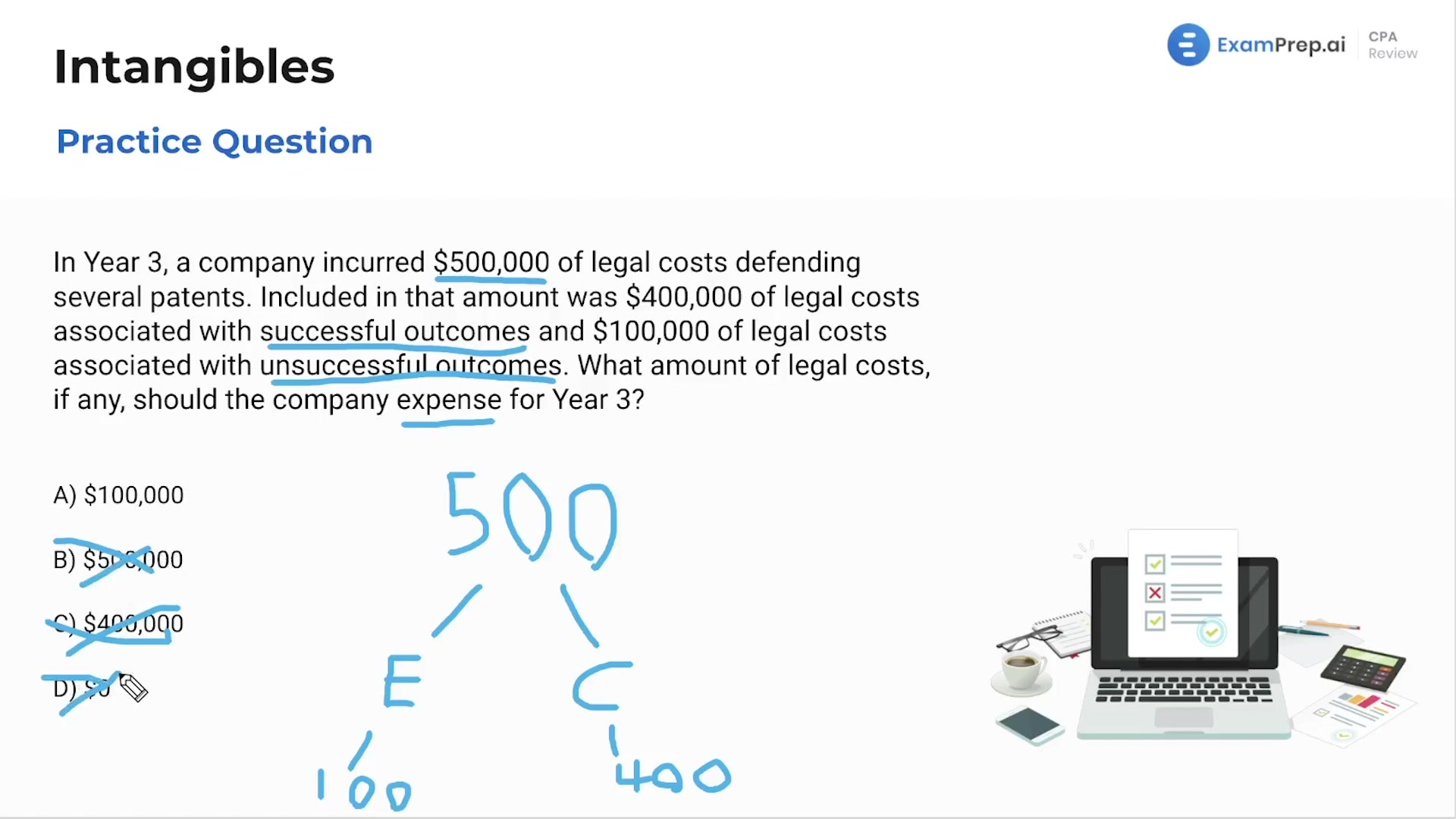

In this lesson, Nick Palazzolo, CPA, breaks down the intricate details of accounting for intangible assets, using practical examples to elucidate the differentiation between expensed costs and capitalizable costs. He walks through the specific treatment of legal costs associated with defending patents, clarifying which expenses should hit the income statement and which should be capitalized and amortized over the asset's life. Nick also demystifies the recognition of goodwill on the balance sheet, offering a clear explanation of when goodwill should be acknowledged as an intangible asset. This engaging run-through of practice questions provides clarification on these nuanced topics, coupled with Nick's encouraging reminder that consistent practice is the key to acing these concepts.

This video and the rest on this topic are available with any paid plan.

See Pricing