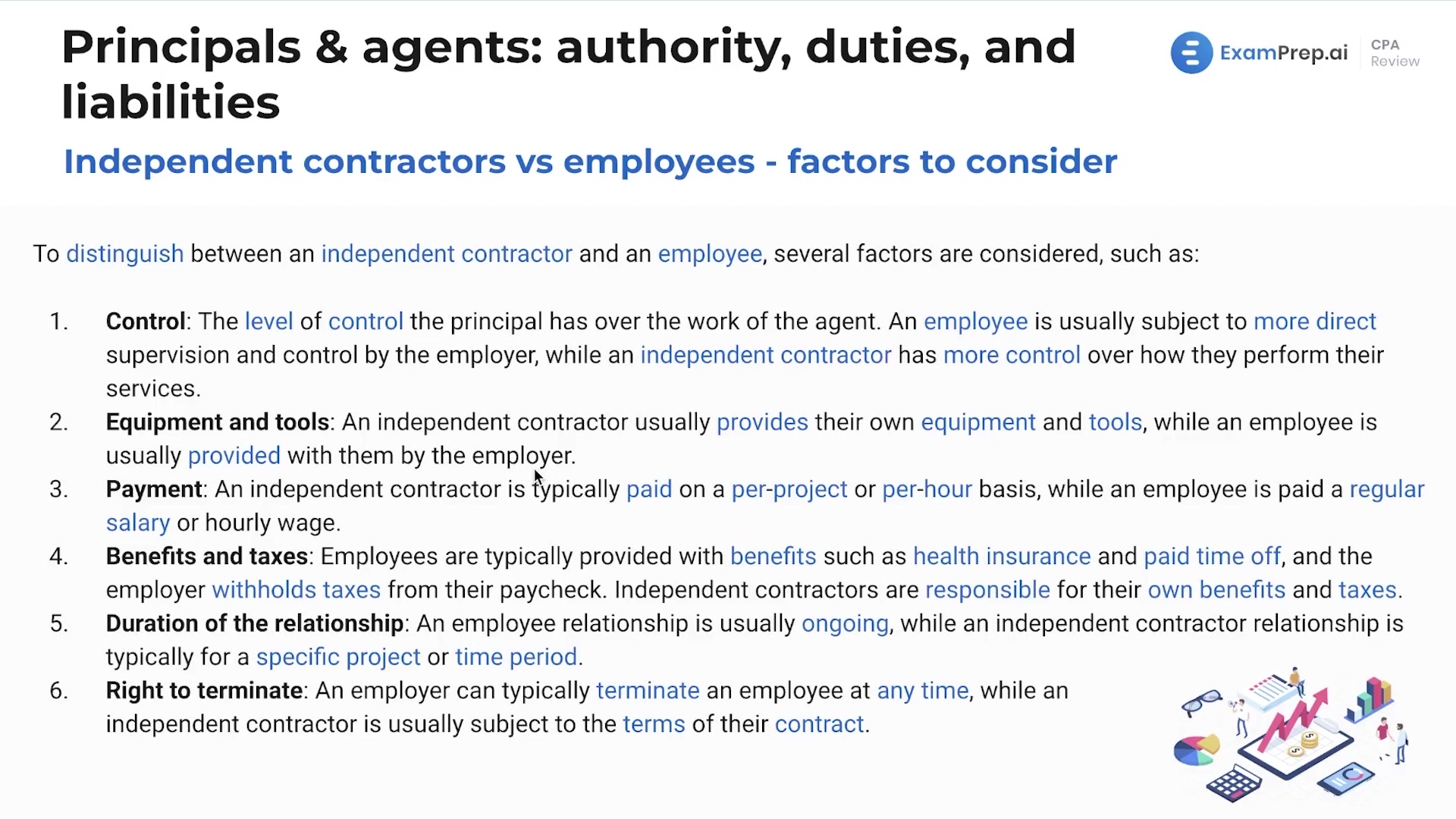

In this lesson, Nick Palazzolo, CPA, breaks down the distinctions between independent contractors and employees, emphasizing the repercussions these classifications have on control, independence, responsibilities, and legal liabilities. He guides through the real-world implications of these roles, particularly in terms of employee rights, benefits, and the legal ramifications for companies like Uber and Lyft in relation to accidents and responsibilities. Nick illustrates these points with real-life scenarios, showing how different factors such as the level of control, supply of tools, and payment methods contribute to determining someone's employment status. Additionally, he delves into what constitutes an independent contractor as an agent and navigates the nuances of agency law with clear, engaging examples, ensuring a comprehensive grasp of these crucial concepts.

This video and the rest on this topic are available with any paid plan.

See Pricing