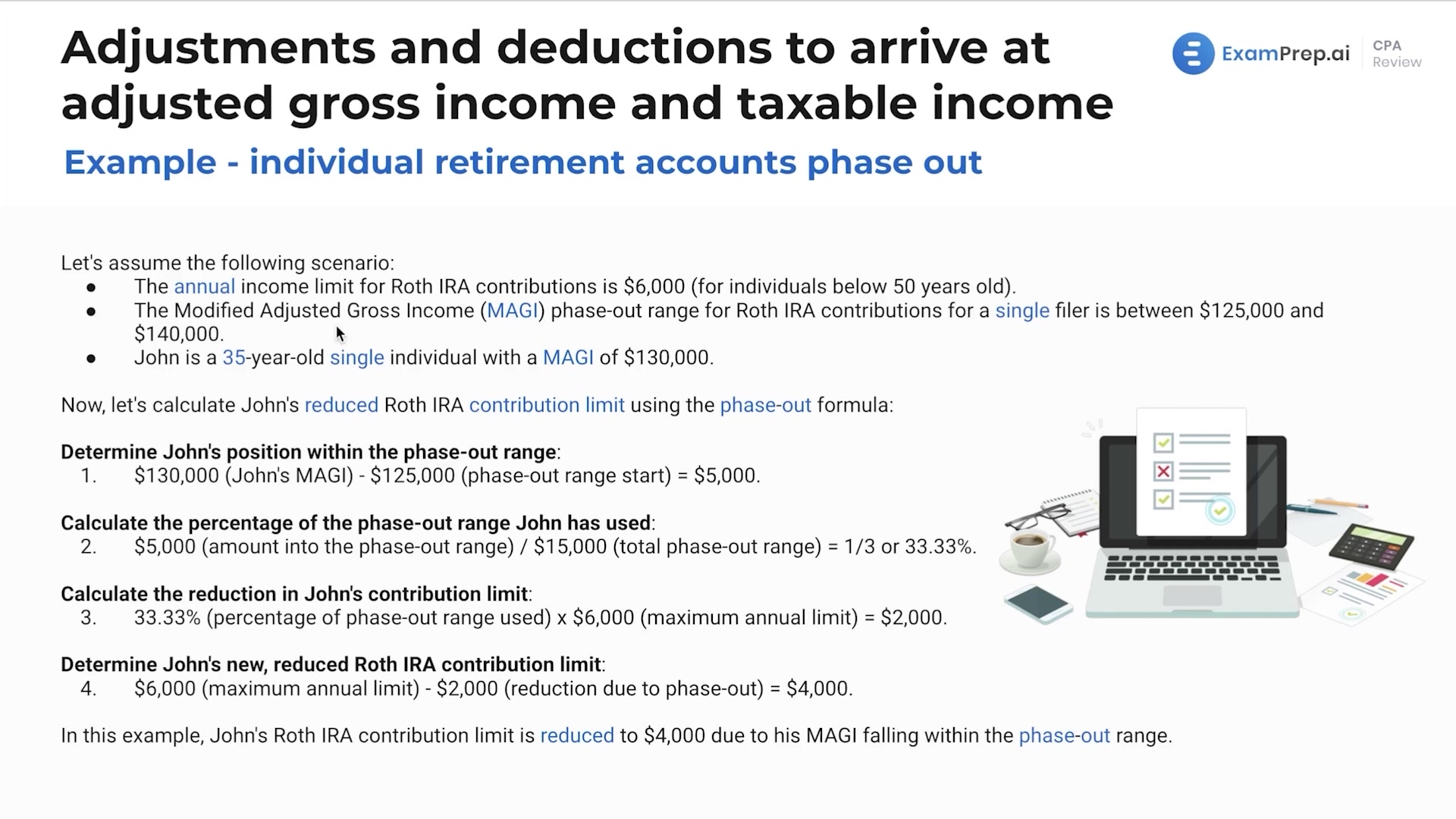

In this lesson, Nick Palazzolo, CPA, dives deep into the world of individual retirement accounts, breaking down the ins and outs of traditional and Roth IRAs, as well as non-deductible traditional IRAs. He elaborates on the tax advantages and unique characteristics of each type, including the tax treatment of contributions and distributions, and the specific conditions under which they grow. Nick illustrates how traditional IRAs offer tax-deferred contributions, while Roth IRAs allow for tax-free growth, and how non-deductible IRAs fit into the retirement planning landscape for those with higher incomes. Additionally, he clarifies the concept of earned income as it relates to contribution limits and provides practical examples to help demystify phase-out calculations. This lesson is essential for anyone looking to grasp the nuances of planning for retirement with an eye on tax implications.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free