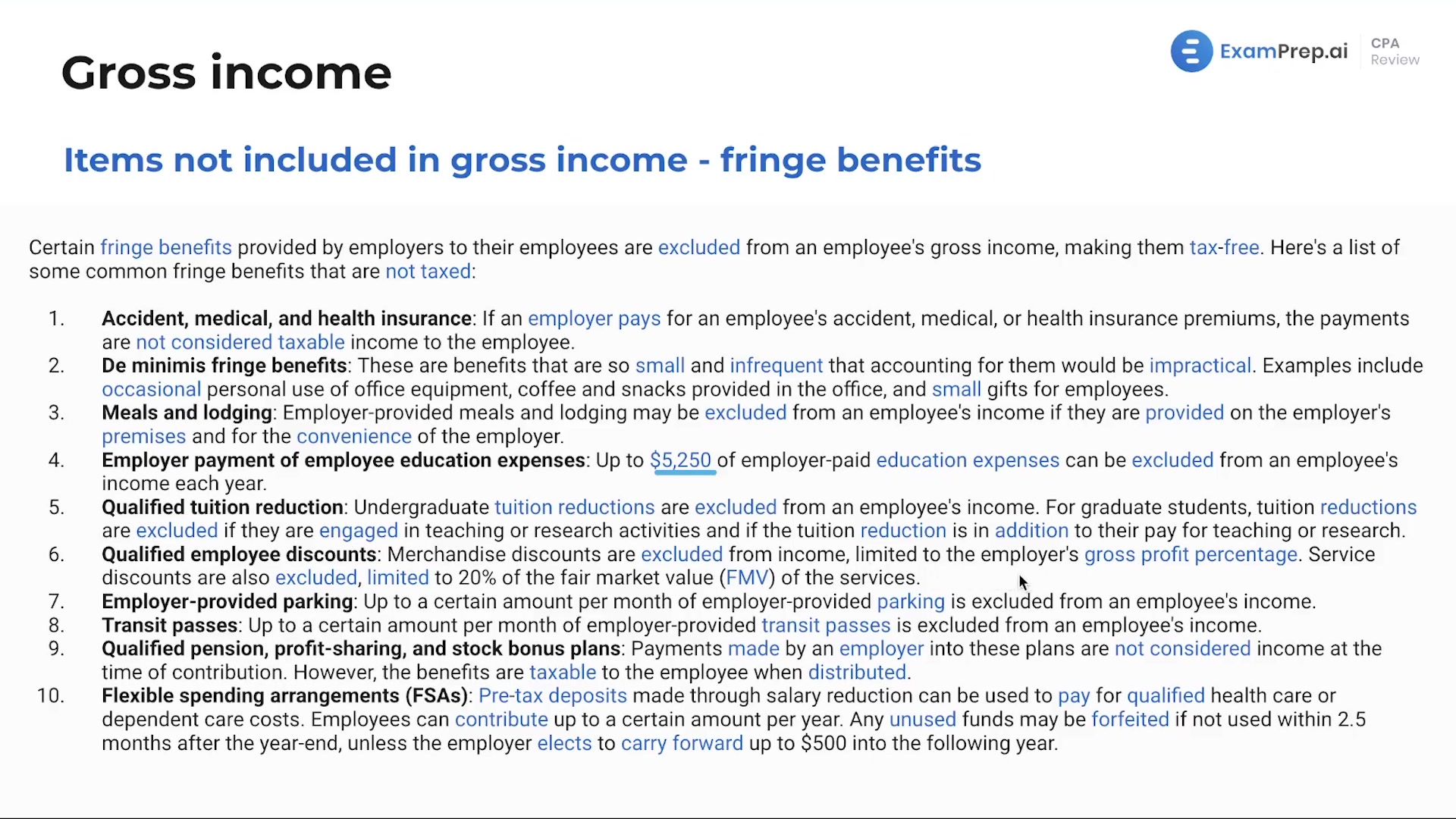

In this lesson, Nick Palazzolo, CPA, delves into the complex world of fringe benefits and how they affect taxable income. With clear and practical explanations, he explores various employer-provided perks such as health insurance, de minimis benefits, employer-paid education, and employee discounts, clarifying which are tax-free and why the IRS chooses to exclude them. Nick uses relatable examples, like the life insurance policy on a CEO, to illustrate why some fringe benefits are not taxed. Additionally, he breaks down the tax implications of employer contributions to pension and profit-sharing plans, as well as flexible spending accounts. Highlighting both employee and employer perspectives, Nick discusses the exceptions and rules—like the tax treatment of meals provided for overtime work—ensuring a thorough understanding of how these benefits play out in real-world scenarios. The lesson includes a detailed walk-through on calculating the taxable portion of group term life insurance, a concept that could easily appear on the CPA exam.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free