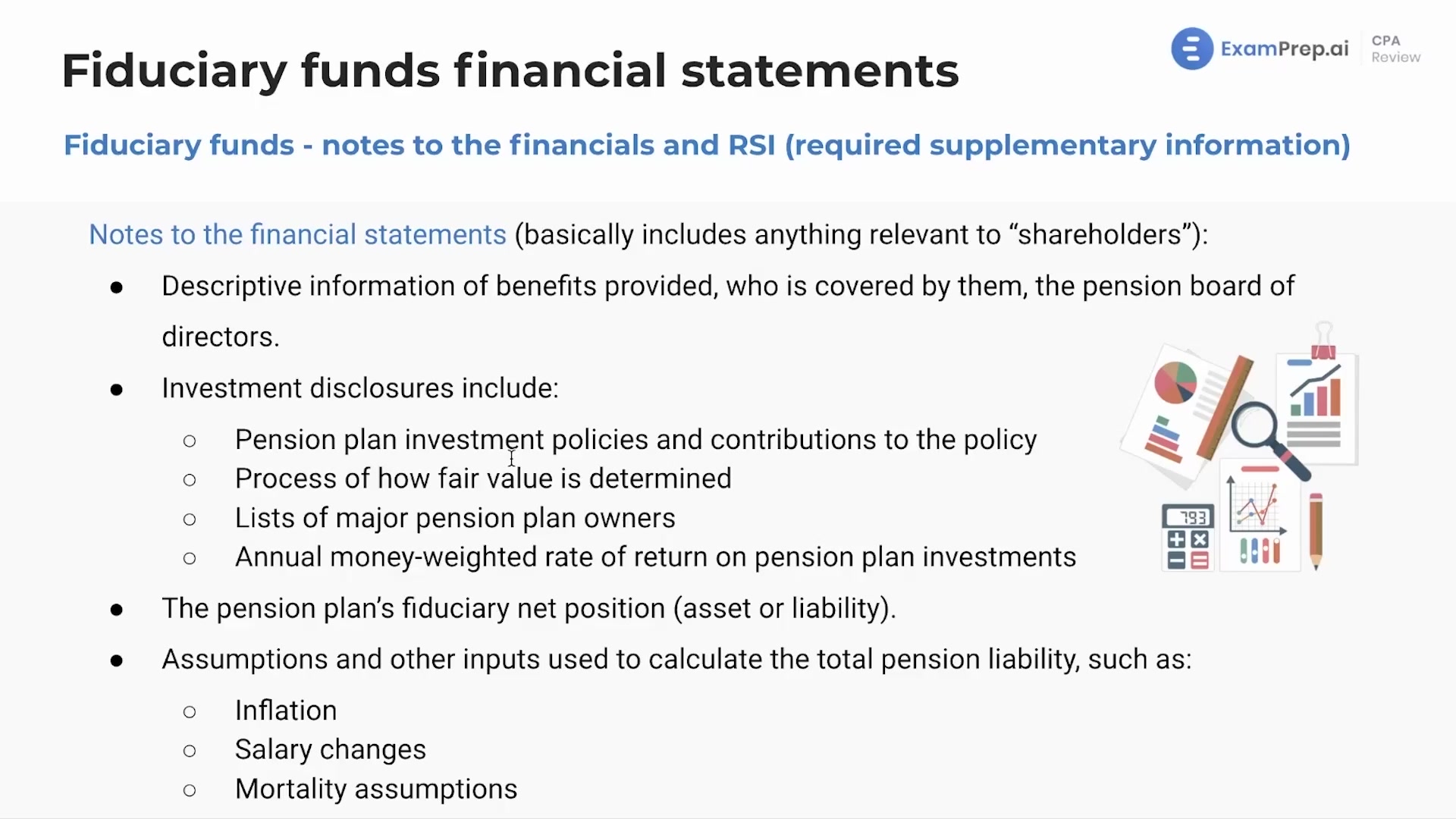

In this lesson, Nick Palazzolo, CPA, delves into the specific reporting requirements for fiduciary funds, pointing out that unlike with proprietary funds, fiduciary funds do not necessitate a Statement of Cash Flows. Nick emphasizes the importance of understanding which financial statements are required and breaks down the key items that must be disclosed in the notes to the financial statements and required supplementary information (RSI). From descriptive information about the benefits and beneficiaries of pension plans to the policies governing contributions and valuation methods for asset determination, Nick ensures that everything necessary to provide a clear picture of a fiduciary fund’s financial status is covered. He also covers significant factors that could impact the fund's financial health, such as longevity and salary changes, which are pivotal in assessing a pension plan's ability to meet its obligations.

This video and the rest on this topic are available with any paid plan.

See Pricing