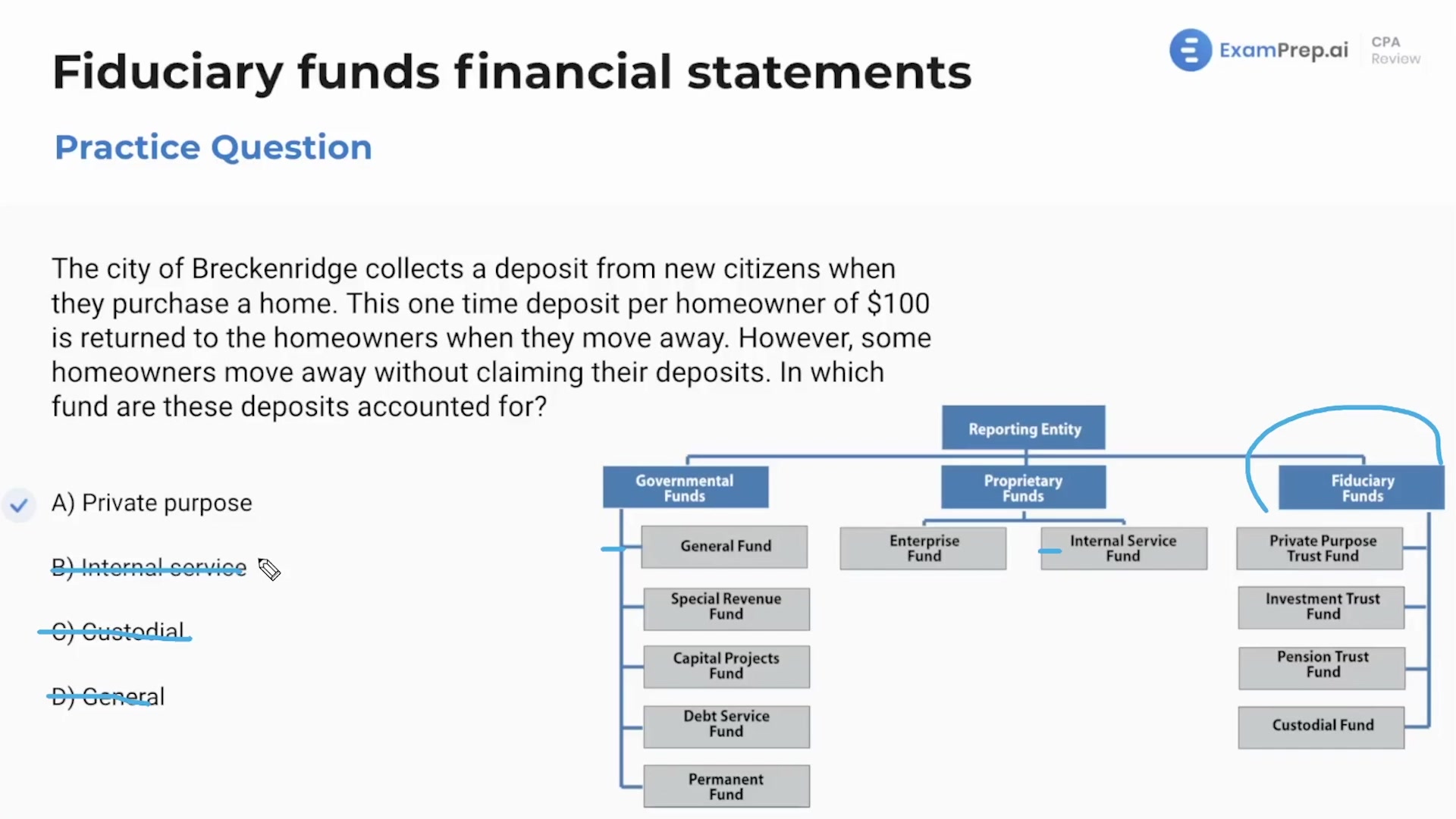

In this lesson, Nick Palazzolo, CPA, dives into the practical aspects of accounting for fiduciary funds in governmental accounting. He presents thought-provoking questions and scenarios that replicate the complexities encounter with fiduciary funds financial statements, specifically focusing on how governments account for deposits and pass-through funding. With his engaging and conversational teaching style, Nick outlines the differences between custodial and private purpose funds, elucidating the significance of understanding where to account for abandoned property and illustrating where to record assets held for other government entities. Wrapped up with his characteristic wit, this session will leave you feeling more confident about tackling fiduciary fund questions with ease.

This video and the rest on this topic are available with any paid plan.

See Pricing