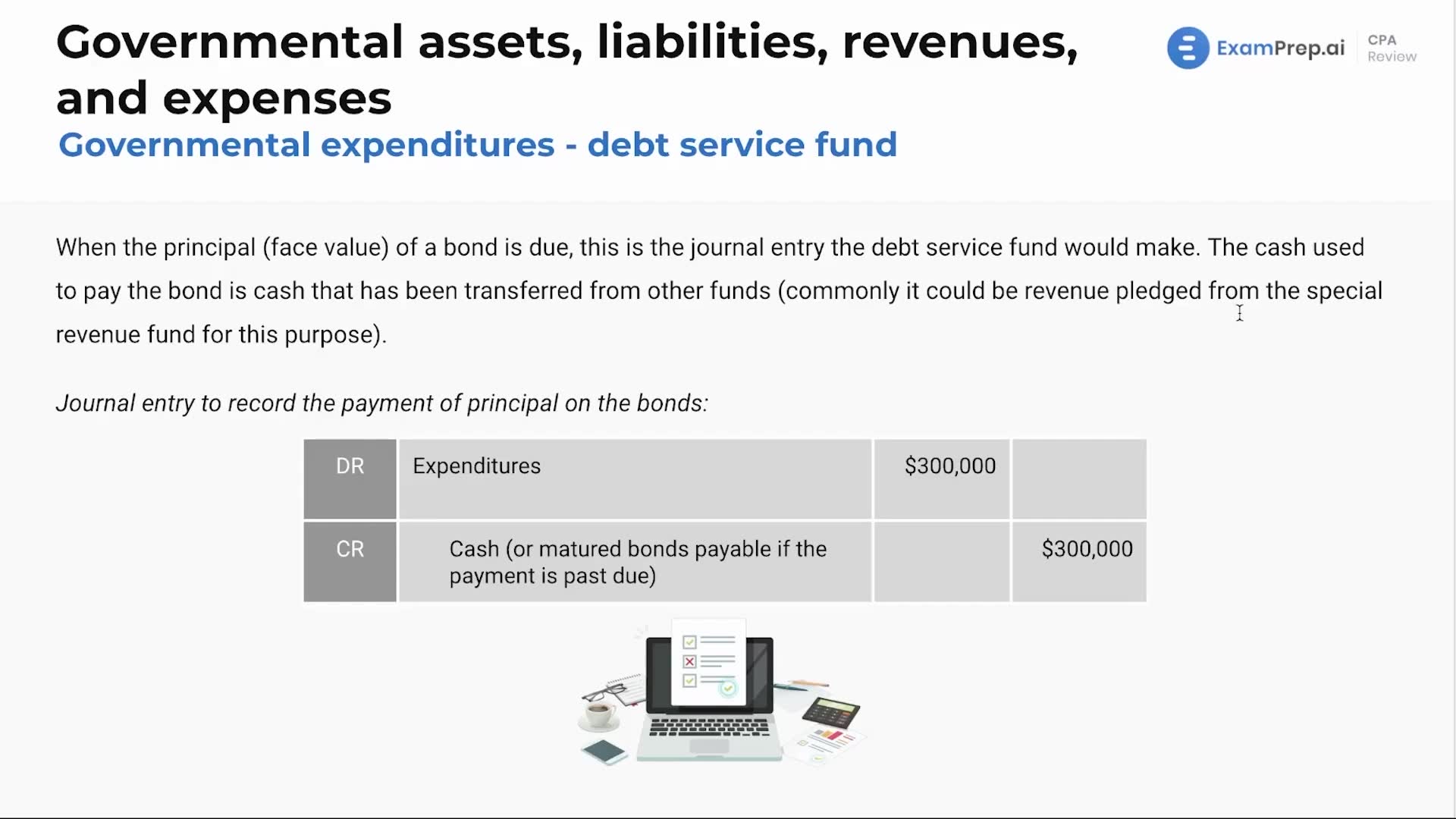

In this lesson, Nick Palazzolo, CPA, dives into the specifics of accounting for governmental expenditures associated with a debt service fund. He meticulously illustrates the journal entry required when the principal—also known as the face value—of a bond is due. By detailing the transfer of cash from other funds, commonly from revenues pledged by the special revenue fund, Nick clarifies the debits and credits involved in paying back bond obligations. Walkthrough this process to comprehend the intricacies of recording the payment of principal on debt to ensure accurate financial reporting within governmental entities.

This video and the rest on this topic are available with any paid plan.

See Pricing