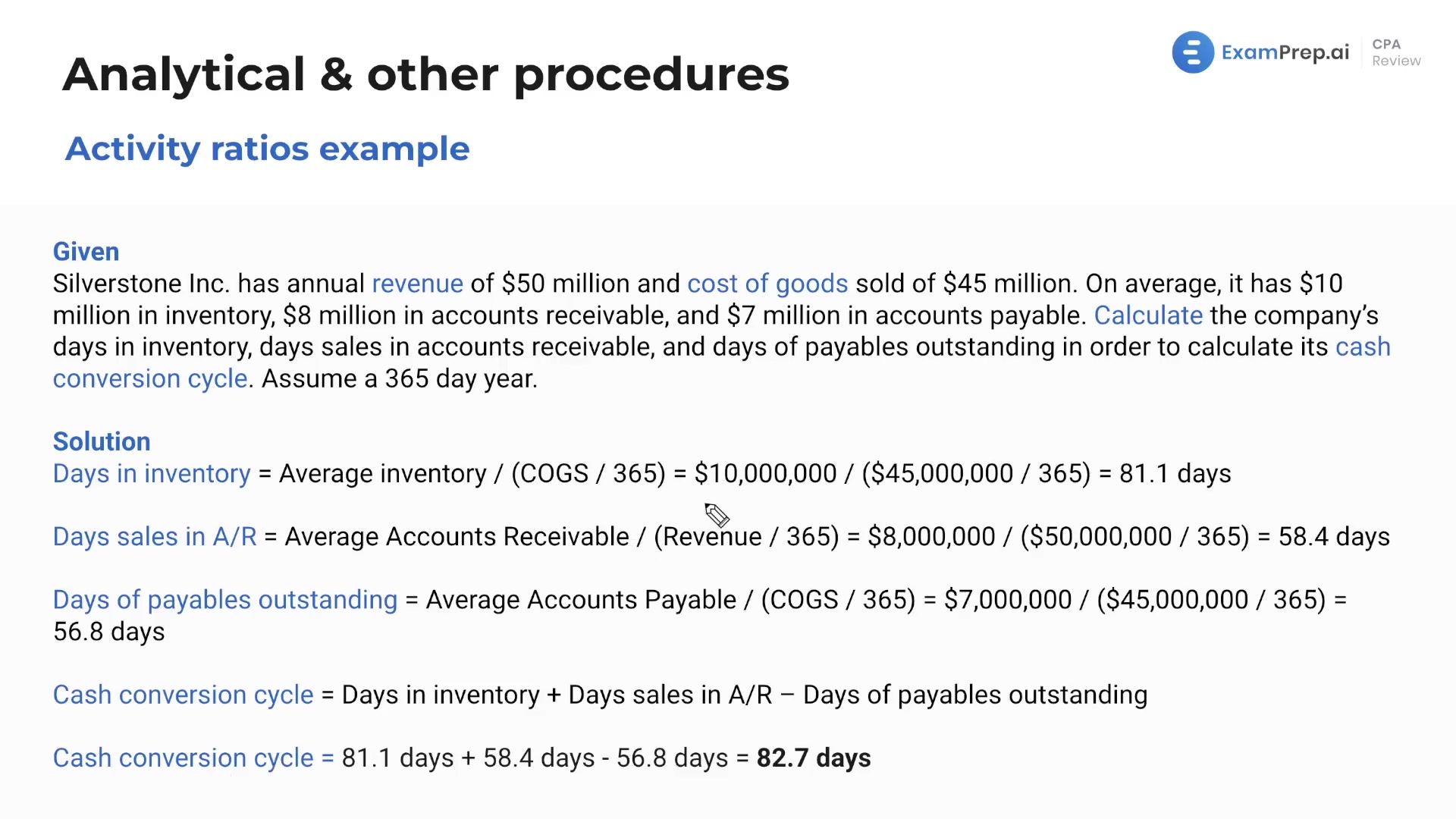

In this lesson, Nick Palazzolo provides an example of how a company can improve their quick ratio by selling obsolete inventory. He explains the importance of a higher quick ratio for liquidity and discusses how this process increases cash without impacting current liabilities. Additionally, Nick examines activity ratios such as days in inventory, days in accounts receivable, and days of payable outstanding, all of which play a crucial role in a company's cash conversion cycle. Through an example, he demonstrates how to calculate these ratios and highlights the importance of having a low cash conversion cycle. By the end of the lesson, viewers will better understand the significance of these ratios and how they relate to a company's financial health.

This video and the rest on this topic are available with any paid plan.

See Pricing