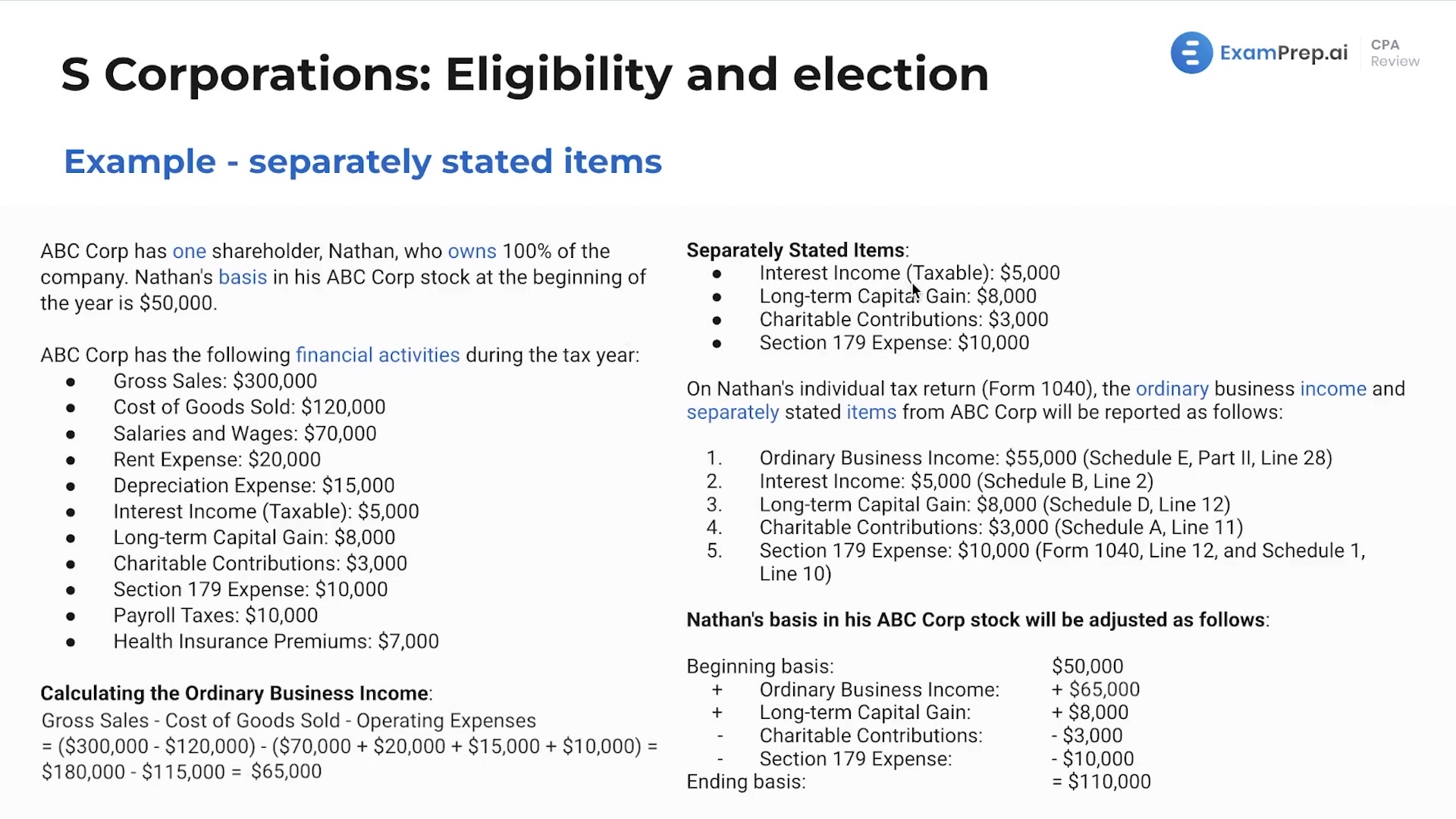

In this lesson, Nick Palazzolo, CPA, delves into the intricate topic of separately stated items and their impact on a shareholder's basis. With an engaging, energetic approach, he walks through a detailed example involving ABC Corp and its sole shareholder, Nathan, highlighting common financial activities and how they're allocated for tax purposes. With a focus on ordinary business income calculation and the importance of proper reporting on various schedules of the tax form, Nick breaks down complex concepts with ease. He makes sure to clarify how items like health insurance premiums and payroll taxes are treated, and explains the significance of understanding the flow-through of these items to Nathan's individual Form 1040. By the end of the lesson, the calculation of Nathan's ending stock basis and taxable income become crystal clear, demystifying the process of how separately stated items affect a shareholder's tax obligations.

This video and the rest on this topic are available with any paid plan.

See Pricing