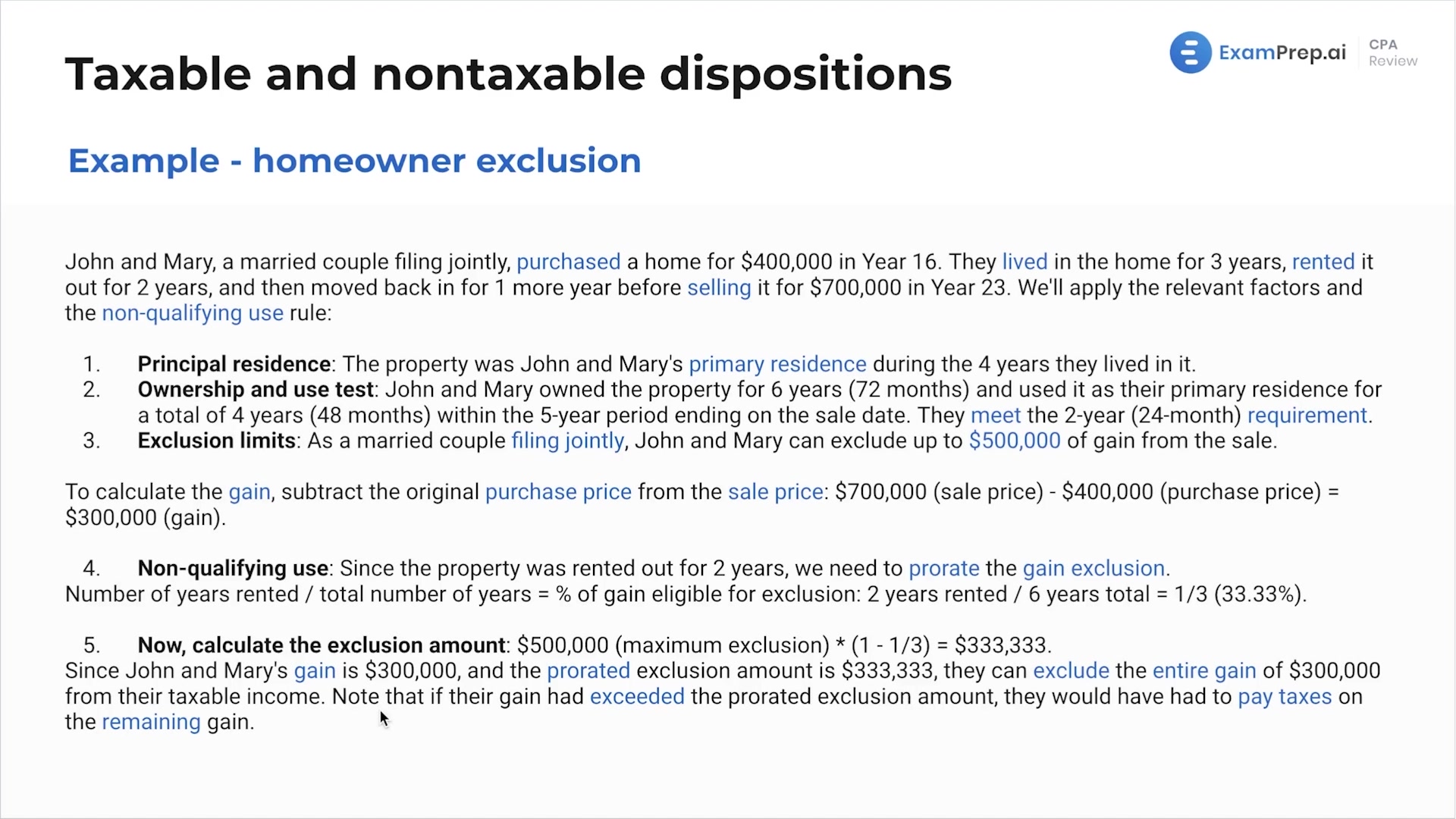

In this lesson, catch up with Nick Palazzolo, CPA, as he delves into the homeowner exclusion that allows eligible taxpayers to exclude a sizable portion of the gain from the sale of their primary residence from their taxable income – a must-know topic for the exam. Nick breaks down key components such as the ownership and use test requirements, exclusion limits for different filing statuses, and special provisions for unforeseen circumstances. By running through relatable examples, he elucidates how these rules apply in real-life situations, even covering cases involving involuntary conversions like property damage or government requisition. Whether it's understanding prorated exclusions for rental periods or handling situations with insurance proceeds, Nick ensures that the complexities of asset disposition are made clear and memorable.

This video and the rest on this topic are available with any paid plan.

See Pricing