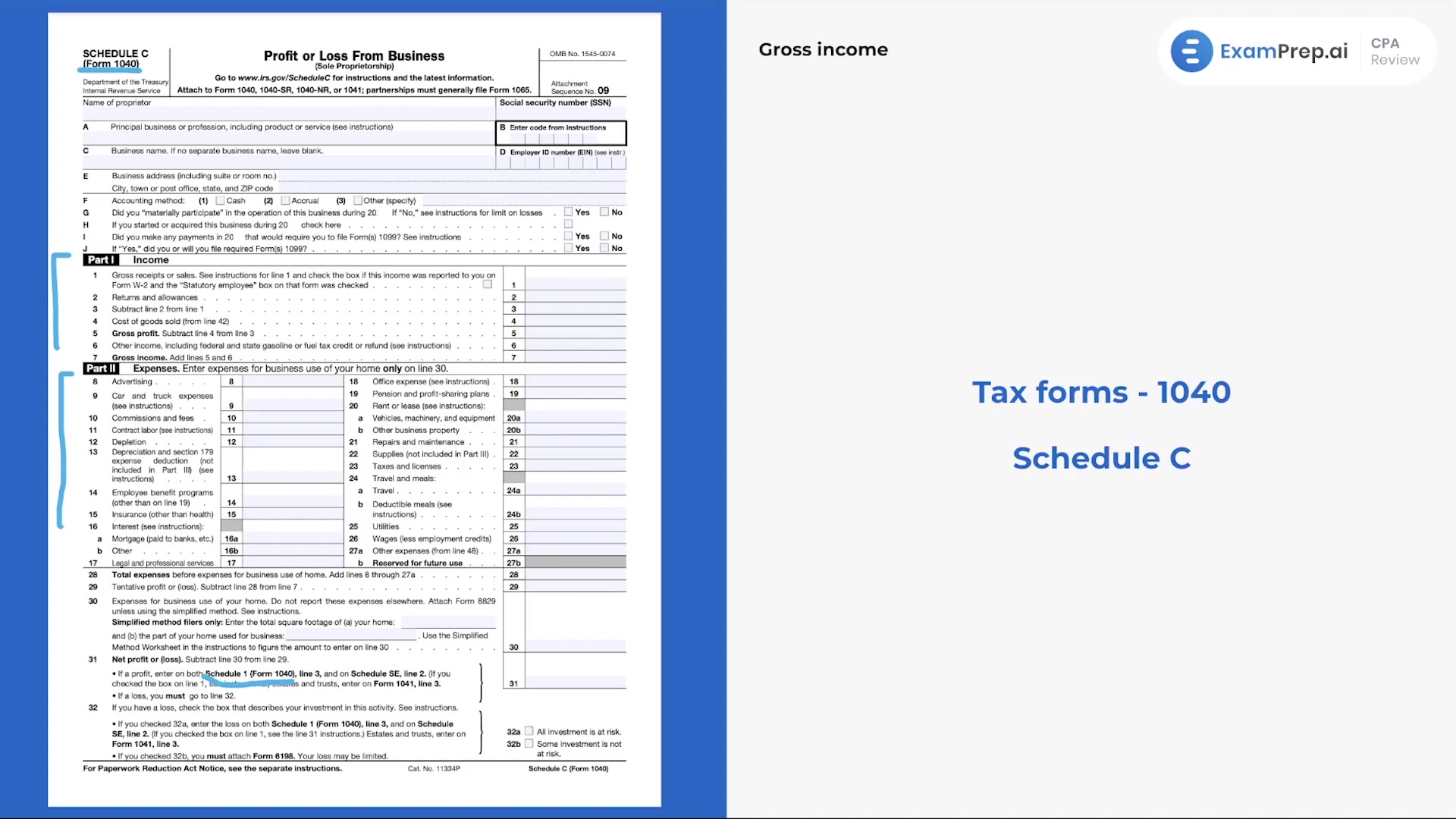

In this lesson, embark on a journey with Nick Palazzolo, CPA, into the intricate world of Schedule C, the form used by individuals to report income or loss from a sole proprietorship or a single-member LLC. Nick meticulously breaks down the purpose and structure of the Schedule C form, demonstrating its imitation of a corporation's tax return but tailored for an individual's business endeavors. With his relatable and practical approach, Nick dives into how business income and losses reported on Schedule C influence an individual's overall gross income on Form 1040, stressing the importance of genuine loss reporting in contrast to manipulative tax practice. Illustrating with typical scenarios and candid insights, Nick navigates the IRS regulations regarding hobby losses and passive activity loss rules, providing a realistic perspective on how the IRS views and treats business losses. Additionally, prepare for a visual walkthrough of the Schedule C form itself, as Nick promises a concrete look at its components—paving the way for a profound understanding of how business financials transit onto a personal tax return.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free