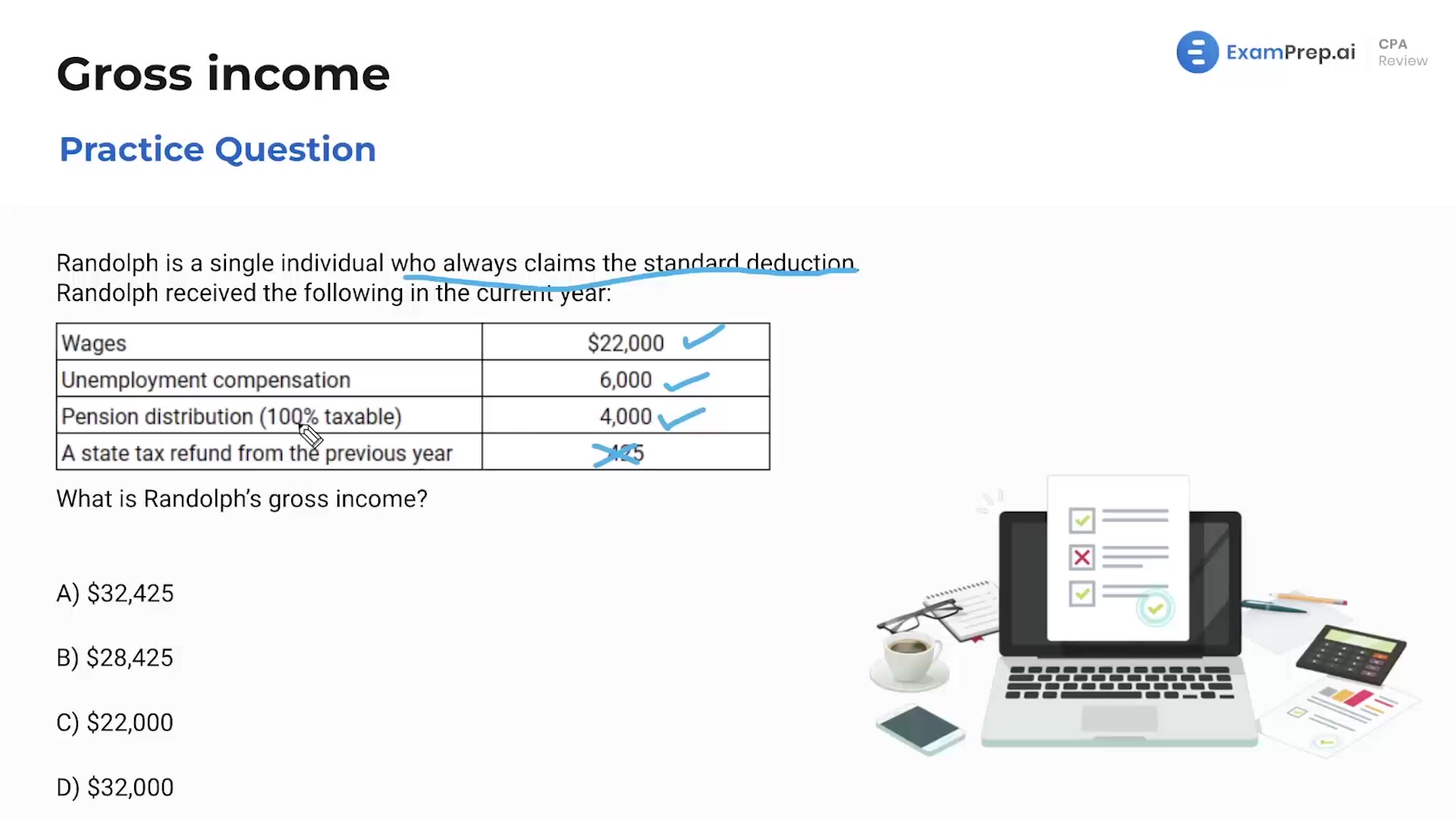

In this lesson, join Nick Palazzolo, CPA, as he navigates through the intricacies of calculating gross income via a set of practice questions. He begins by taking a detailed look at a hypothetical situation involving various income sources such as wages, unemployment compensation, and pension distributions, providing insights on what constitutes taxable income. Emphasizing the importance of understanding the standard deduction’s impact on state tax refunds, Nick guides you through a logical process of income inclusion and exclusion. The latter part of the lesson dives into unique scenarios such as divorce-related financial receipts, distinguishing between cash that should be counted as gross income, like alimony payments, and funds that are not taxable, such as child support and property settlements. Wrap up your understanding of these crucial concepts on gross income with Nick's clear explanations and reminders on the value of consistent practice with multiple-choice questions and simulations.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free