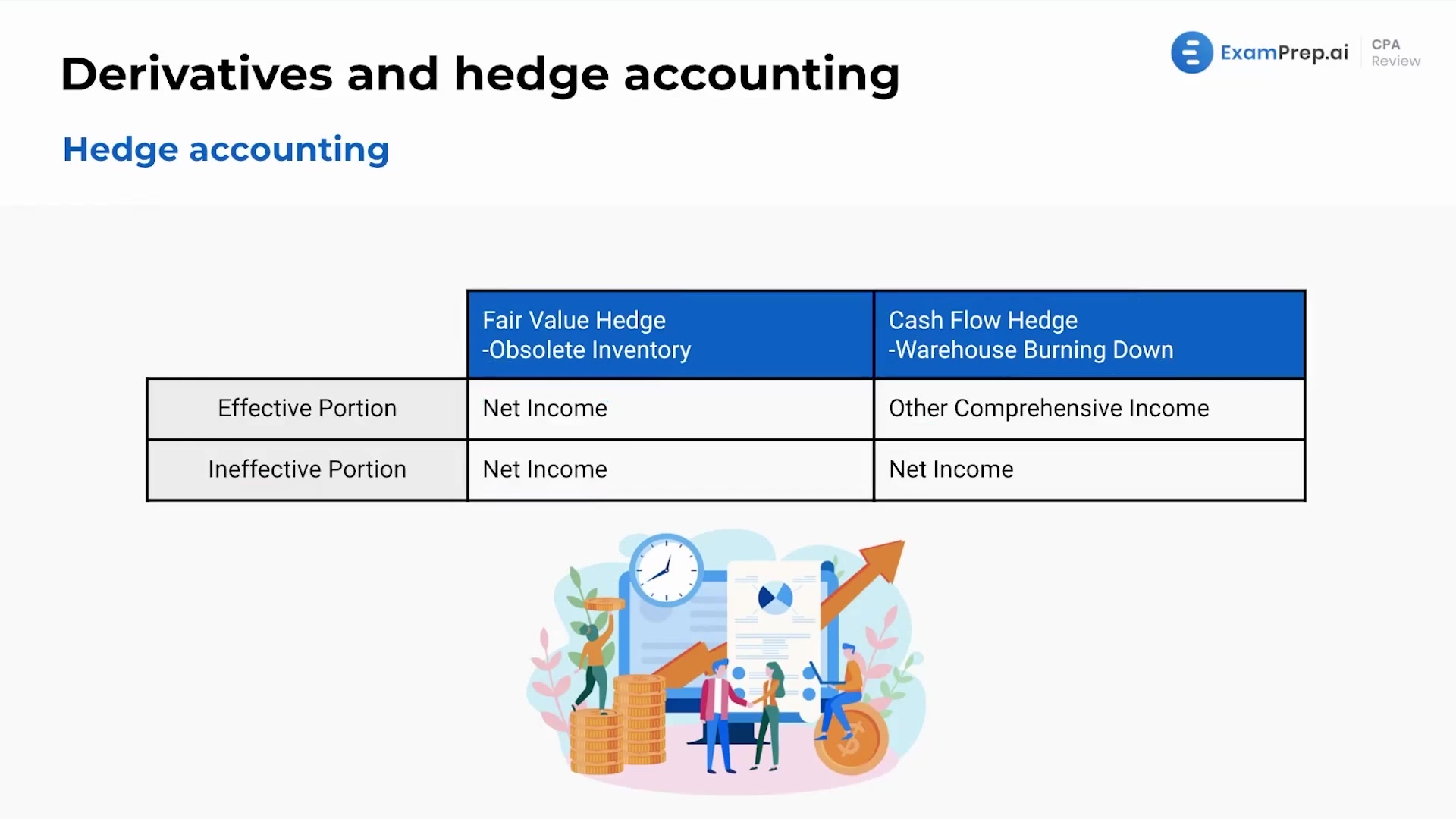

In this lesson, Nick Palazzolo, CPA, demystifies hedge accounting, a critical concept for stabilizing financial positions against market fluctuations. He begins by explaining the fundamentals of fair value and cash flow hedges, using practical examples like inventory depreciation and operational disruptions to illustrate how these financial instruments can protect against losses. Nick clarifies how to distinguish between effective and ineffective hedges and their respective reporting in net income versus other comprehensive income (OCI). Diving deeper, he breaks down the specifics of fair value hedges, including their identification requirements and the assumption of their effectiveness, while also touching on the nuances of perfect hedges and qualified derivatives. This comprehensive overview ensures nothing feels too out of the ordinary and reinforces the importance of mastering these concepts for real-world applications and on the exam.

This video and the rest on this topic are available with any paid plan.

See Pricing