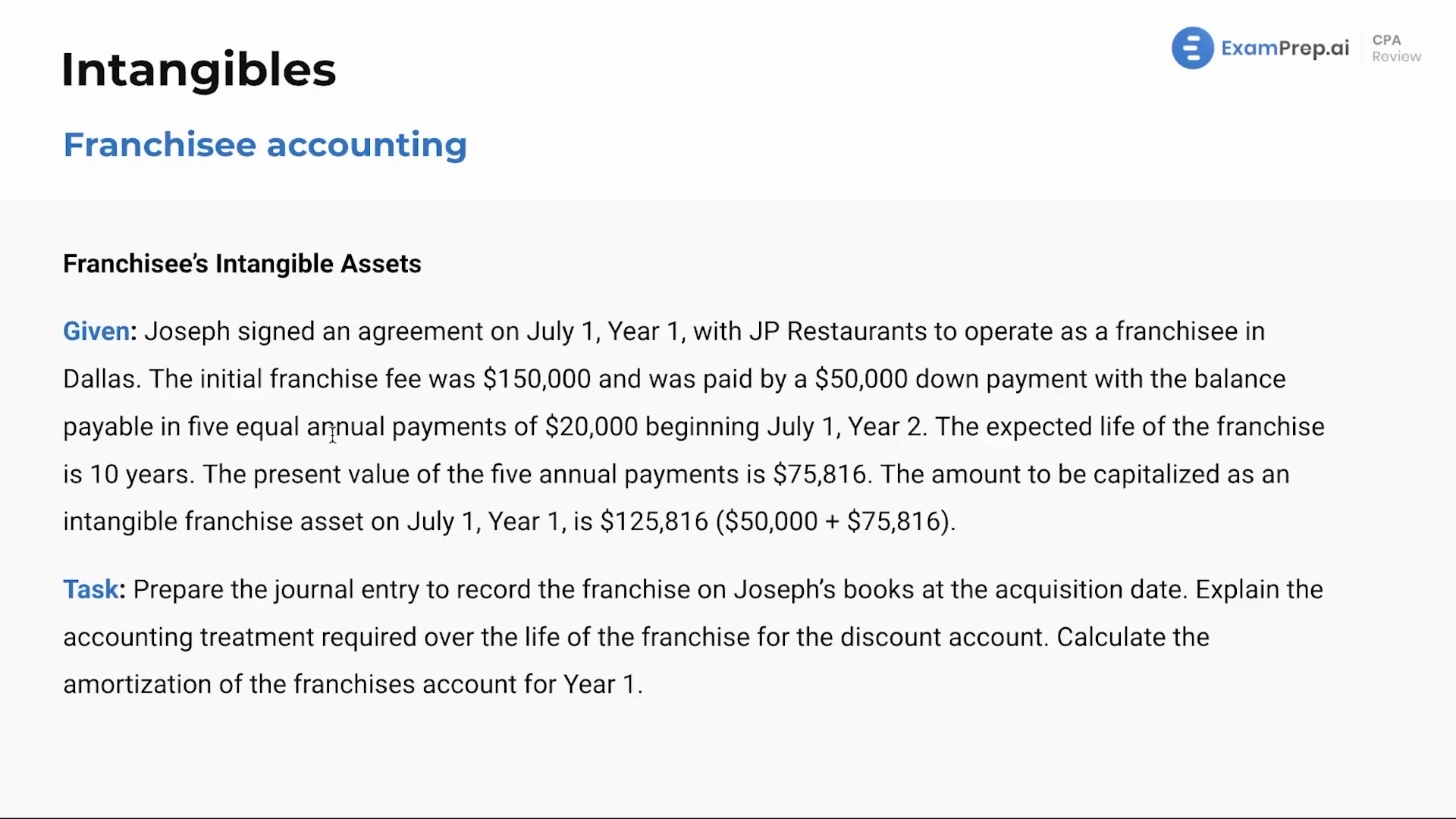

In this lesson, diving into the practical side of accounting for franchise agreements, Nick Palazzolo, CPA, walks through a detailed example involving the financials of a new franchisee in Dallas. Highlighting the significance of the initial franchise fee and subsequent annual payments, Nick meticulously demonstrates how to prepare the initial journal entry on the acquisition date. Furthermore, viewers are guided on how to account for the discount on note payable and the process of recognizing this as interest expense over the payment period. The lesson also unfolds the method for calculating the annual amortization of the franchise's intangible asset, taking into consideration the time value of money and the expected life of the franchise. Through this example, grasp the importance of capturing the present value of future payments and the nuances of amortization within the realm of franchisee accounting.

This video and the rest on this topic are available with any paid plan.

See Pricing