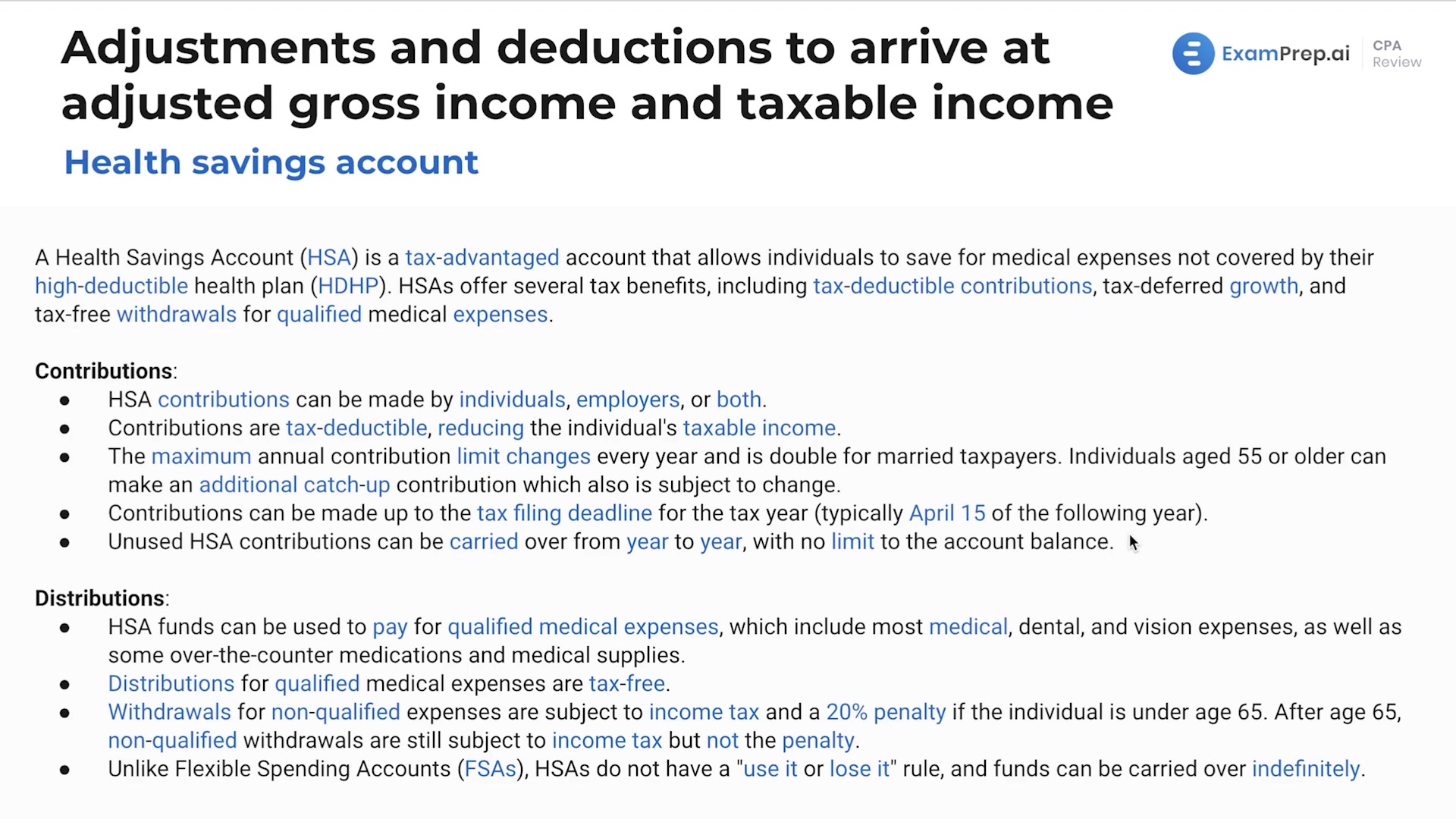

In this lesson, Nick Palazzolo, CPA, demystifies Health Savings Accounts (HSAs) by explaining how they are a tax-advantaged way to save for medical expenses when paired with a high deductible health plan. He shares both his personal insights and professional experience to offer a relatable understanding of the benefits and limitations of HSAs. Nick outlines how contributions work, the tax benefits they offer, such as tax deductible contributions, tax deferred growth, and tax-free withdrawals for qualified medical expenses. He contrasts HSAs with Flexible Spending Accounts (FSAs), emphasizing the 'use it or lose it' rule and how HSAs funds roll over indefinitely. Real-life examples are used to illustrate the financial impacts of contributing to an HSA, including potential tax savings and the way gains on investments within the HSA remain untaxed.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free