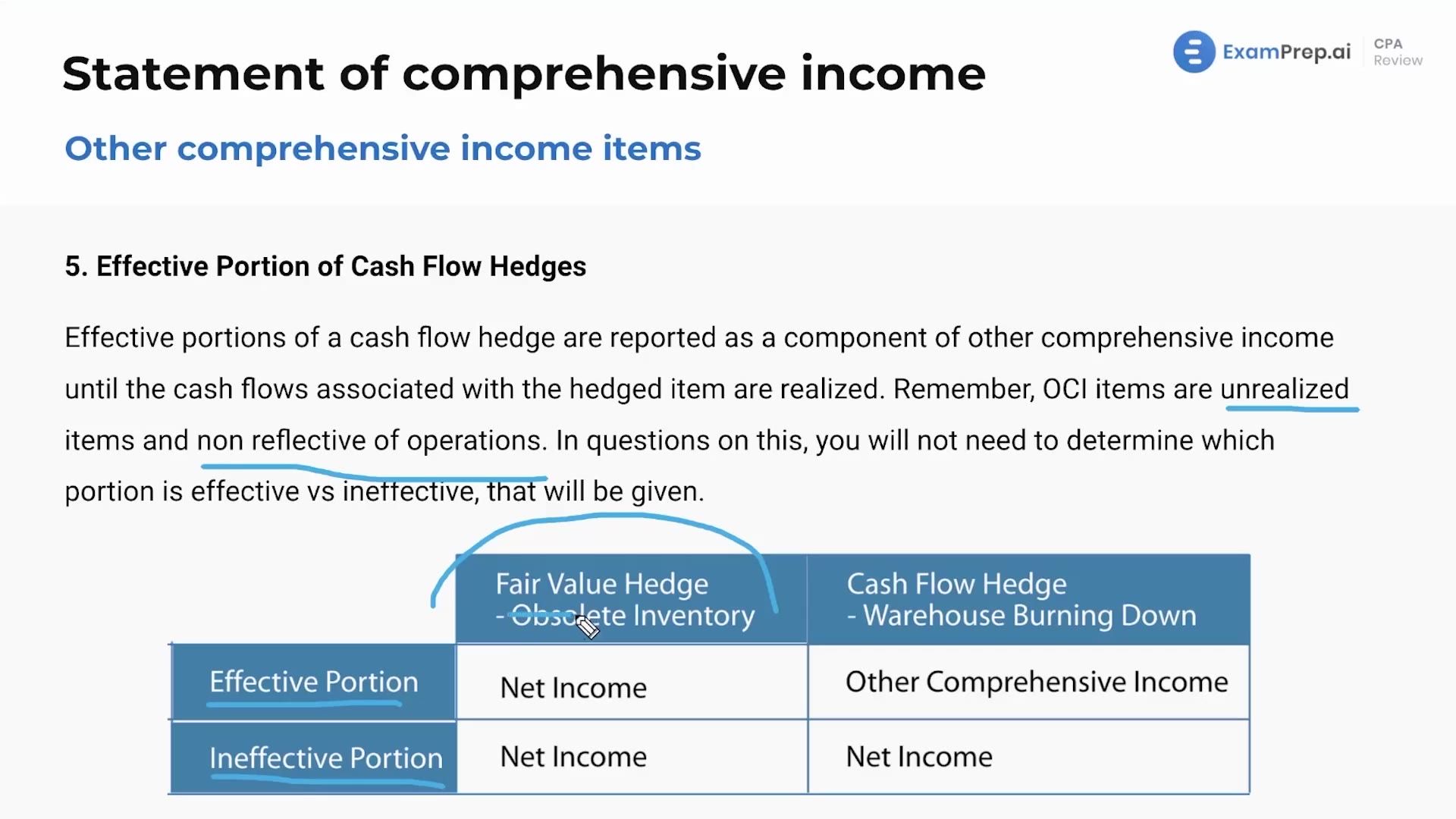

In this lesson, Nick Palazzolo delves into the specifics of cash flow hedges and their effective portion, explaining how they fit within the broader context of hedges and derivatives. Nick breaks down the terms by comparing financial hedging to an insurance policy, providing relatable examples such as inventory insurance at an electronics store. He clarifies that the effective portion of these hedges — the part that truly offsets the losses — is reported in Other Comprehensive Income (OCI) since it represents unrealized gains or losses and isn't part of the day-to-day operations. Nick lays out, in straightforward terms, the difference between fair value hedges and cash flow hedges, emphasizing the importance of understanding where these items are reported for proper financial representation.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free