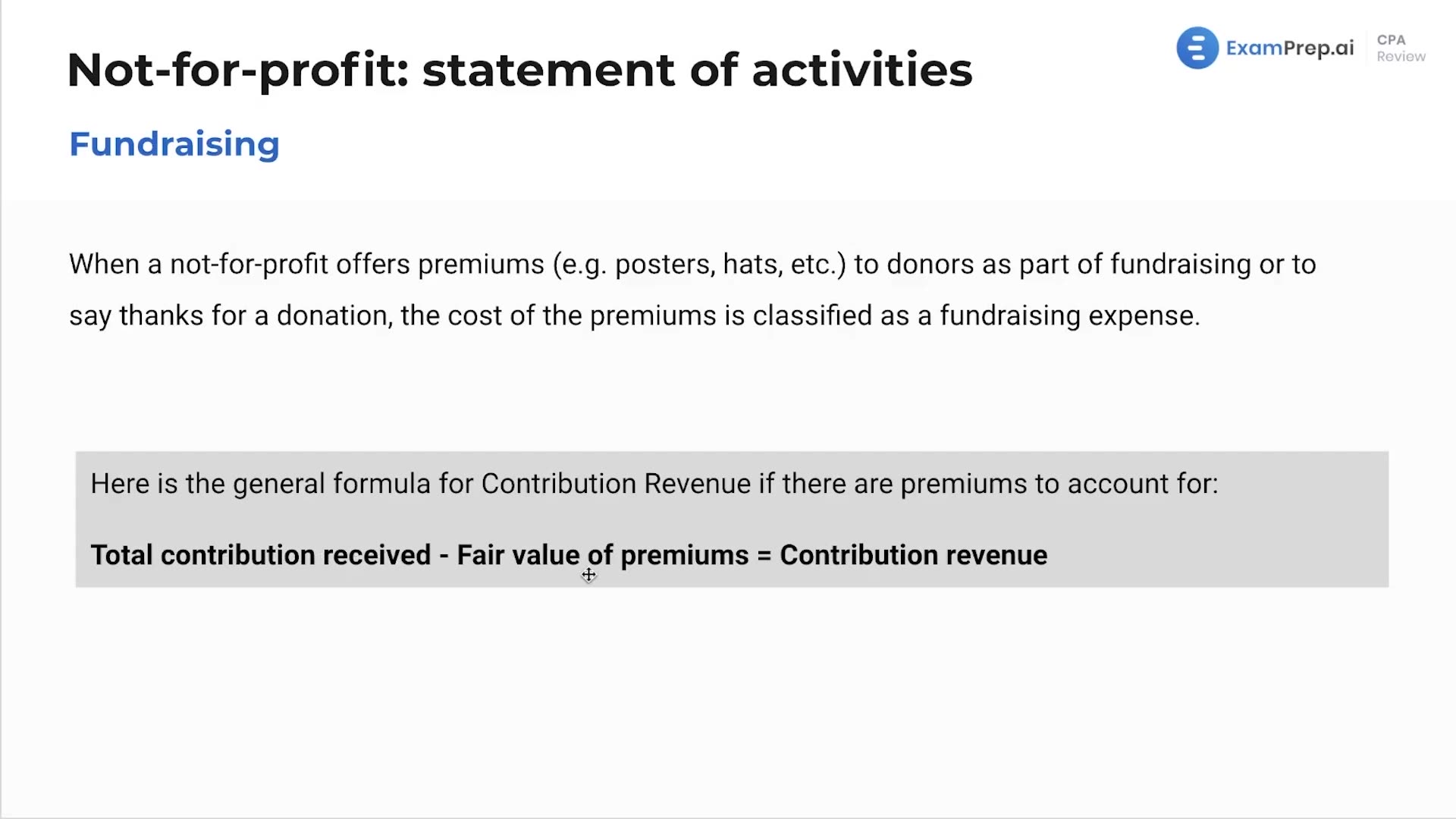

In this lesson, Nick Palazzolo, CPA, unravels the nuances of accounting for fundraising activities within not-for-profit organizations. He zeroes in on the treatment of premiums—those thank-you gifts given to donors, such as posters or hats. Nick simplifies the process by explaining that the cost of these items is recorded as a fundraising expense and then demonstrates the impact of these costs on contribution revenue through a clear, easy-to-follow formula. The session is approachable and straightforward, providing reassurance that while the concept is important, it's far from daunting. Nick also encourages taking breaks to maintain focus, underscoring the importance of absorbing the material at a comfortable pace.

This video and the rest on this topic are available with any paid plan.

See Pricing