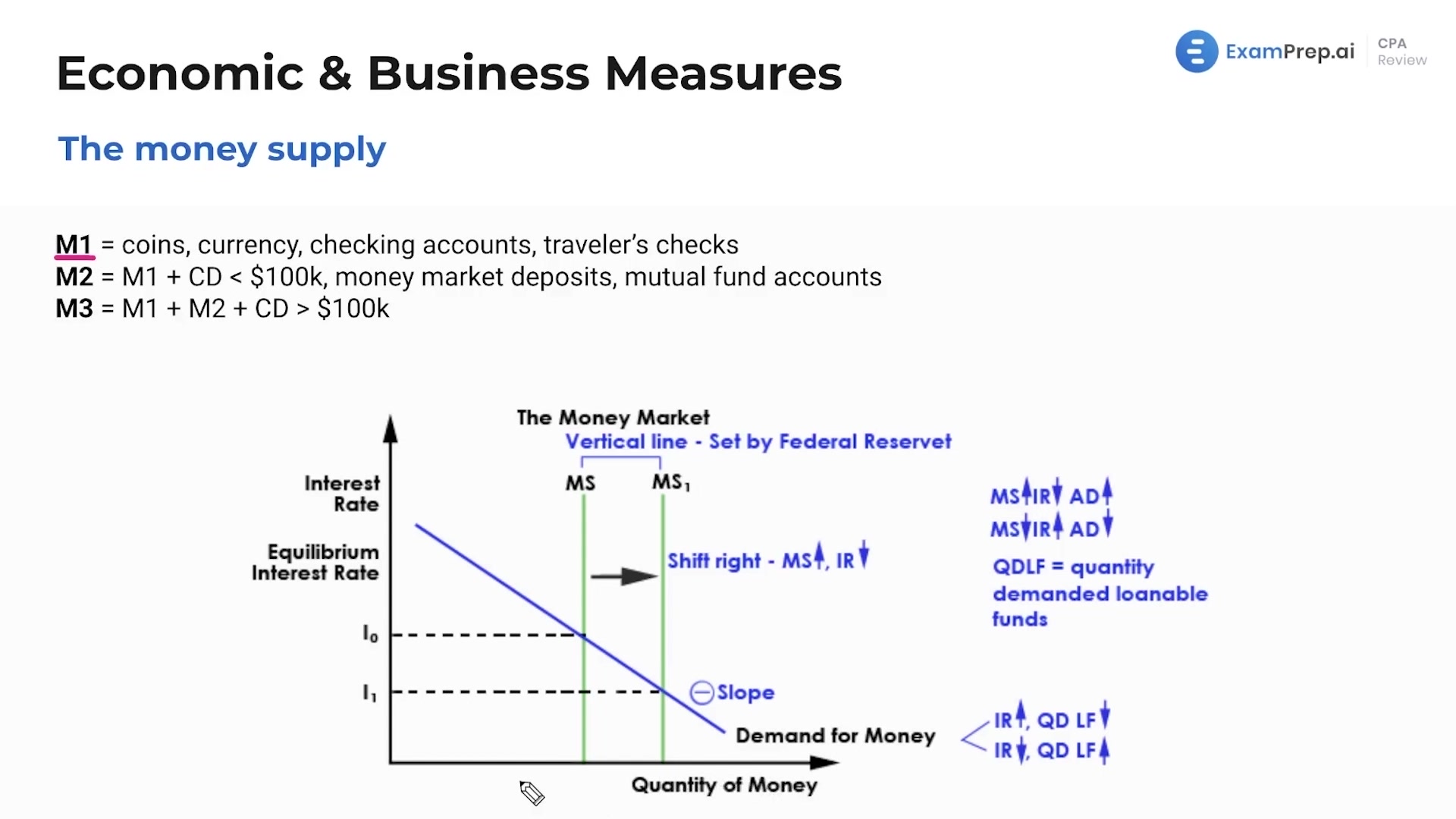

In this lesson, Nick Palazzolo, CPA, demystifies the concepts of inflation and deflation, describing their causes and implications on the economy. He simplifies how demand-pull and cost-push factors can lead to changes in price levels and output, punctuating his explanations with easy-to-understand graph interpretations. Nick also breaks down the complexities of the money supply by unpacking the nuances of M1, M2, and M3 money supplies, relating their liquidity and composition to real-world scenarios. The final portion of the lesson ties in nicely, detailing how the Federal Reserve's monetary policy influences interest rates through changes in the money supply, and illustrating the calculation of real interest rates by factoring in inflation. Wrapping up, Nick works through an example of how inflation impacts nominal dollars, giving a practical view of these economic principles at play.

This video and the rest on this topic are available with any paid plan.

See Pricing