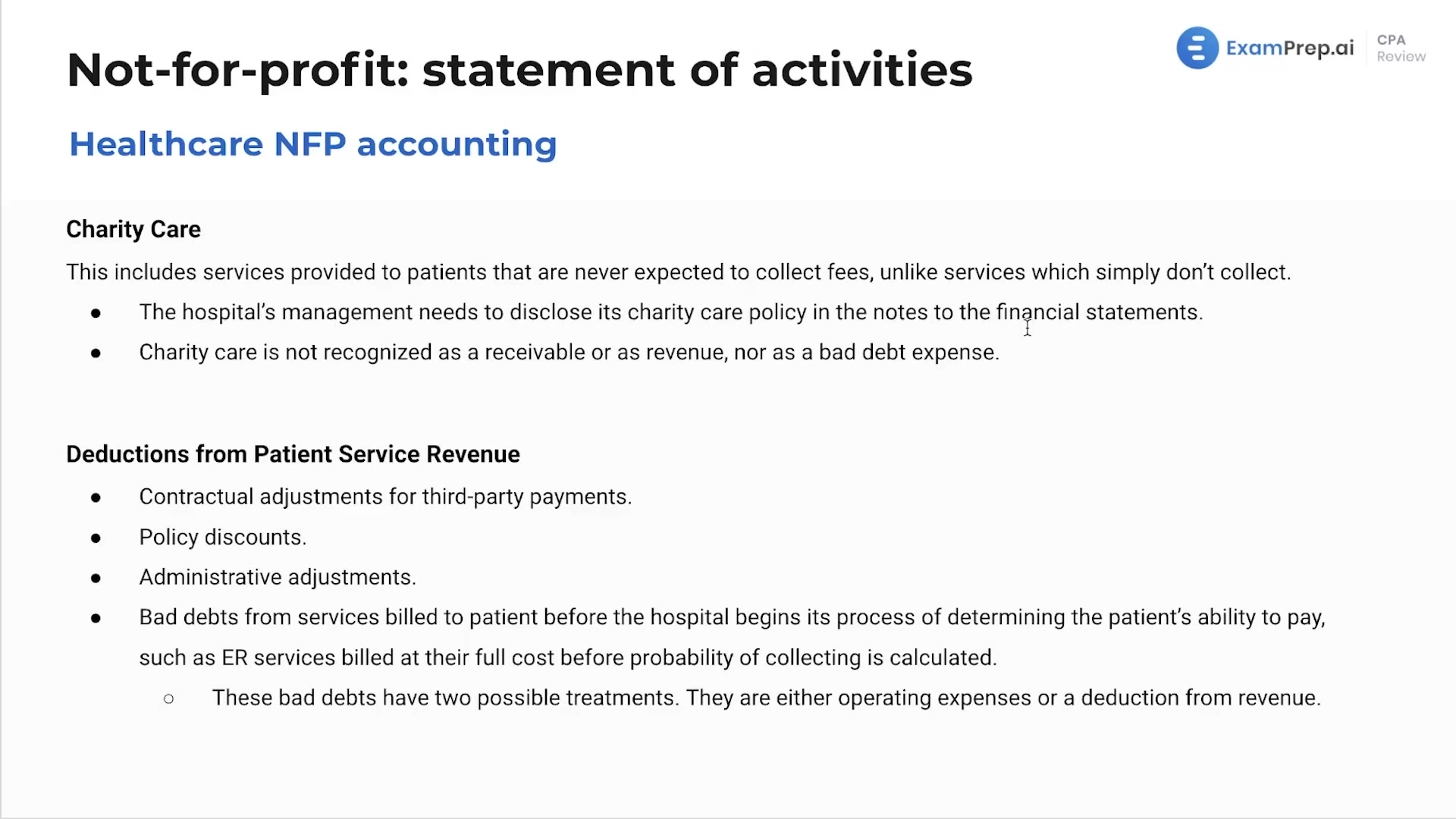

In this lesson, get ready to demystify the complexities of revenue recognition for healthcare not-for-profits with Nick Palazzolo, CPA. Nick breaks down how these organizations account for their primary source of income, which comes from medical services rendered to patients. He illuminates the nuances between gross revenue and net deductions, taking into account the realities of insurance company negotiations and patient payment abilities. Delve into charity care and its financial implications as Nick clarifies why these services are not recorded as receivables or revenues, and how they should be disclosed in the financial statements. Lastly, grasp the distinction between bad debts as operating expenses versus deductions from revenue, and the criteria that determine these classifications, guiding you through the maze of financial decision-making within the health sector’s not-for-profit entities.

This video and the rest on this topic are available with any paid plan.

See Pricing