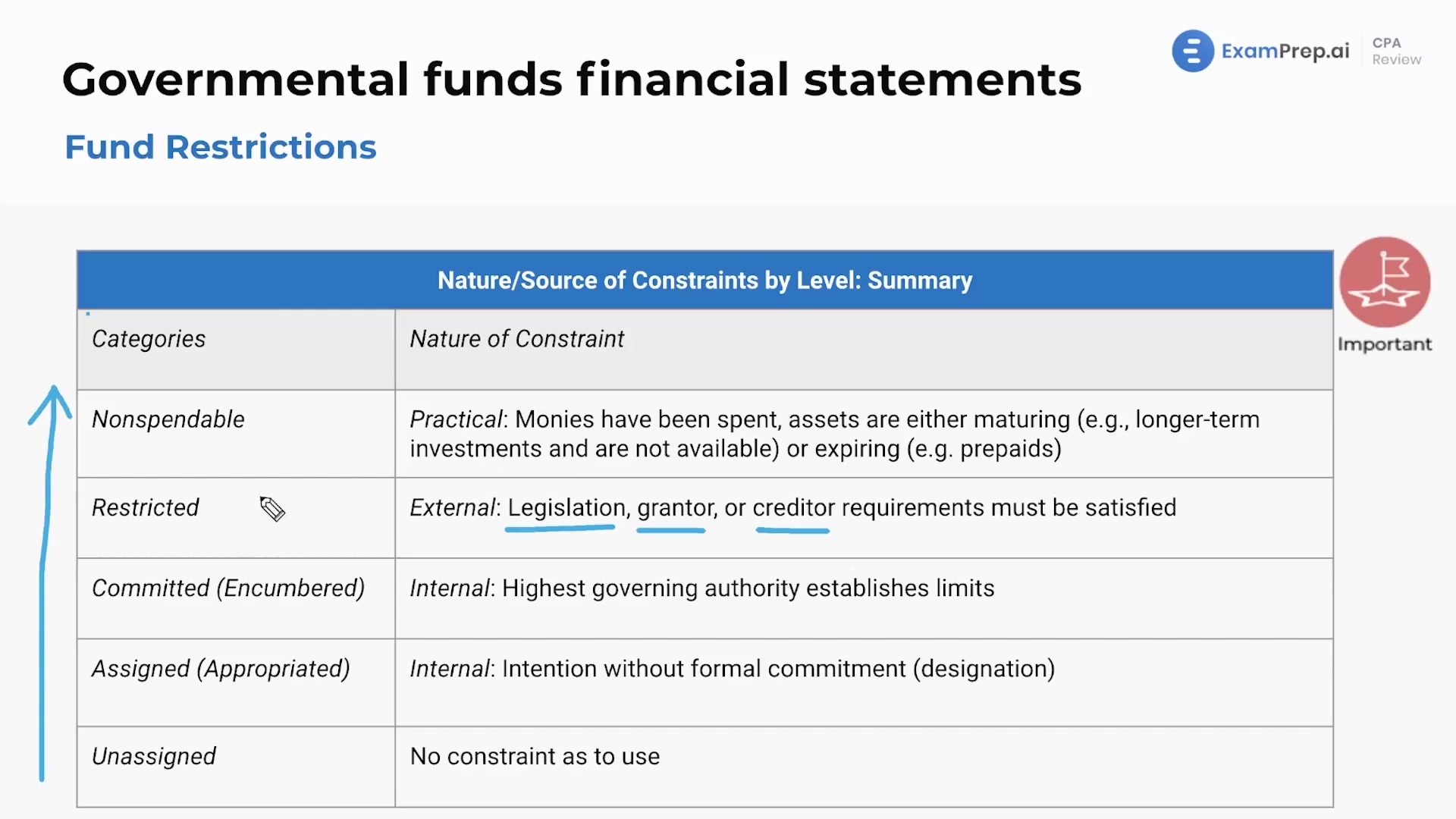

In this lesson, Nick Palazzolo, CPA, breaks down the various classifications of fund restrictions often encountered in not-for-profit and governmental accounting. He uses a logical chart to illustrate the gradation of restrictions, from unassigned funds to nonspendable funds, detailing the accountability that comes with each level. Nick simplifies this complex topic by explaining the distinctions between assigned, committed, encumbered, and restricted funds, and how intention and formal action differentiate them. He also sheds light on common test questions students may face, by identifying common tricks and clarifying terminology such as the difference between 'restricted' and 'reserved.' To reinforce understanding, he offers practical examples and an in-depth exploration of each restriction category, ensuring a comprehensive grasp of fund balances within government and nonprofit accounts.

This video and the rest on this topic are available with any paid plan.

See Pricing