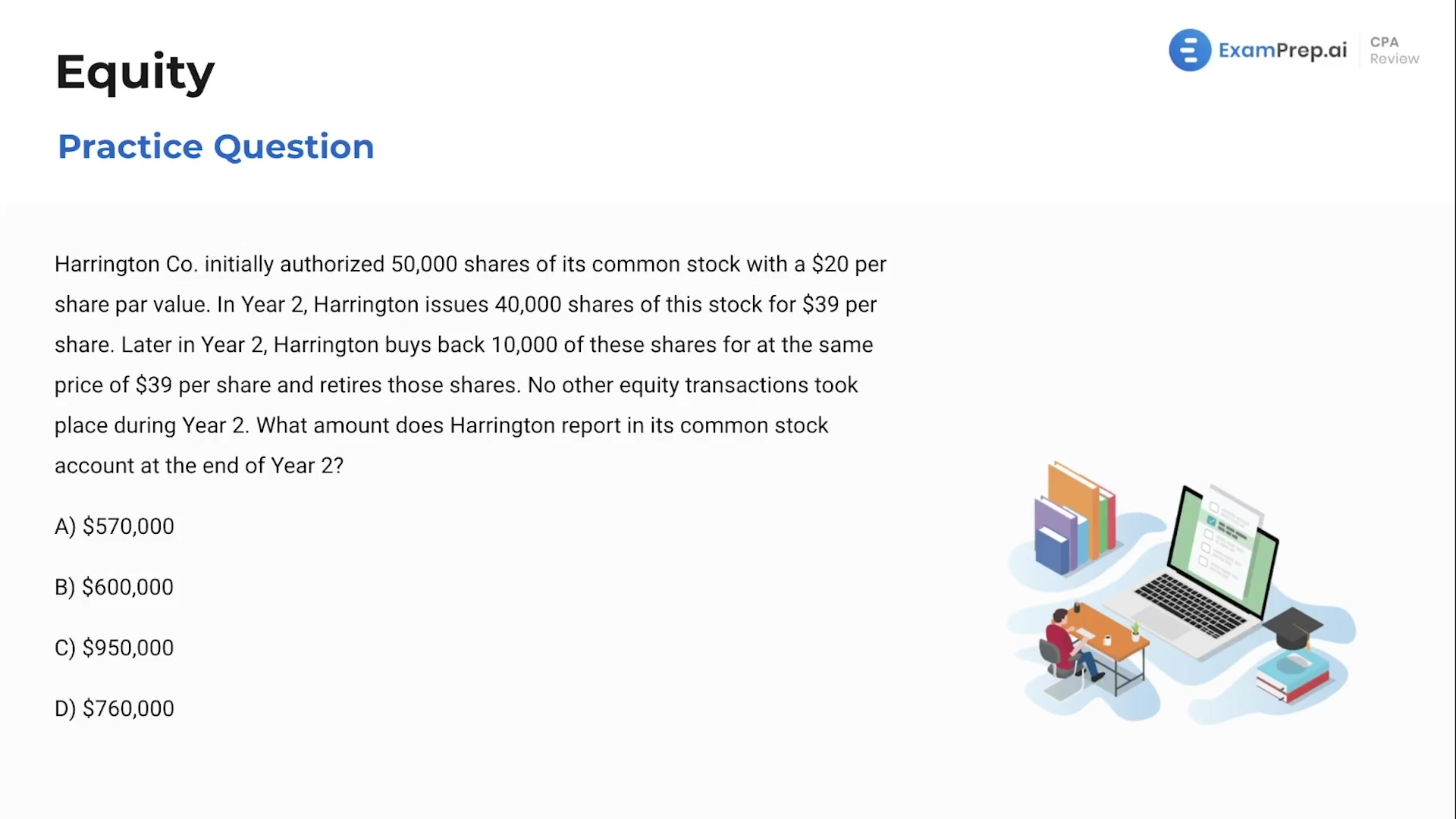

In this lesson, Nick Palazzolo, CPA, takes you through a series of practice questions designed to enhance your understanding of equity accounts and their impact on a company's financial statements. Starting with stock dividends, Nick breaks down the journal entries that correspond to various dividend declarations and payments. He skillfully guides you through the rationale behind these entries and their effects on retained earnings and additional paid-in capital. Moving on, he clarifies the specific dates on which changes in retained earnings occur and navigates through the complexities of stock transactions, such as issuances and buybacks. Lastly, Nick relates these concepts back to the bigger picture, illustrating how equity transactions feed into the calculation of net income, an essential component of a company's health and performance. With practical examples and step-by-step explanations, this lesson arms you with the analytical tools to tackle equity-related questions confidently.

This video and the rest on this topic are available with any paid plan.

See Pricing