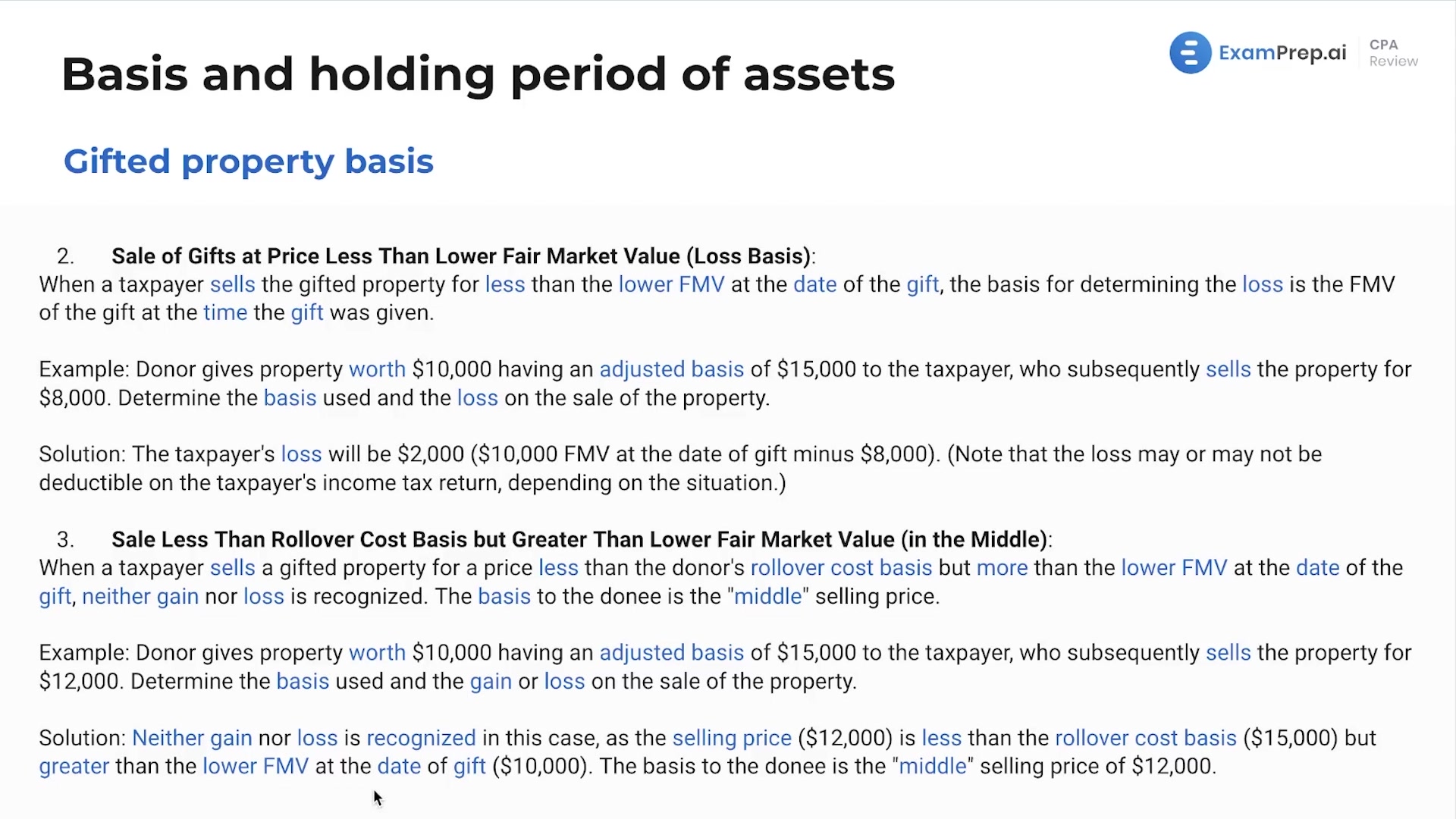

In this lesson, Nick Palazzolo, CPA, breaks down the complexities of gifted property, providing a clear explanation of the rules surrounding the basis determination for such assets. He makes it easier to understand how the basis is calculated when you receive property as a gift, contrasting it against scenarios where assets are purchased, inherited, or transferred through business entities. Nick dissects various situations where the property's basis can shift due to gift tax payment and its subsequent impact on calculating gains and losses. Through a series of practical examples, he clarifies the concept of 'choosing the middle amount' for determining the basis and shows why this is crucial to grasp for tax implications. The lesson navigates through intricate details such as dealing with sale prices greater than donor's rollover basis, less than fair market value, or in-between cases, ensuring that the nuances of each case are properly understood and remembered. This lesson, while an introduction to the topic, serves as a vital building block to mastering the concept before diving deeper into gift taxes in upcoming lessons.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free