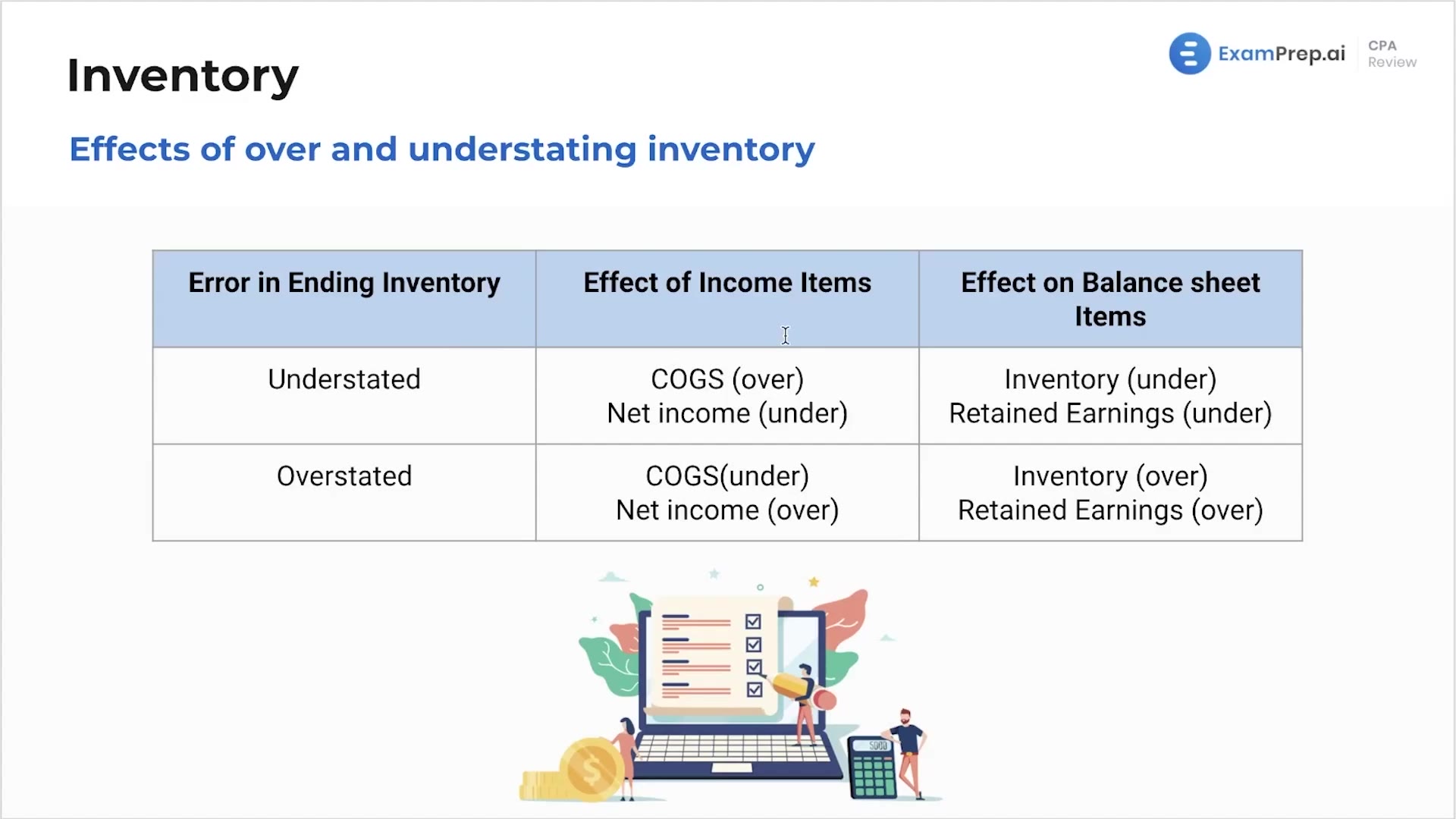

In this lesson, explore the ramifications of inaccuracies in inventory accounting with a focus on the consequences of overstatement and understatement. Unpacking the domino effects that an error in year-end inventory figures can have, Nick Palazzolo, CPA, examines how such miscalculations can lead to inflated or deflated cost of goods sold and net income. Moving from the income statement to the balance sheet, he explains the impact on ending inventory and retained earnings. Always emphasizing understanding over rote memorization, Nick demonstrates how these fundamental concepts are not only crucial for grasping the basic accounting principles but also for tackling simulation questions and the most challenging aspects of inventory accounting scenarios.

This video and the rest on this topic are available with any paid plan.

See Pricing