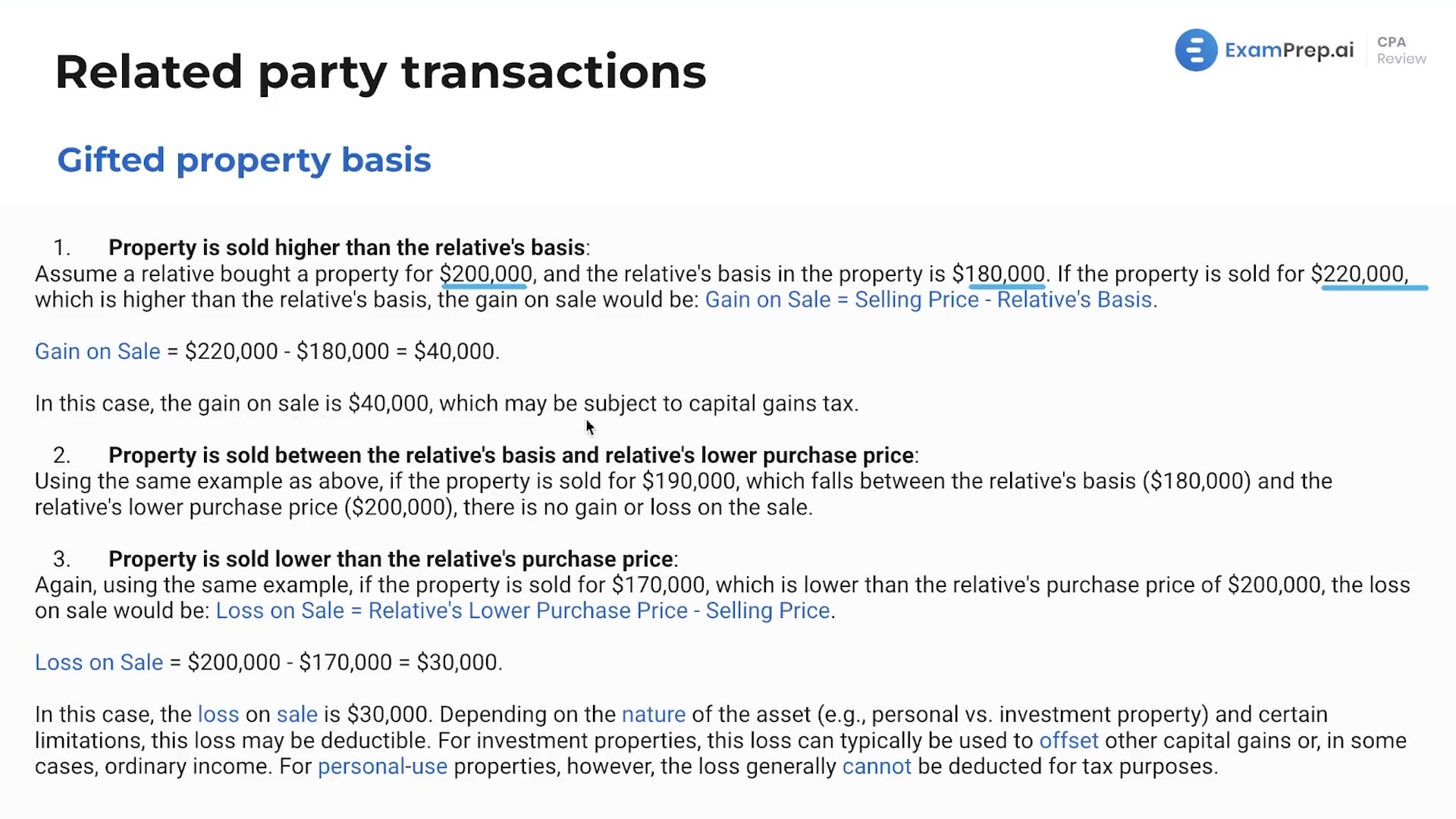

Dive into the intricacies of tax implications for gifted property with Nick Palazzolo, CPA, as he clarifies the basis determination in various scenarios of property sales between relatives. Watch as he skillfully breaks down the different outcomes when property is sold above, between, or below the original owner’s basis and purchase price. Using clear examples, Nick illustrates how to calculate gains or losses, discusses capital gains tax considerations, and details the treatment of investment versus personal use property losses. With his engaging teaching style, Nick ensures this concept is crystal clear, setting the foundation for an upcoming exploration into gift tax rules.

This video and the rest on this topic are available with any paid plan.

See Pricing