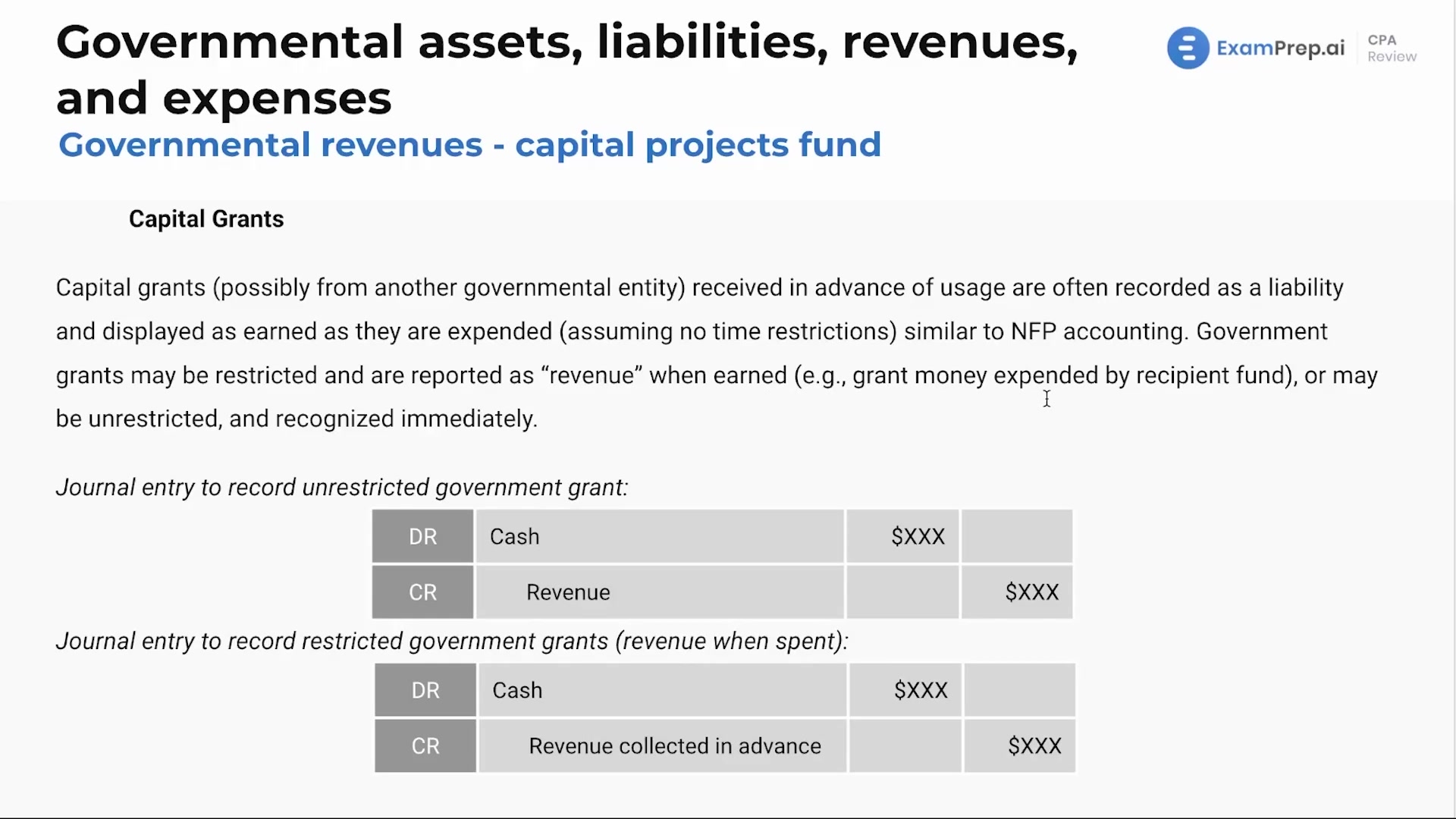

In this lesson, Nick Palazzolo, CPA, delves into the intricacies of the Capital Projects Fund in governmental accounting. He clarifies the fund's purpose for significant fixed assets used by governmental entities, excluding business-type activities such as airports and utilities. Nick demystifies the financing of these capital projects, emphasizing that they are generally funded through bonds, inter-fund transfers, specific tax revenues, capital grants, or investment earnings. With engaging explanations, he dissects various journal entries related to unrestricted and restricted government grants, illustrating how these funds are recognized and recorded. Whether it's detailing the handling of investment earnings or the nuances of fund transfers, Nick ensures a comprehensive understanding of the Capital Projects Fund's financial ins and outs, prepping for smooth navigation of the fiscal responsibilities found within government accounting.

This video and the rest on this topic are available with any paid plan.

See Pricing