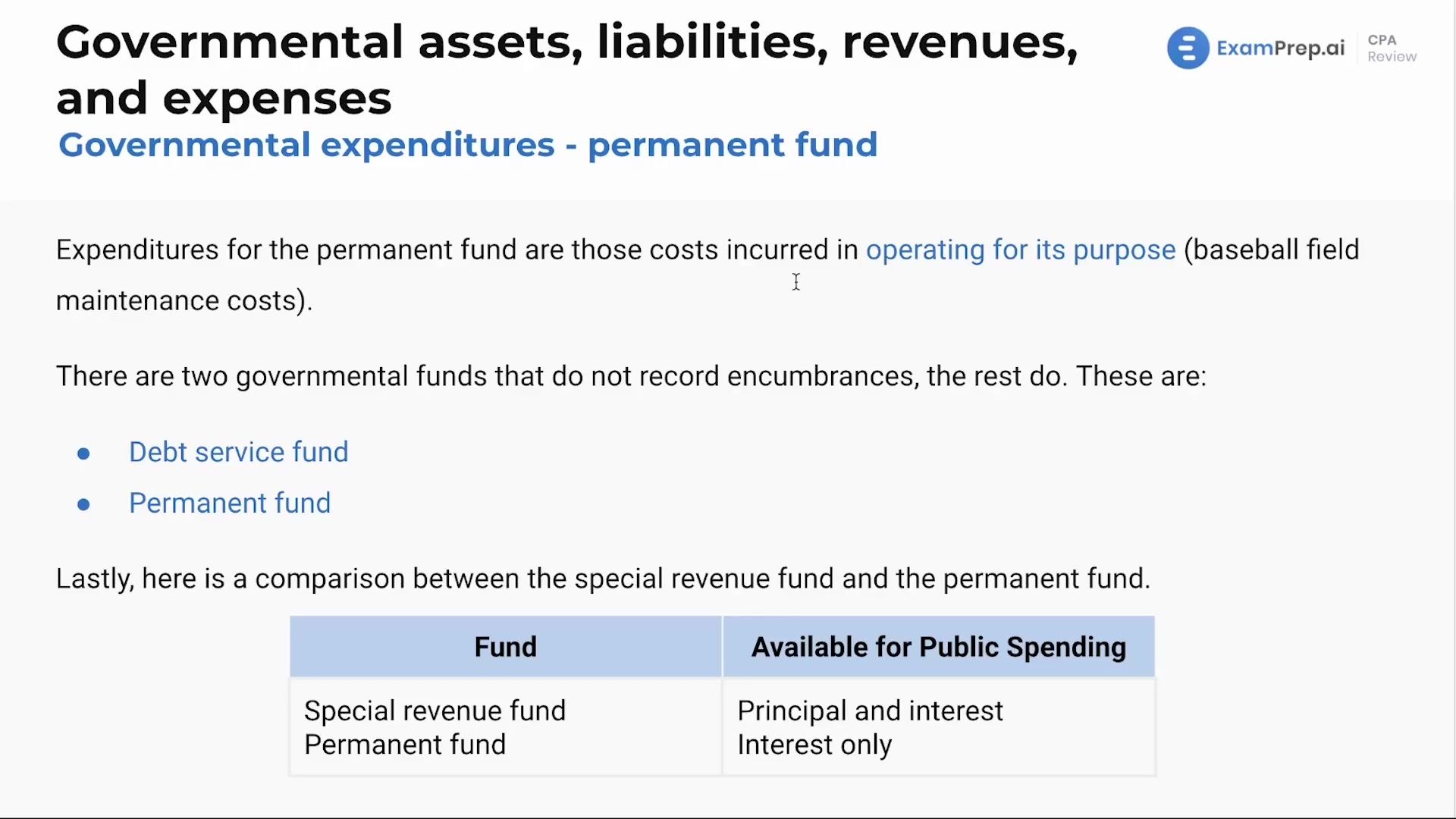

In this lesson, explore the intricacies of the Permanent Fund within the realm of governmental accounting. Nick Palazzolo, CPA, breaks down the concept using a relatable example of a generous community member who donates a significant amount of money with specific spending conditions. Dive into the legal restrictions of the fund, understanding that only earnings, not the principal, are expendable. Nick also contrasts Permanent Funds with Special Revenue Funds, clarifying how each is earmarked and the stipulations tied to their use. Uncover why Permanent Funds and Debt Service Funds differ by not recording encumbrances and learn about appropriate expenditures, including costs to maintain projects like a baseball field mentioned in the example – all tailored to paint a vivid picture of how these funds operate for a clear grasp on the topic.

This video and the rest on this topic are available with any paid plan.

See Pricing