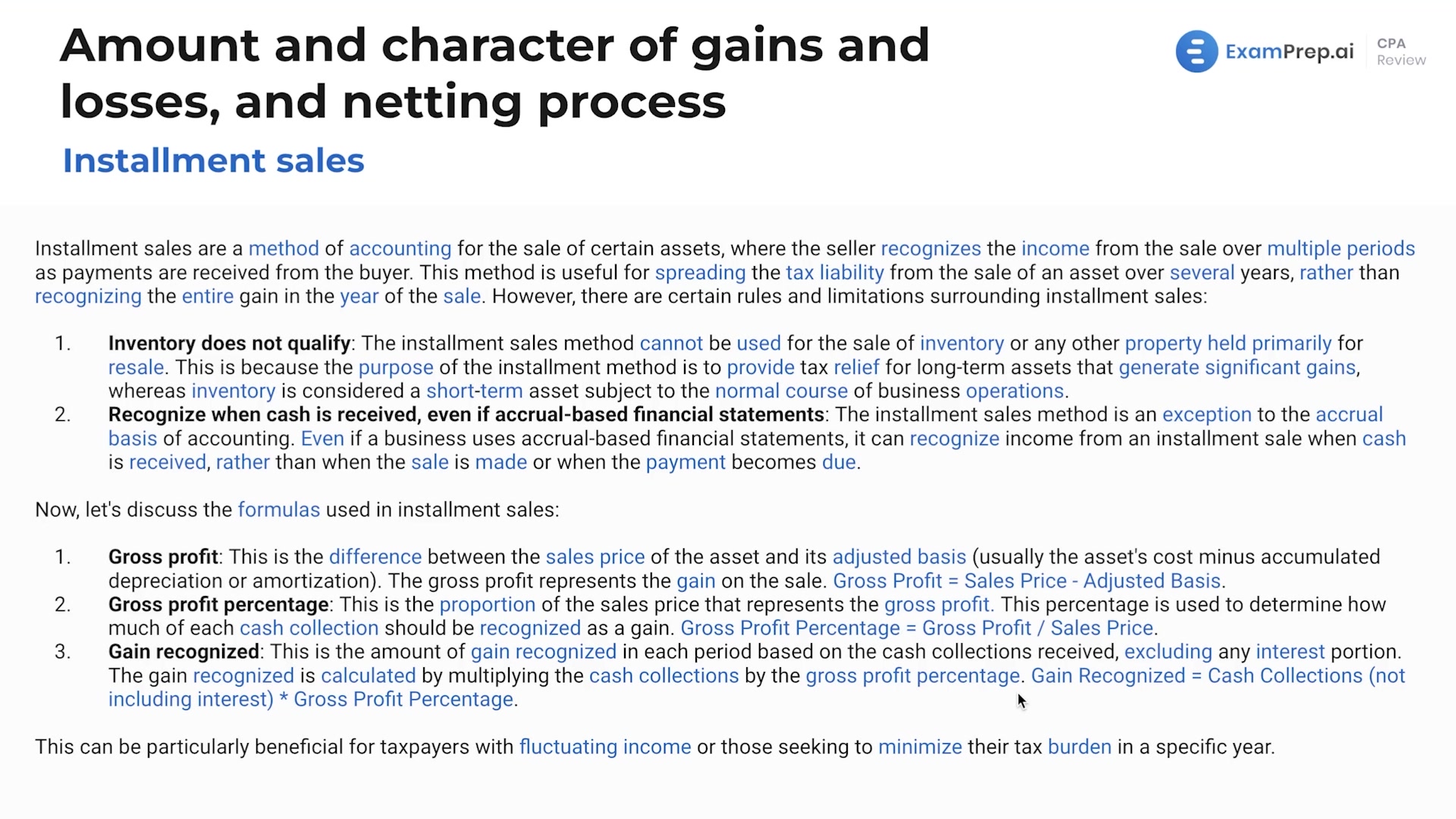

In this lesson, join Nick Palazzolo, CPA, for a deep dive into installment sales and their significance within the scope of accounting and taxation. Nick demystifies the process by defining installment sales and explaining the rationale behind spreading income recognition over the period payments are received. The lesson breaks down key concepts such as gross profit percentage, the timing of income recognition, and their practical application in tax calculations. Walk through detailed numerical examples that shed light on calculating the recognized gain per payment and become equipped to handle scenarios that involve installment sales, complete with Nick's expert guidance on navigating the subtleties of this method. Whether dealing with the sale of machinery or property, this session sheds light on how to manage installment sales for tax purposes effectively.

This video and the rest on this topic are available with any paid plan.

See Pricing