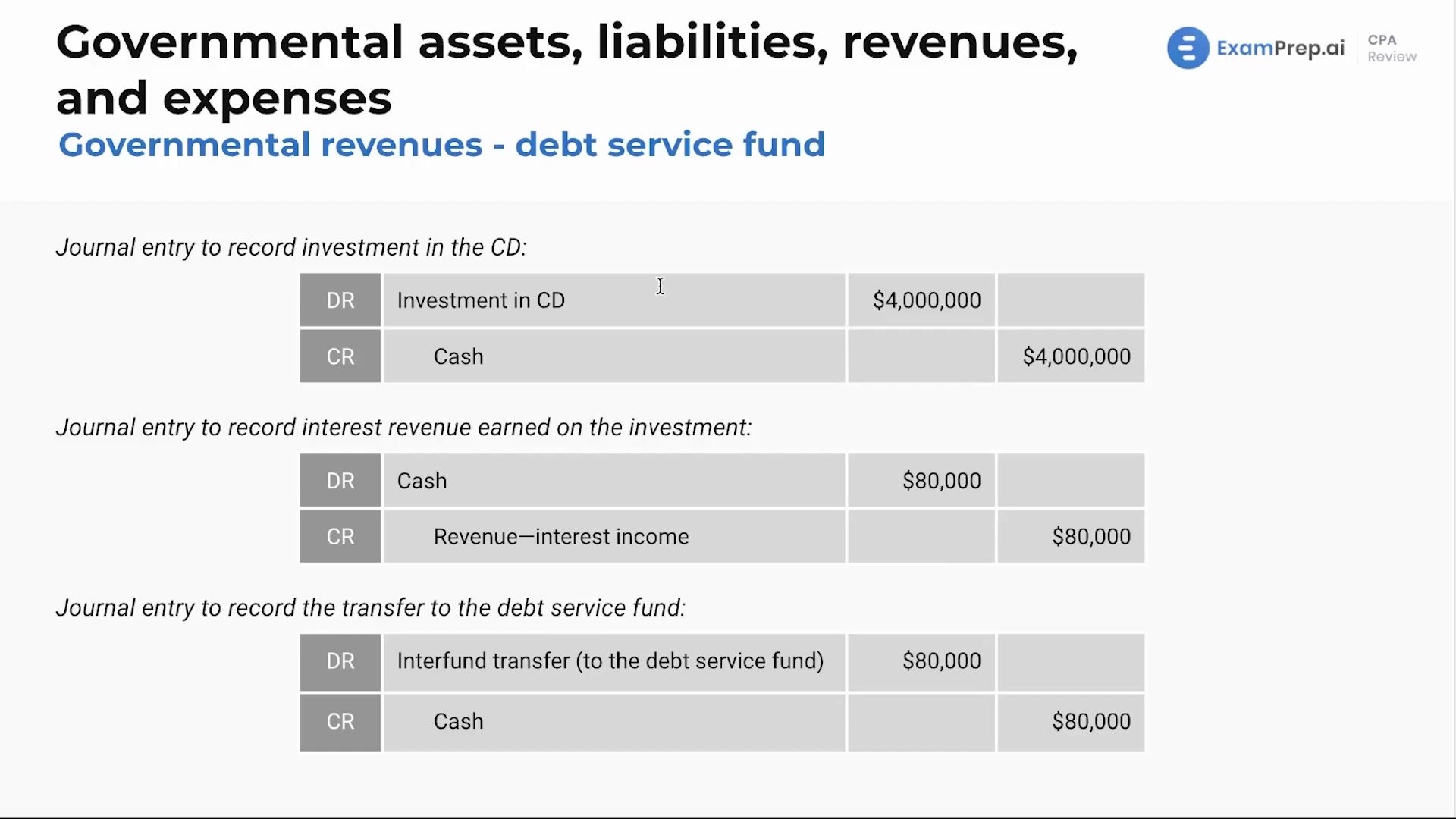

In this lesson, Nick Palazzolo, CPA, dives into the nuances of accounting within a debt service fund, especially when handling bond sales that result in premiums or discounts. Nick patiently breaks down the complexities of managing the extra cash received from a premium by transferring it to the debt service fund, explaining the impact on both the capital projects fund and the subsequent accounting entries. He also explores scenarios where bond proceeds exceed construction costs or fall short due to a discount, and the government's likely course of action in each case. Furthermore, Nick discusses the investment of idle bond proceeds and the transfer of earnings to the debt service fund via clear examples and journal entries, ensuring a comprehensive understanding of how these transactions affect governmental accounting processes.

This video and the rest on this topic are available with any paid plan.

See Pricing