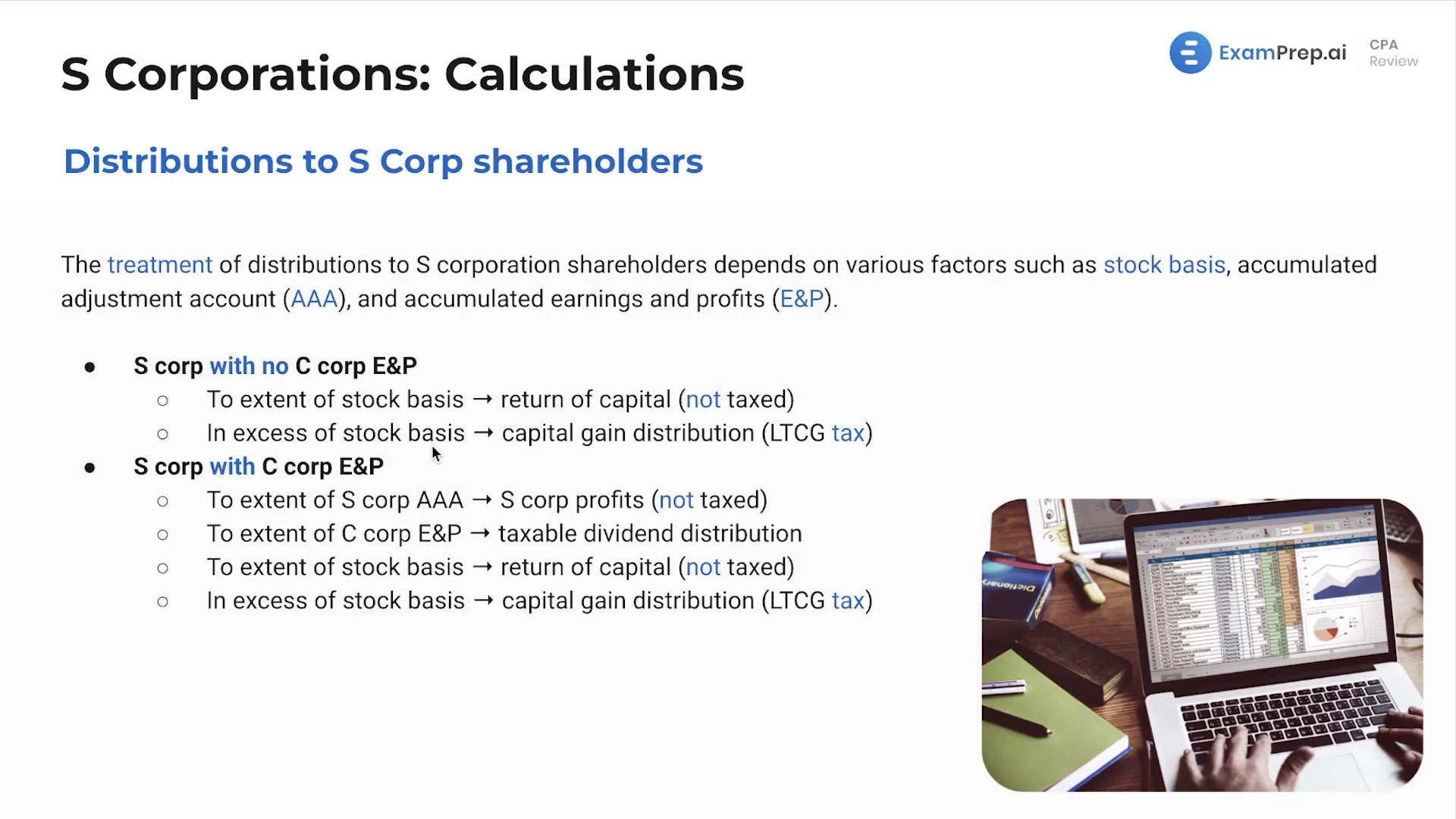

In this lesson, Nick Palazzolo, CPA, breaks down the nuances of distributions to shareholders in an S Corporation, particularly focusing on the tax implications of these distributions. He clarifies the different scenarios a shareholder might face, especially when dealing with an S-Corp that was previously a C-Corp. He goes in-depth on the various factors that influence how distributions are taxed, such as stock basis, accumulated adjustments account (AAA), and accumulated earnings and profits (E&P). Through examples, he illustrates the 'filling up the buckets' concept to showcase the classification of profits and describes how distributions can be treated as a return of capital, dividend, or capital gain. Nick's clear explanations shed light on the complexities of S-Corp distributions, making it easier to navigate the taxation landscape.

This video and the rest on this topic are available with any paid plan.

See Pricing