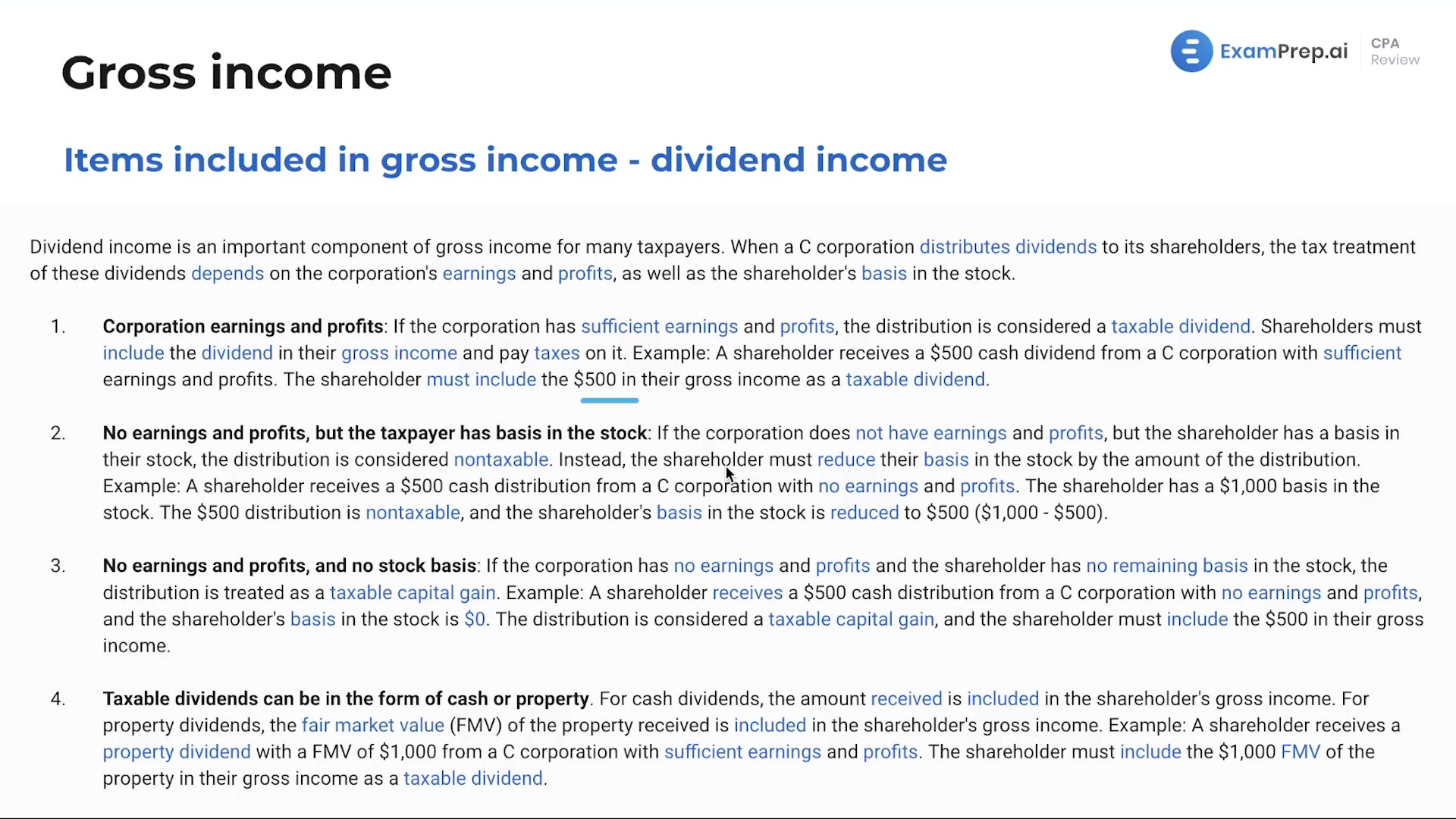

In this lesson, Nick Palazzolo, CPA, takes a deep dive into the nuanced world of dividend income and its implications on tax filings. He paints a clear picture of how dividend distributions from C corporations affect shareholders, emphasizing the significance of earnings and profits as well as shareholder stock basis in determining tax treatments. Nick walks through several scenarios, from standard taxable dividends to distributions without earnings and profits, clarifying when and how reductions to stock basis or taxation as capital gains occur. He ensures the nuances of cash versus property dividends aren’t overlooked, imparting a comprehensive understanding that is vital for navigating related exam questions and real-world applications.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free