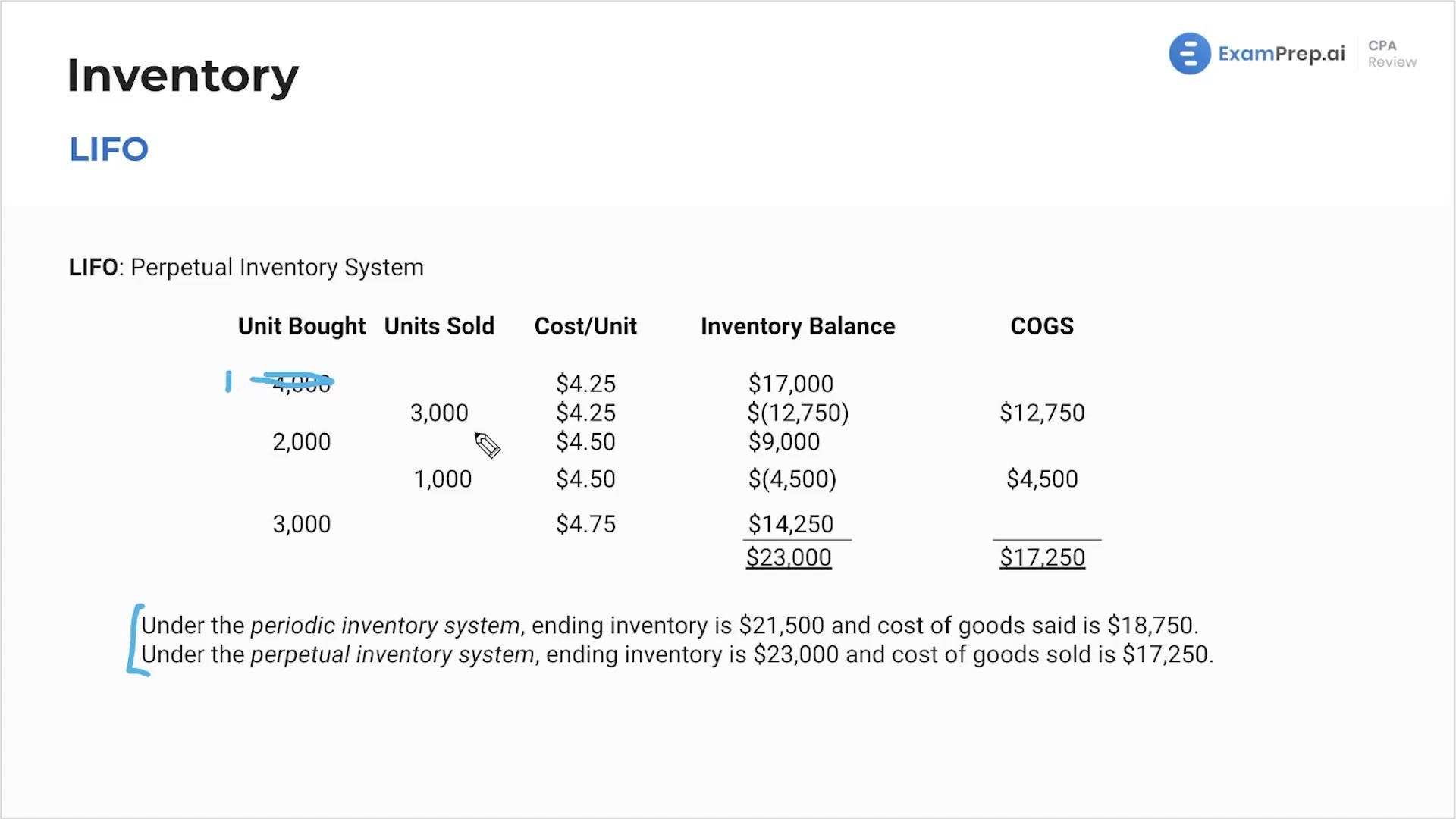

In this lesson, Nick Palazzolo, CPA, breaks down the perpetual inventory system under the LIFO (Last-In, First-Out) method with a practical example. He walks through the nuanced differences between periodic and perpetual inventory systems when using LIFO, emphasizing the unique approach to determining cost of goods sold from the most recent inventory. As Nick reads through the inventory 'story' chronologically, he meticulously details the process of matching sales with the latest inventory batches, calculating cost of goods sold, and arriving at the ending inventory value. This methodical approach to the perpetual LIFO system highlights its distinctive nature and the strategic insights it provides for inventory management.

This video and the rest on this topic are available with any paid plan.

See Pricing