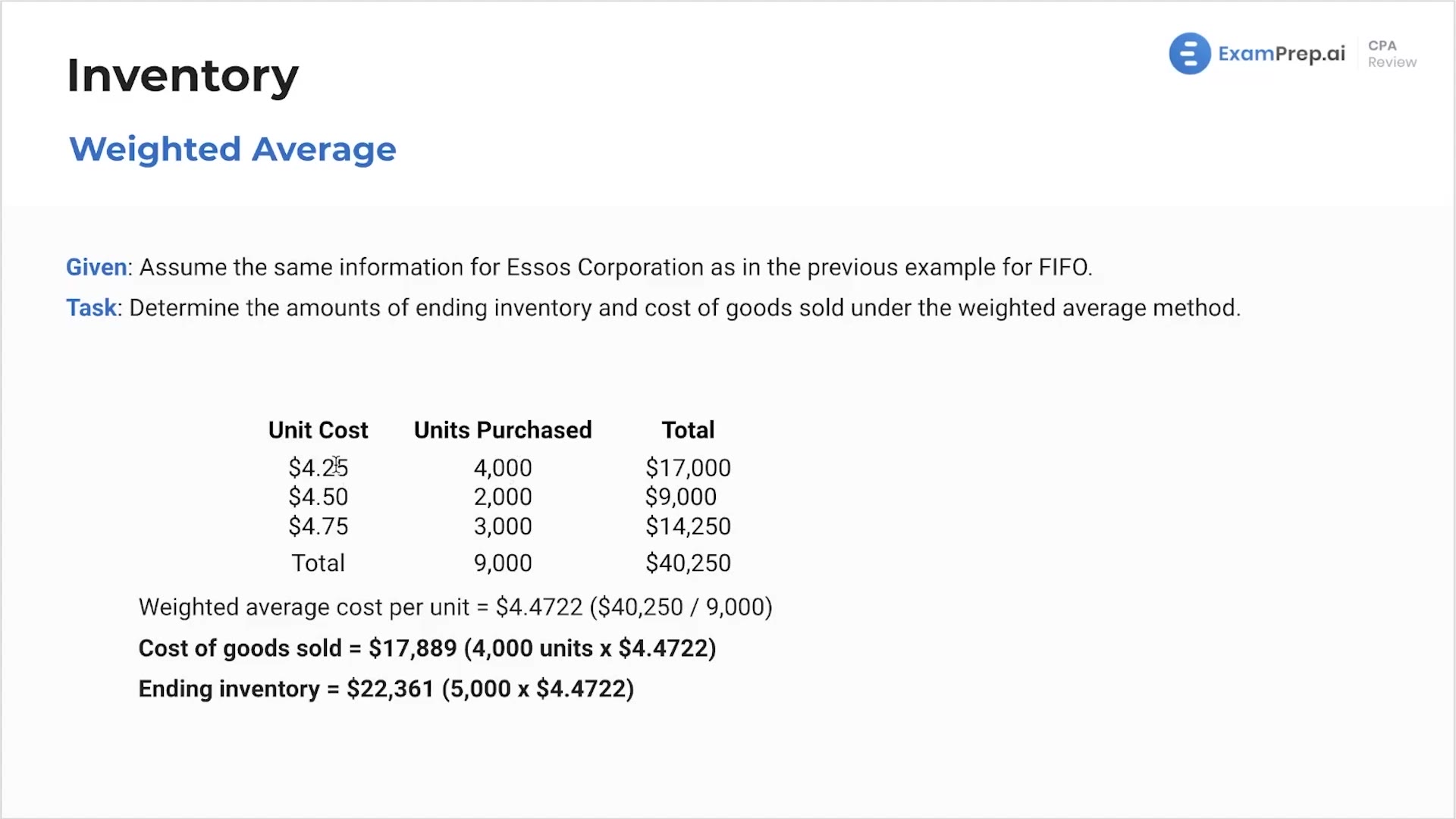

In this lesson, Nick Palazzolo takes the mystery out of inventory valuation by explaining the weighted average method. He clarifies the distinction between weighted average and moving average, indicating that the former uses the periodic method while the latter uses the perpetual method. With a hands-on approach, Nick walks through the process of calculating the weighted average cost by diving into the calculation itself—dividing the total cost of inventory available by the available units. He further simplifies the concept by working through an example that demonstrates how to determine the cost of goods sold using the average cost per unit, reinforcing the practical application of this method in inventory accounting.

This video and the rest on this topic are available with any paid plan.

See Pricing