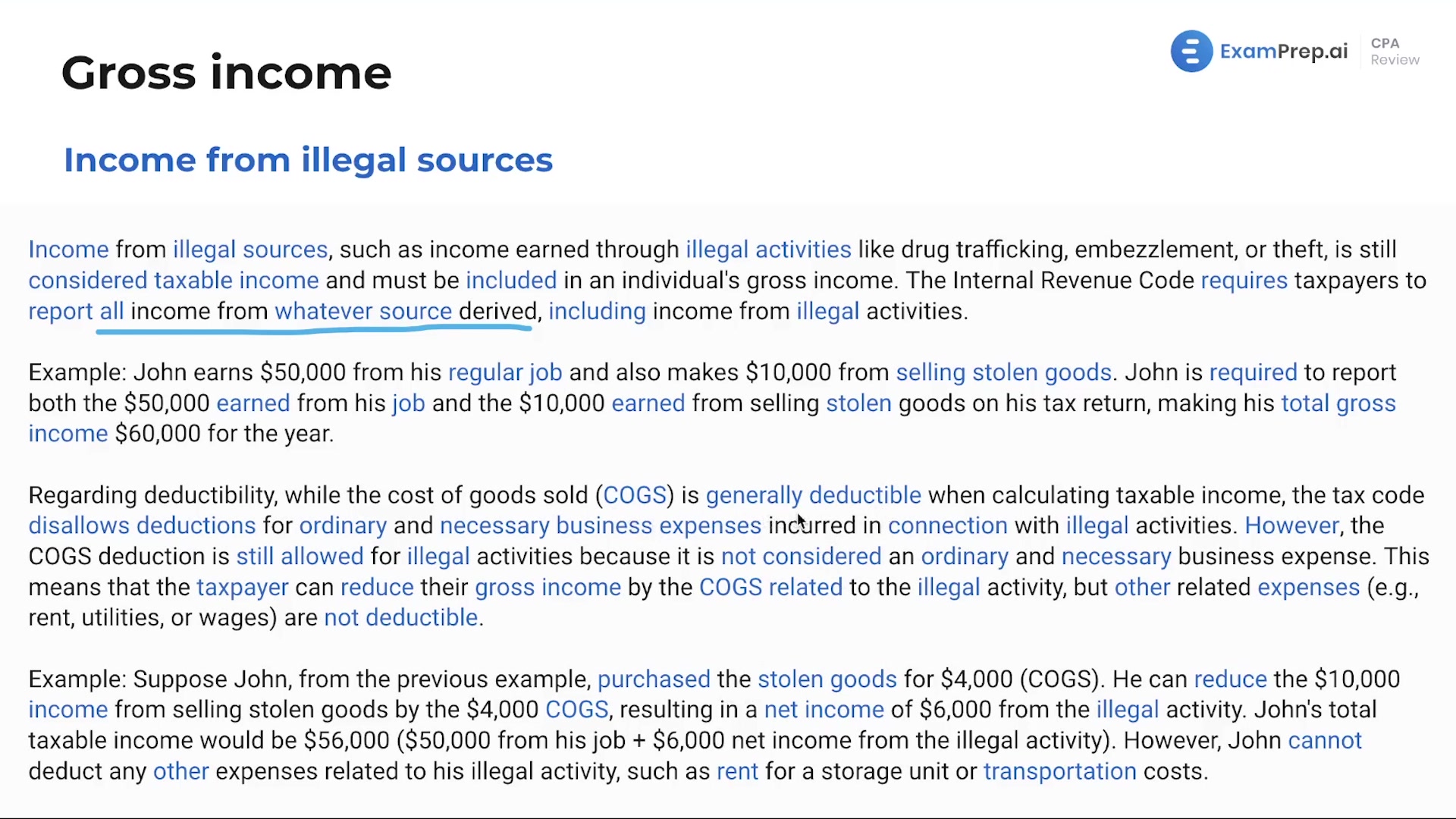

In this lesson, Nick Palazzolo, CPA, unfolds the intriguing topic of taxation of illegal income with a blend of humor to aid comprehension and retention. Explore the surprising concept that income from illegal activities, such as drug trafficking, embezzlement, or theft, is still taxable and must be included in gross income as per the IRS requirements. Nick uses the case of Al Capone to underline how even notorious figures can fall for tax evasion. He delves into specifics, like the inclusion of both legitimate and illegal income in the total gross income, and the deductions allowed—though limited—for cost of goods sold in illegal transactions. The lesson is peppered with examples that clarify which deductions are permitted and which aren't, ensuring a clear understanding of this peculiar aspect of tax law.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free