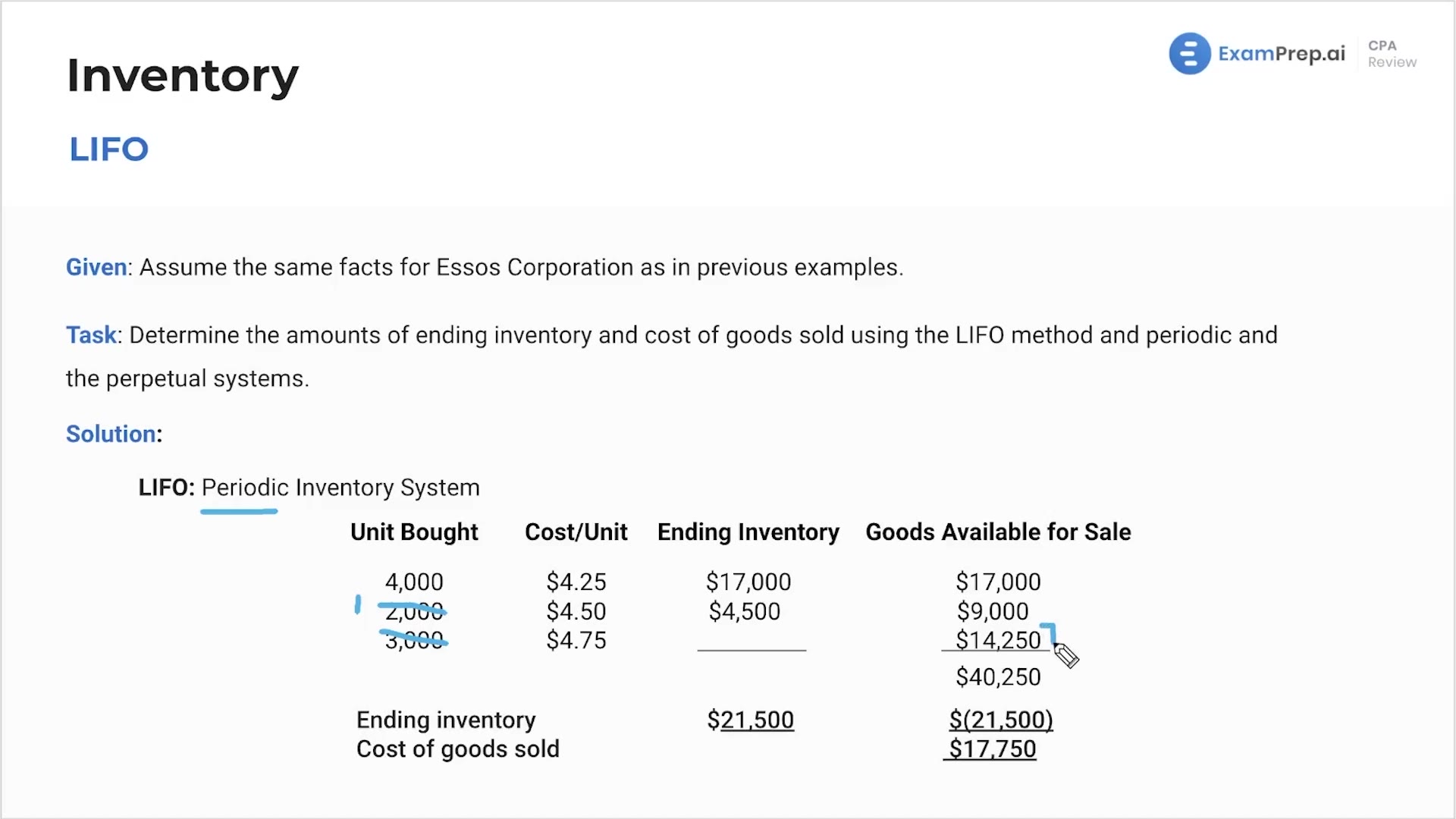

In this lesson, Nick Palazzolo, CPA, takes a deep dive into LIFO, or Last In, First Out, valuation within a periodic inventory system context. With his upbeat and engaging style, Nick illustrates how to calculate both ending inventory and cost of goods sold under LIFO. He breaks down the methodology by considering a company's latest inventory purchases and sales, ensuring a clear understanding of the process from start to finish. Nick makes sure to differentiate between periodic and perpetual systems, simplifying the concept by working through a practical example and reminding everyone to pay attention to the details, as they always matter when it comes to inventory valuation.

This video and the rest on this topic are available with any paid plan.

See Pricing