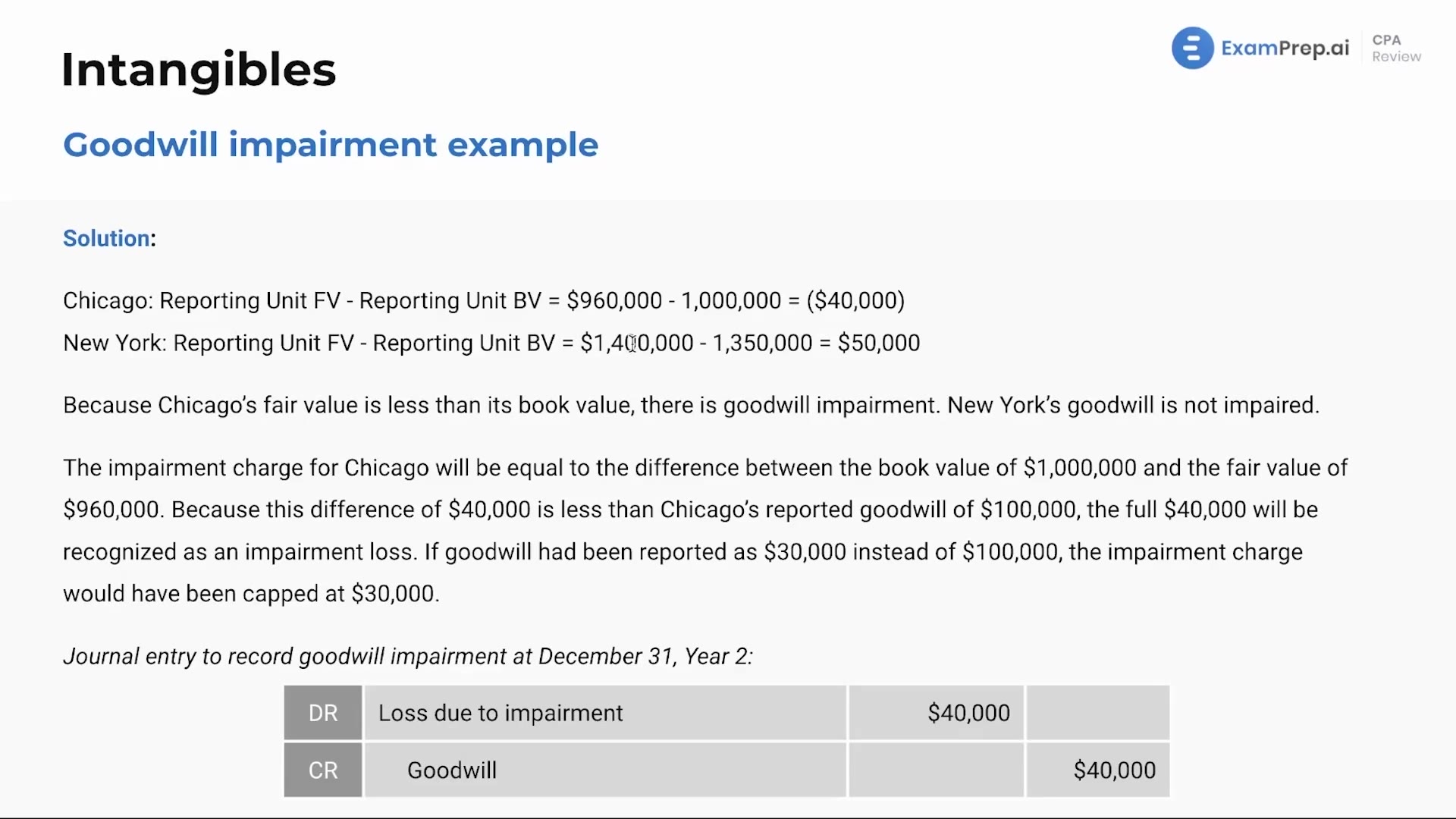

In this lesson, Nick Palazzolo, CPA, breaks down how to assess and account for goodwill impairment using a practical example. By comparing the fair values of TP, Inc.'s reporting units to their book values, he illustrates the calculation of impairment losses and the necessary adjusting journal entries. Through the example, Nick demonstrates the impairment testing process, leading to recognizing an impairment loss when the book value exceeds fair value. He also explains the implications of reporting a lower pre-existing goodwill amount on the potential impairment charge. Detailed explanations of the journal entries provide a clear understanding of debiting losses and crediting goodwill in the context of an impairment event.

This video and the rest on this topic are available with any paid plan.

See Pricing