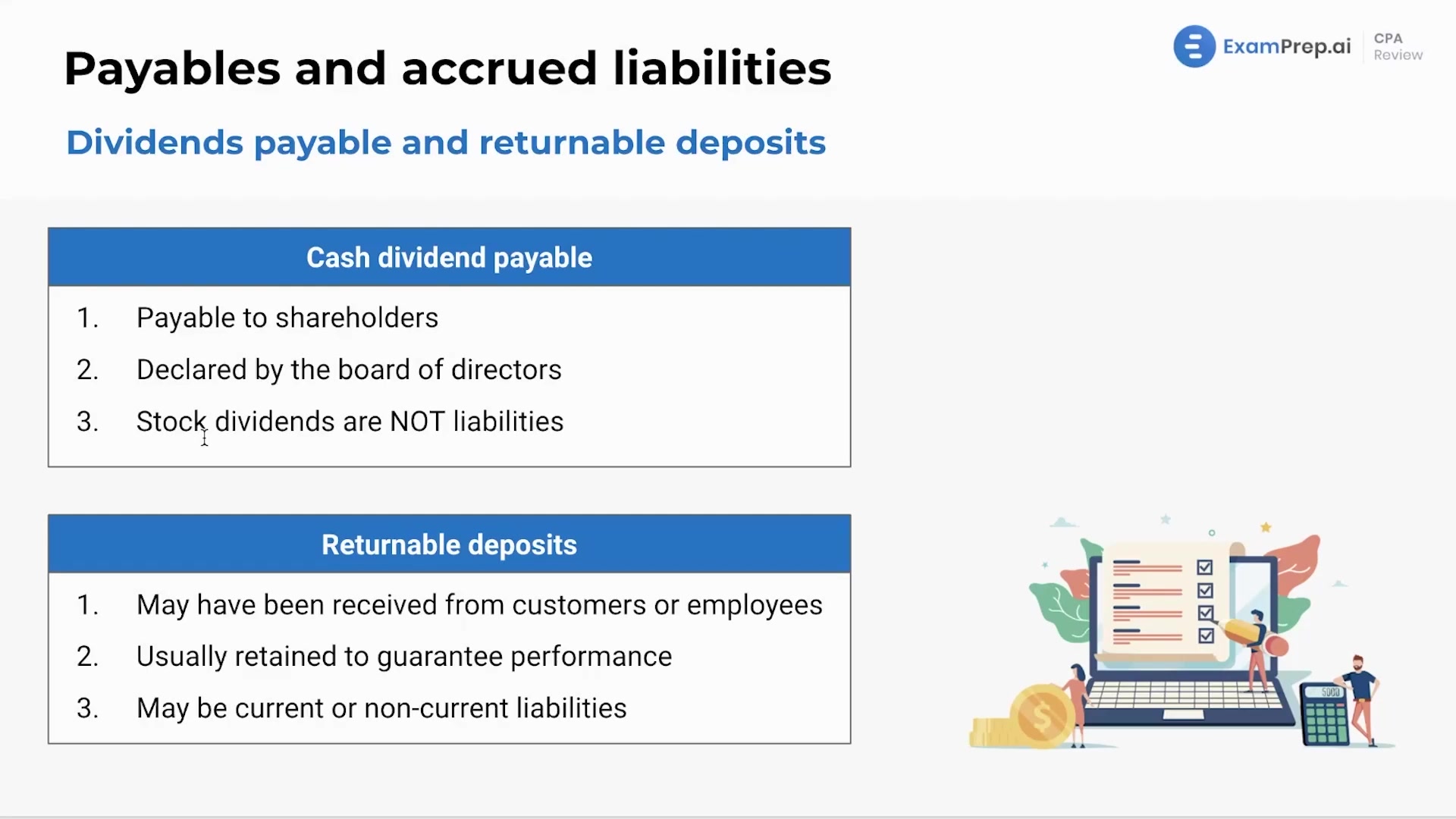

In this lesson, Nick Palazzolo, CPA, clarifies the nature of dividends payable and the accounting treatment for returnable deposits, both of which are types of liabilities. Nick breaks down the process of declaring cash dividends payable and how they are paid out of retained earnings to shareholders after being declared by the board of directors. He further distinguishes between cash and stock dividends, emphasizing that stock dividends do not count as liabilities since they involve the distribution of additional stock rather than cash. The lesson also covers returnable deposits, drawing an analogy to security deposits, and explains their role as financial guarantees and their classification as either current or non-current liabilities based on the term of the associated agreement.

This video and the rest on this topic are available with any paid plan.

See Pricing