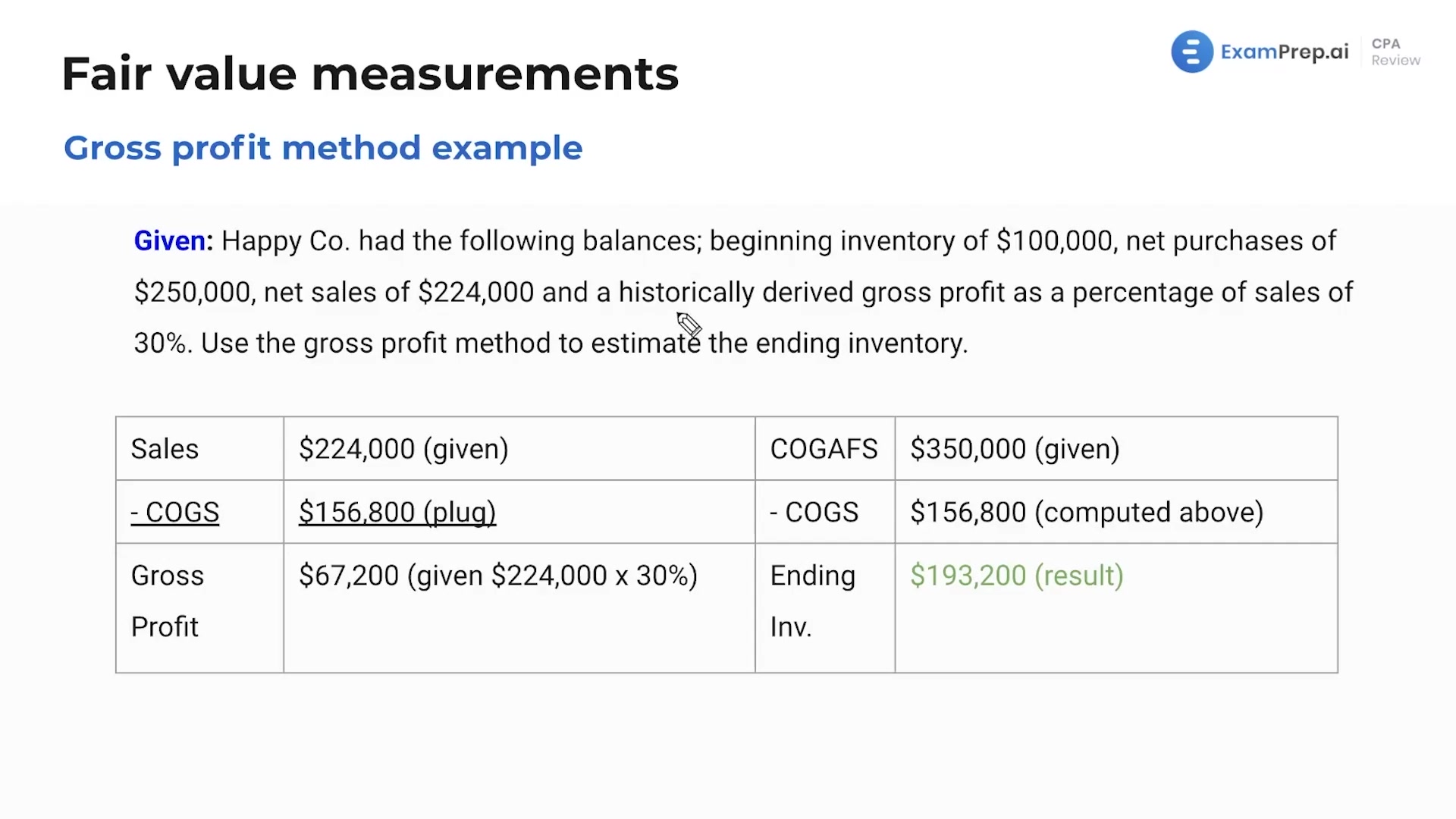

In this lesson, harness an understanding of how to apply the gross profit method for estimating inventory cost, which is particularly useful in scenarios like casualty losses where quick estimation is needed. Nick Palazzolo, CPA, breaks down the fundamental assumptions of the method, emphasizing the importance of starting with familiar cost accounting formulas for inventory valuation. Through a practical example involving a company's balances and a gross profit rate based on historical data, Nick demonstrates step-by-step how to plug in given information to deduce the ending inventory figure. This method may not be the standard for financial reporting, but it's crucial for preparing for those curveball questions that can pop up during the exam.

This video and the rest on this topic are available with any paid plan.

See Pricing