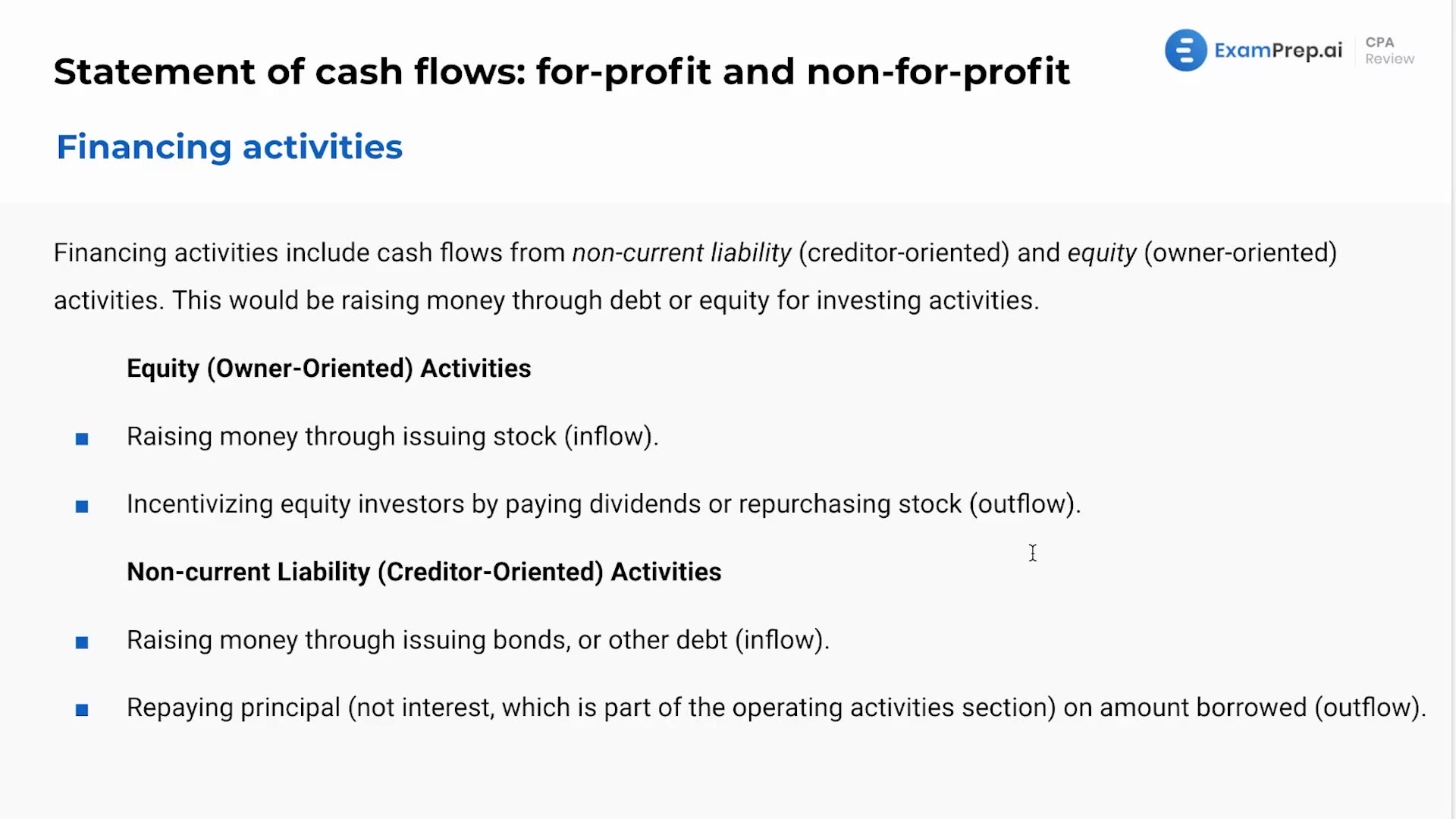

In this lesson, embark on a journey with Nick Palazzolo, CPA, as he delves into the realm of financing activities, an essential component of managing a company's finances. Discover the strategies for raising capital through two primary avenues: debt and equity. Nick breaks down how cash flows from noncurrent liabilities and equity transactions shape a business's ability to fund investments. He emphasizes the significance of how inflows, such as acquiring funds through issuing stock or taking on debt, contrast with outflows, like paying dividends or repaying principal on loans. A fascinating aspect Nick highlights is the treatment of interest payments as operating activities, setting them apart from the principal repayment involved in financing. Get to grips with the concept that 'cash is king' in business, the backbone for company operations and a pivotal factor in earning stakeholder trust.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free