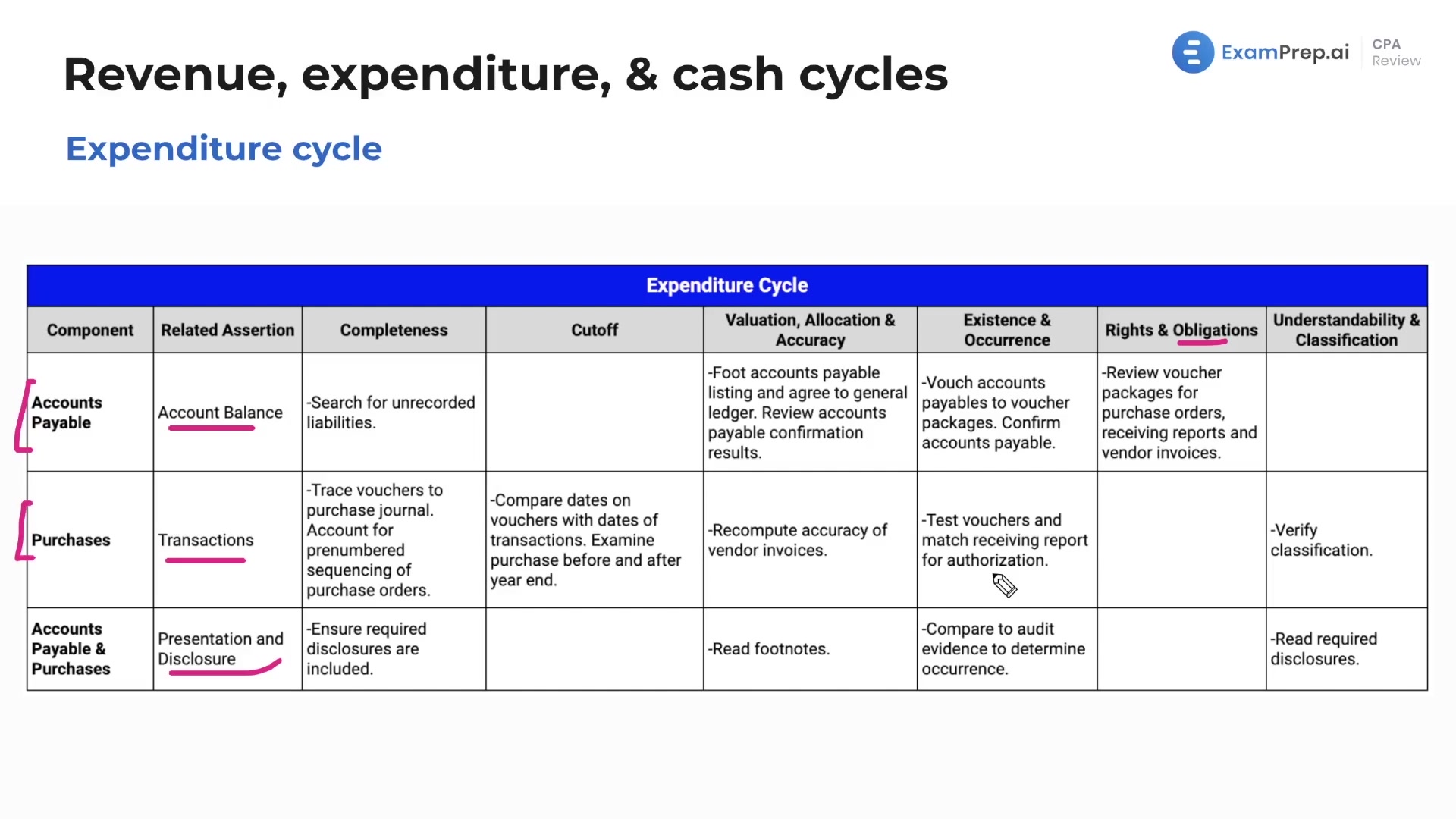

In this lesson, the focus is on the expenditure cycle, which involves accounts payable, purchases, and cash disbursements. The lesson covers various audit procedures for testing assertions such as completeness, valuation, allocation, and accuracy, among others. It starts with accounts payable procedures and then moves on to audit procedures for testing purchases. Additionally, the lesson outlines the importance of assessing presentation and disclosure, ensuring that the required disclosures are included, footnotes are read, and audit evidence is compared to determine occurrence. Lastly, the general assumption of the expenditure cycle is discussed, emphasizing the prevalence of credit purchases and the relationship between purchases, accounts payable, and cash disbursements.

This video and the rest on this topic are available with any paid plan.

See Pricing