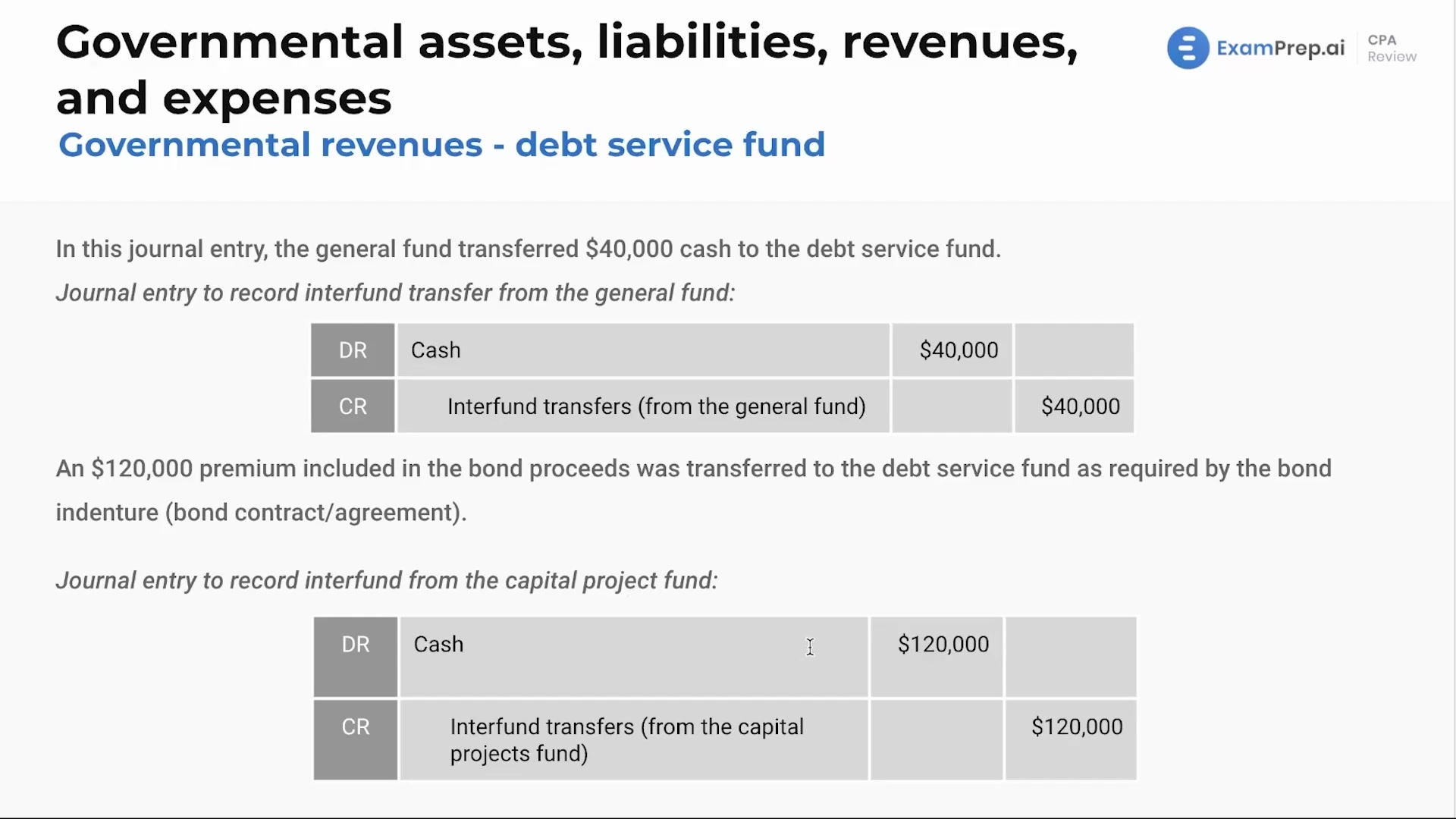

In this lesson, Nick Palazzolo, CPA, dives into the financial intricacies of debt service funds within governmental accounting. He illustrates the process of managing revenues and expenses through comprehensive journal entries, focusing on transfers and the role of debt service funds as the central hub for debt-related financial activity. Nick simplifies the intricate relationships between the debt service and capital projects funds, and how they work together to manage borrowed funds used in large-scale projects. As he breaks down the transactions between the general fund, debt service fund, and capital projects fund, he ensures that the intricate web of inter-fund transfers is made clear. Whether discussing cash inflows from bond issues or investment income, Nick demystifies the accounting for these critical governmental functions with an engaging walkthrough of relevant journal entries.

This video and the rest on this topic are available with any paid plan.

See Pricing