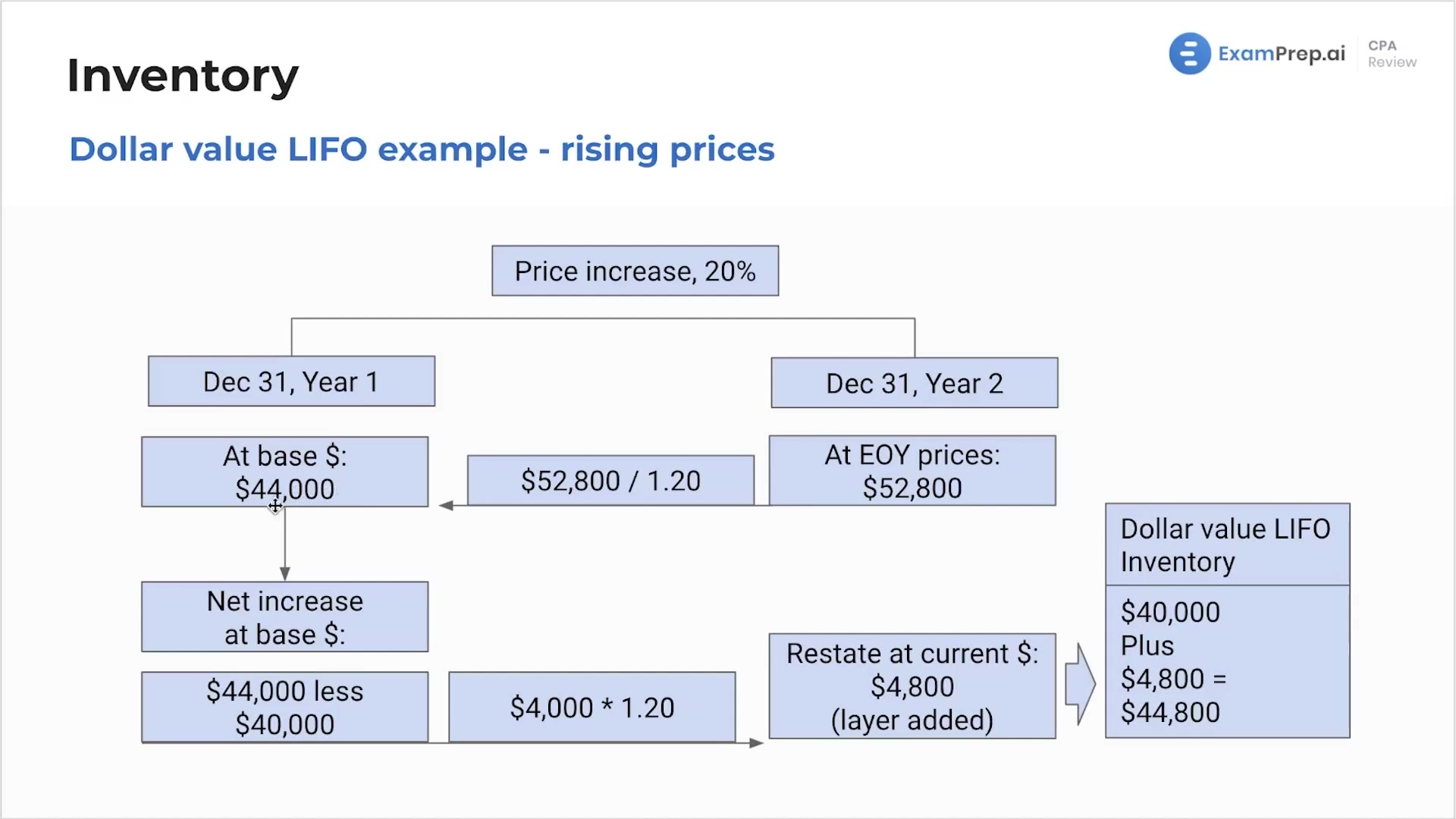

In this lesson, Nick Palazzolo, CPA, breaks down the intricacies of the dollar value LIFO method using a practical example. He walks through the process of determining how inventory layers are affected by inflation and general price increases. With an engaging graphic, Nick examines a scenario involving Hawk Inc. to illustrate how to adjust the base layer of inventory to reflect changes in prices. He provides a step-by-step guide to restating the year-one inventory to account for an inflation adjustment. Additionally, Nick explains what happens in the unusual situation of declining prices and how this impacts the inventory layers—shedding light on the peeling off of layers and the inability to rebuild them, thereby clarifying this often-confusing topic.

This video and the rest on this topic are available with any paid plan.

See Pricing