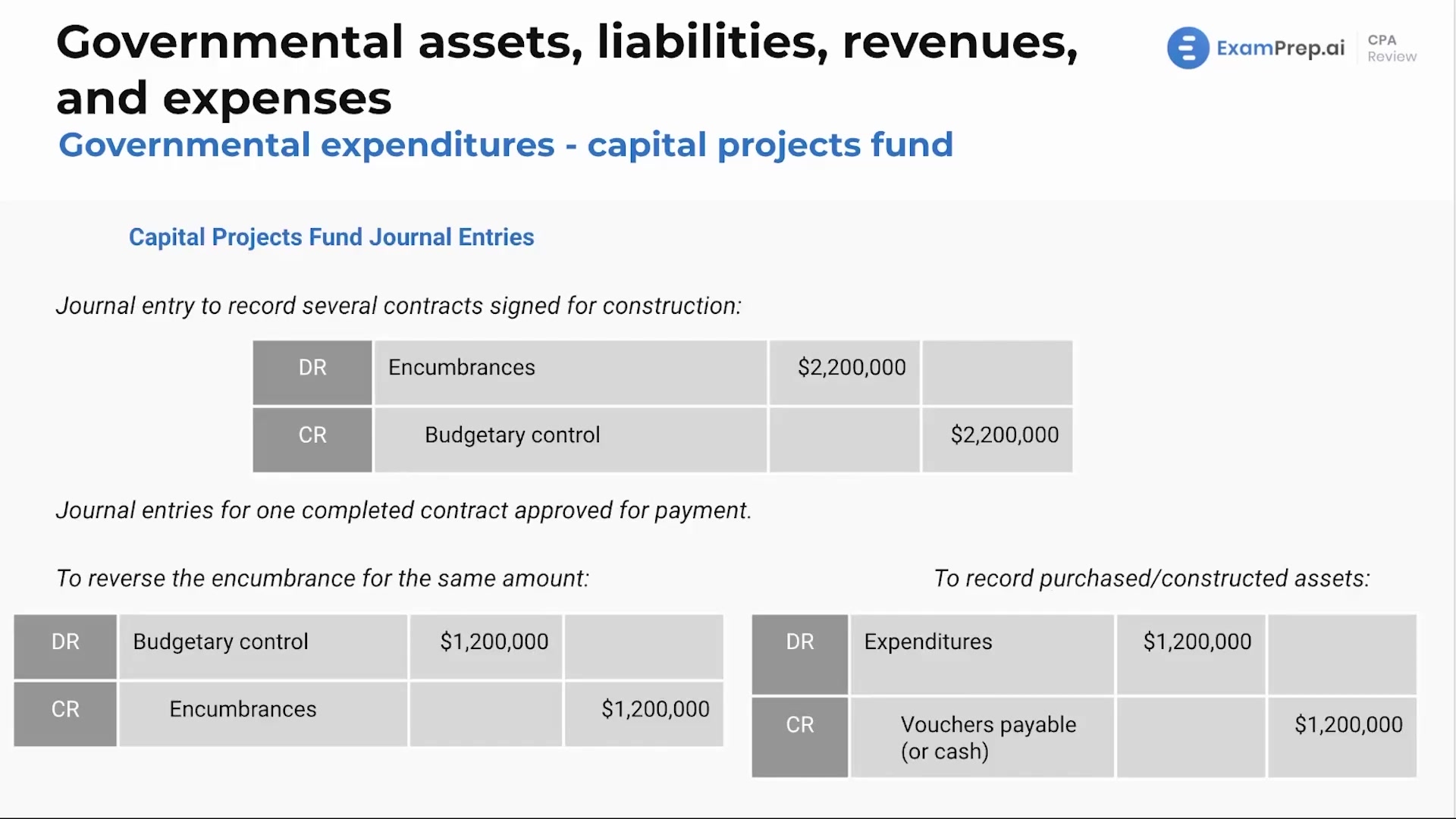

In this lesson, delve into the intricacies of the Capital Projects Fund with Nick Palazzolo, CPA, illuminating the way government accounting treats expenditures during the construction process. Nick decodes the concept of encumbrances, explaining how they serve as commitments akin to those in corporate accounting, and underscores the significance of recording vouchers payable—akin to accounts payable—when a government entity incurs a liability. With a mix of humor and clarity, he guides through journal entries related to various stages of government contracting, from the initial recording of contract commitments to the reversal of encumbrances and the eventual payment processing. Whether dealing with construction contracts or government bureaucracy, this lesson provides essential insights into the fiscal maneuvers of capital project funding and the parallel accounting practices between the government and corporate sectors.

This video and the rest on this topic are available with any paid plan.

See Pricing