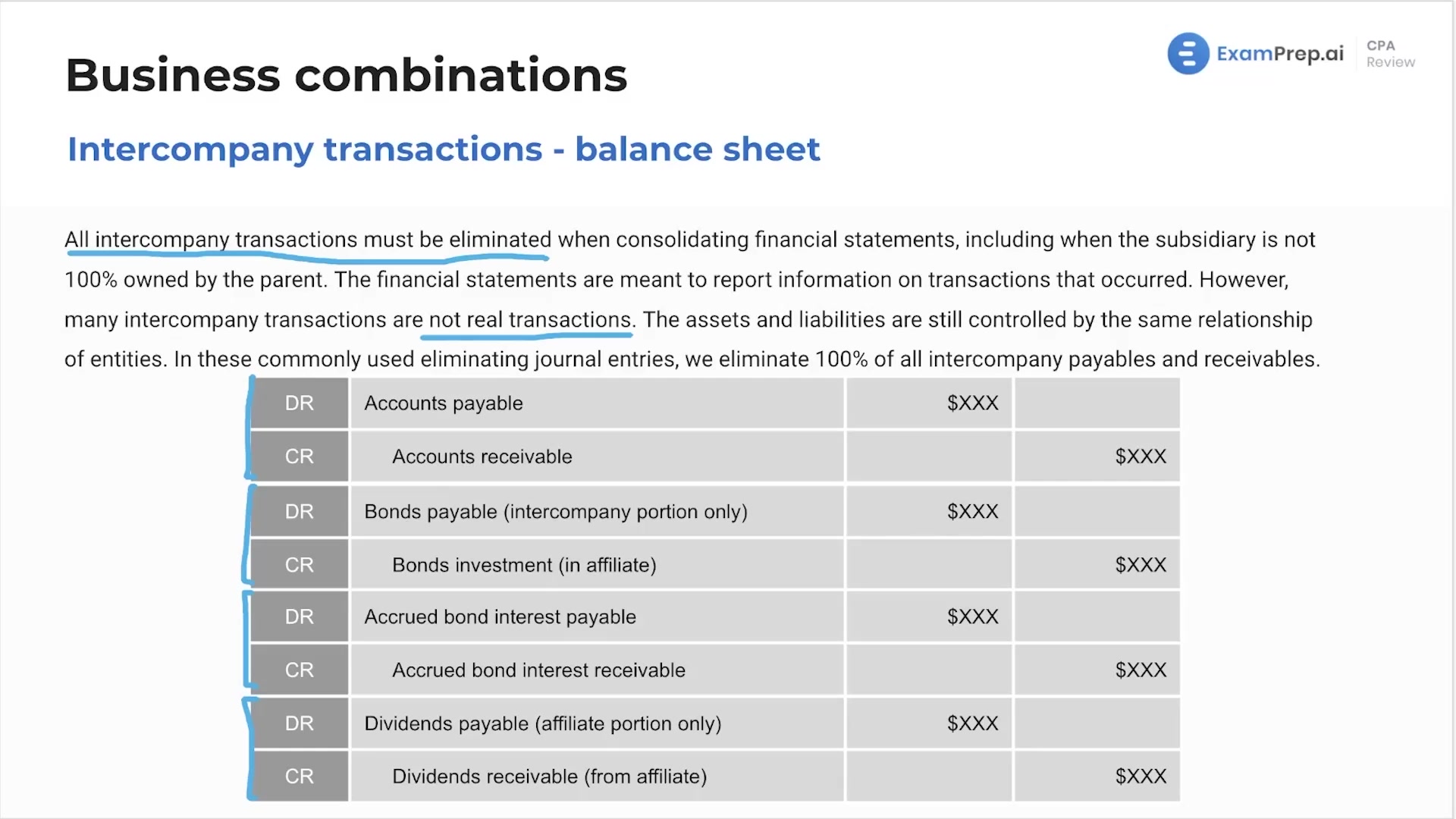

In this lesson, Nick Palazzolo, CPA, simplifies the complex world of intercompany transactions, walking through the process of identifying and eliminating them from consolidated financial statements. Nick breaks down the rationale behind removing transactions that occur within the same entity group—debunking the illusion of actual sales or loans between a parent company and its subsidiary. He conveys the vital principle that real income and expenses are not generated through these internal dealings and demonstrates, with vivid examples, how to correct financial statements to reflect this reality. With a clear explanation of eliminating entries and practical tips for handling tricky questions, the session aims to make this challenging topic accessible and approachable.

This video and the rest on this topic are available with any paid plan.

See Pricing