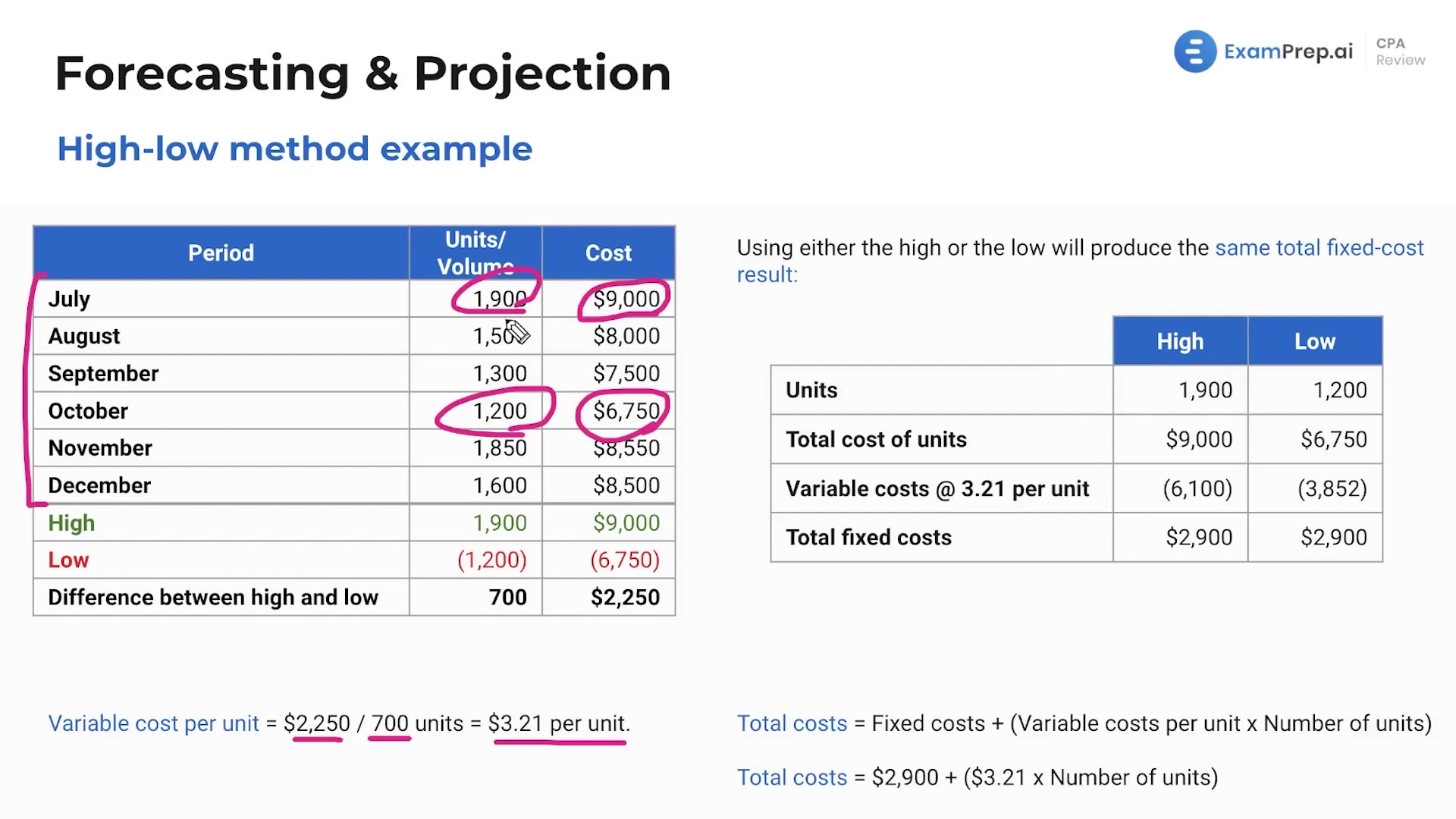

In this lesson, Nick Palazzolo, CPA, breaks down the high-low method of cost accounting, a technique that's handy for tackling those multiple-choice questions. He'll show how to use this method to estimate variable and fixed costs from a given set of data, illustrating it with a clear example. The method's about comparing the highest and lowest levels of activity with their corresponding total costs to find the variable cost per unit. Nick then demonstrates how to apply this variable cost to calculate total costs for any level of production, ensuring that by the end of this lesson, the seemingly complex high-low method will be nothing more than a 'brainless process' that can be solved by simply understanding and applying a few key steps.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free