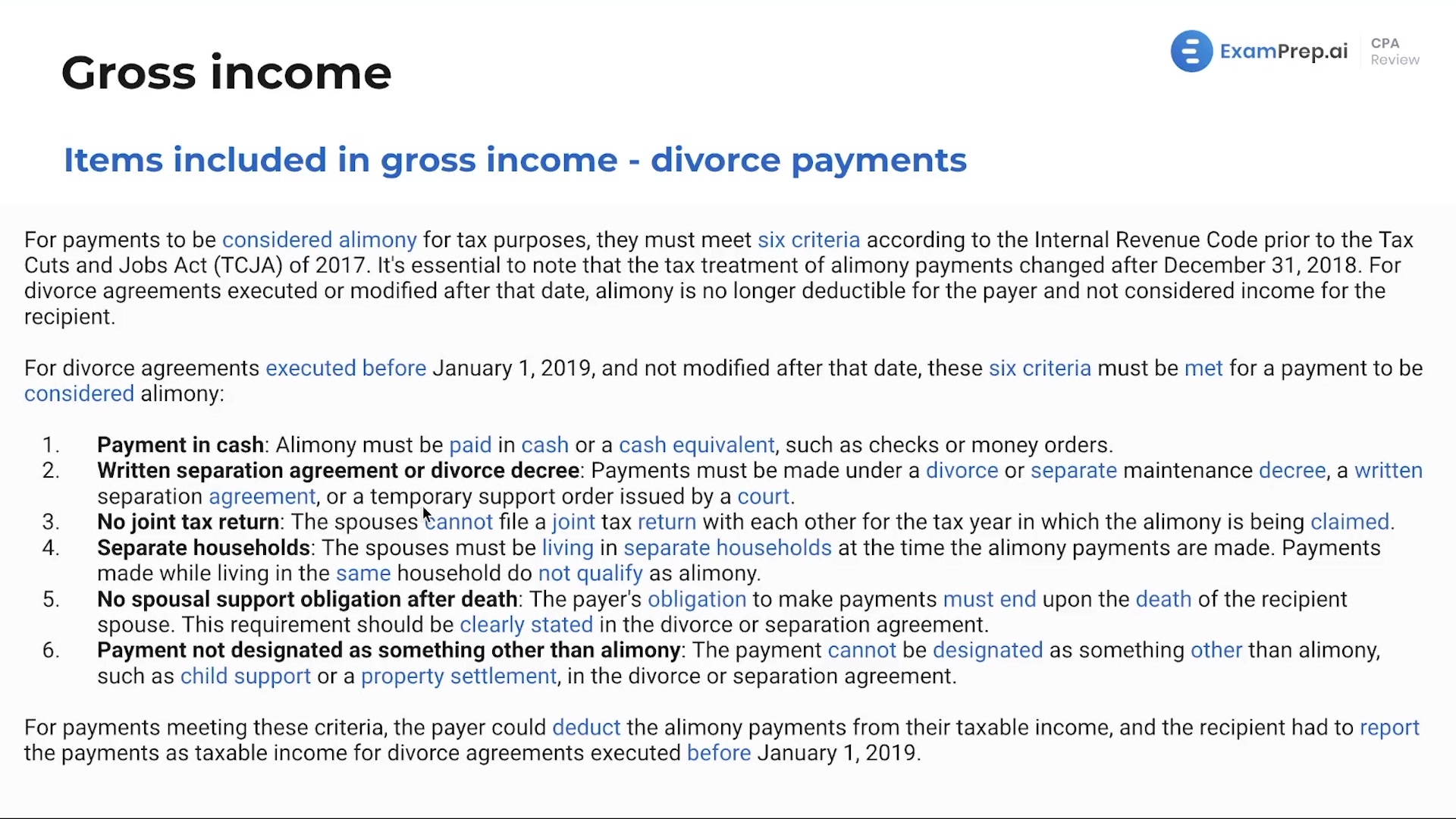

In this lesson, dive into the complexities of divorce payments and their tax implications with Nick Palazzolo, CPA. He clarifies the significant changes brought about by the Tax Cuts and Jobs Act, emphasizing the tax treatment alterations for alimony before and after December 31st, 2018—previously deductible and included in gross income before the cutoff date but not after. Discussions also include the rationale behind the tax treatment of child support payments, which remain unaffected by date. The lesson further dissects property settlement considerations during divorce and outlines six essential criteria for payments to be classified as alimony, according to the Internal Revenue Code (IRC). Nick ensures that by the end of this lesson, the criteria for what constitutes alimony, property settlements, and child support are not merely remembered but fully understood using practical scenarios that could emerge on the exam.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free