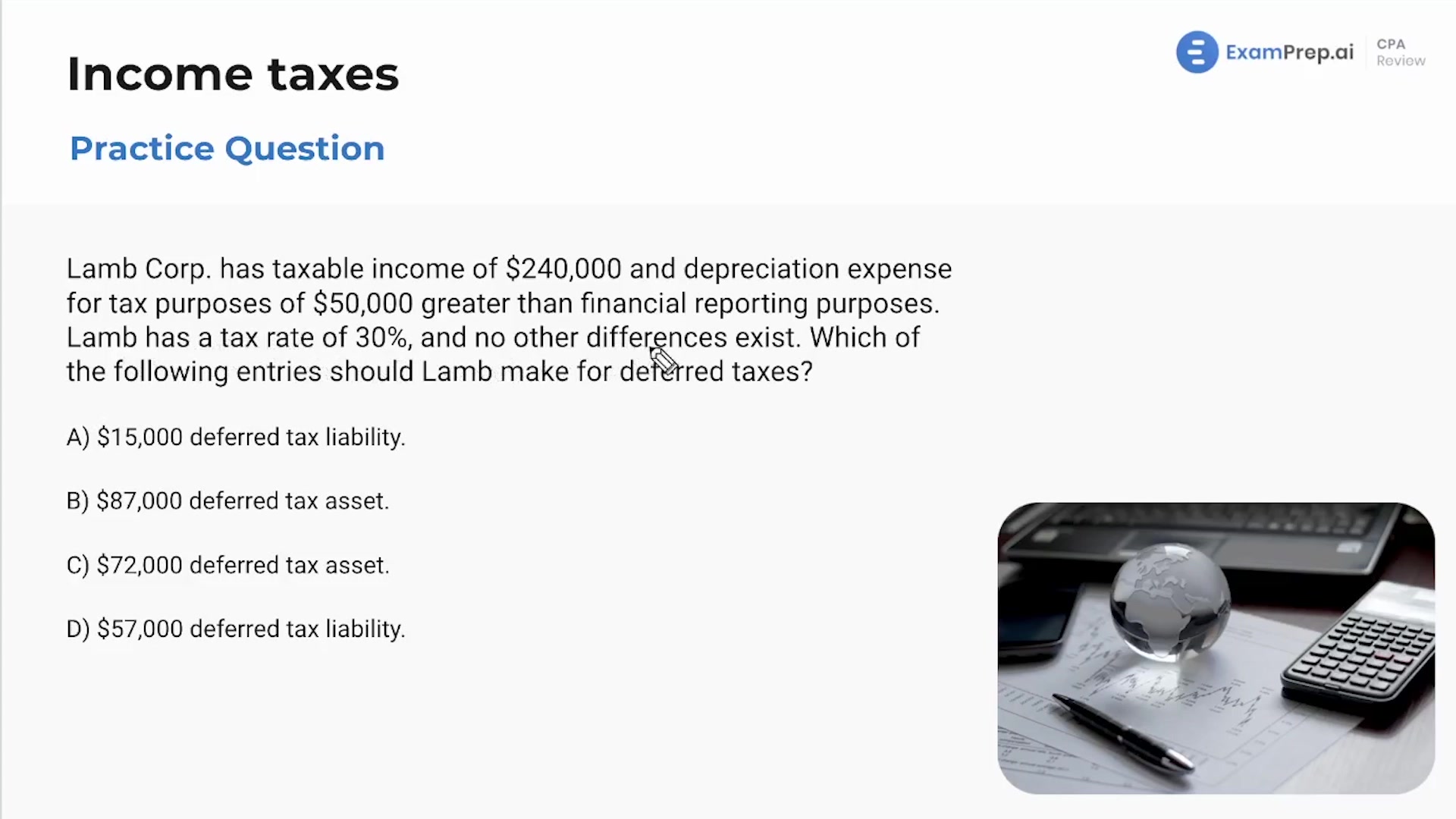

In this lesson, Nick Palazzolo, CPA, takes a deep dive into the intricacies of accounting for income taxes by addressing a couple of practice questions. He starts by clearing up confusions surrounding the primary objective of accounting for such taxes, breaking it down to the recognition of deferred tax assets and liabilities arising from temporary differences. Nick further illustrates how to calculate a deferred tax liability through a hands-on mathematical example that clarifies the distinctions between book and tax purposes. This explanation not only solidifies the conceptual understanding but also equips you with practical skills to handle similar problems encountered in financial reporting. By the end of the lesson, Nick ensures that the core concepts of income taxes are no longer just theoretical but also practically applicable.

This video and the rest on this topic are available with any paid plan.

See Pricing