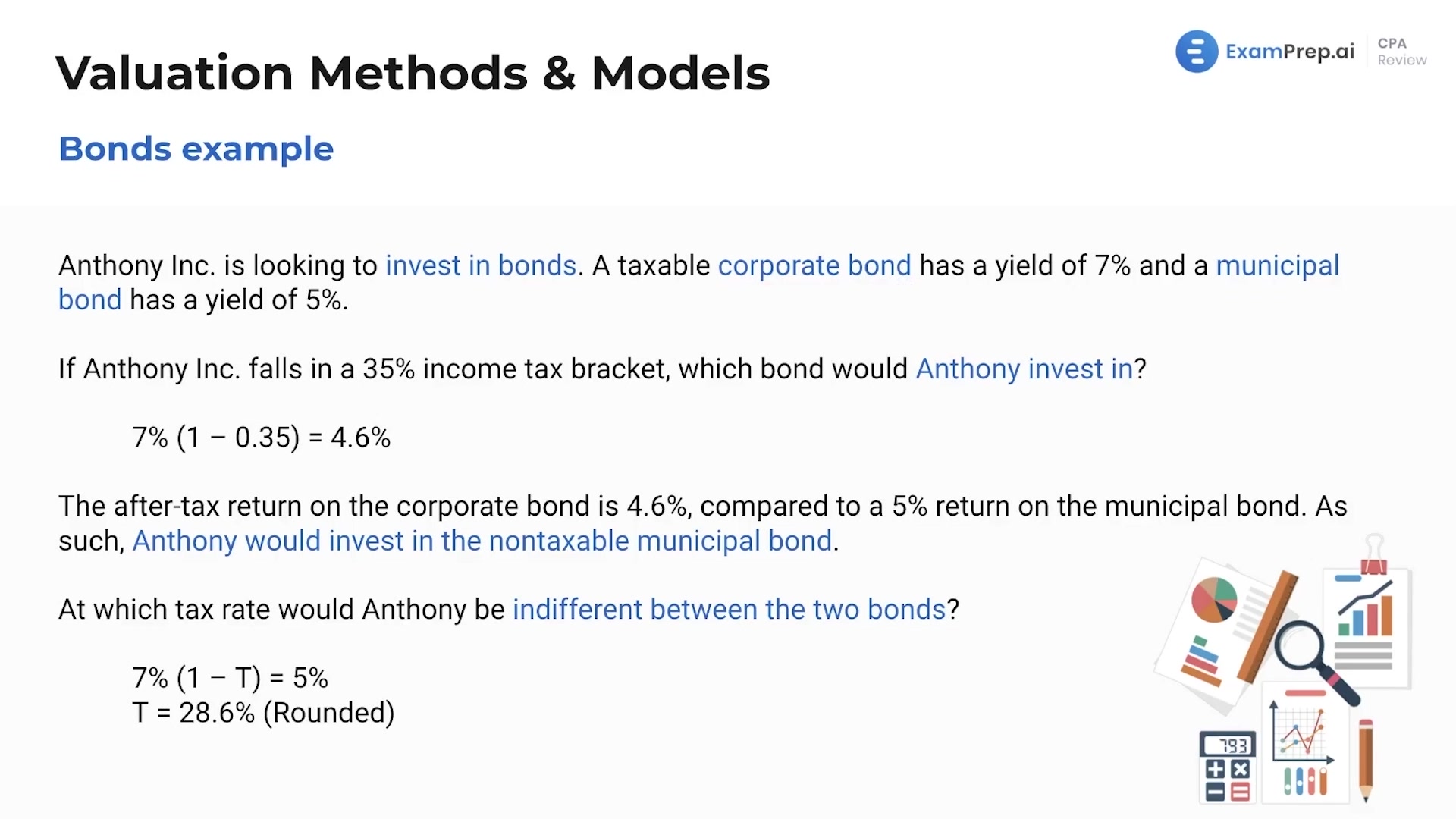

In this lesson, Nick Palazzolo, CPA, demystifies dividends and bonds with a refreshing conversational approach, setting aside complex mathematics to focus on core concepts vital for BEC. Nick clarifies that dividends become a company's liability only after the board's declaration and are discretionary rewards from surplus cash, not shareholder entitlements. Using real-world examples like Amazon and Disney, he explains strategic dividend distributions and their implications for shareholder incentives and stock prices. Nick also outlines the non-deductible nature of dividends on corporate taxes and their ordinary income taxation for individuals. Diving into preferred stock characteristics, Nick walks you through dividends in arrears and the nuances that differentiate preferred stock from common stock and debt instruments. Lastly, Nick provides a relatable example comparing corporate bonds to municipal bonds, unwrapping the concept of yields, tax implications, and investment decision-making based on tax brackets, bringing clarity to the often daunting topic of bonds.

This video and the rest on this topic are available with any paid plan.

See Pricing