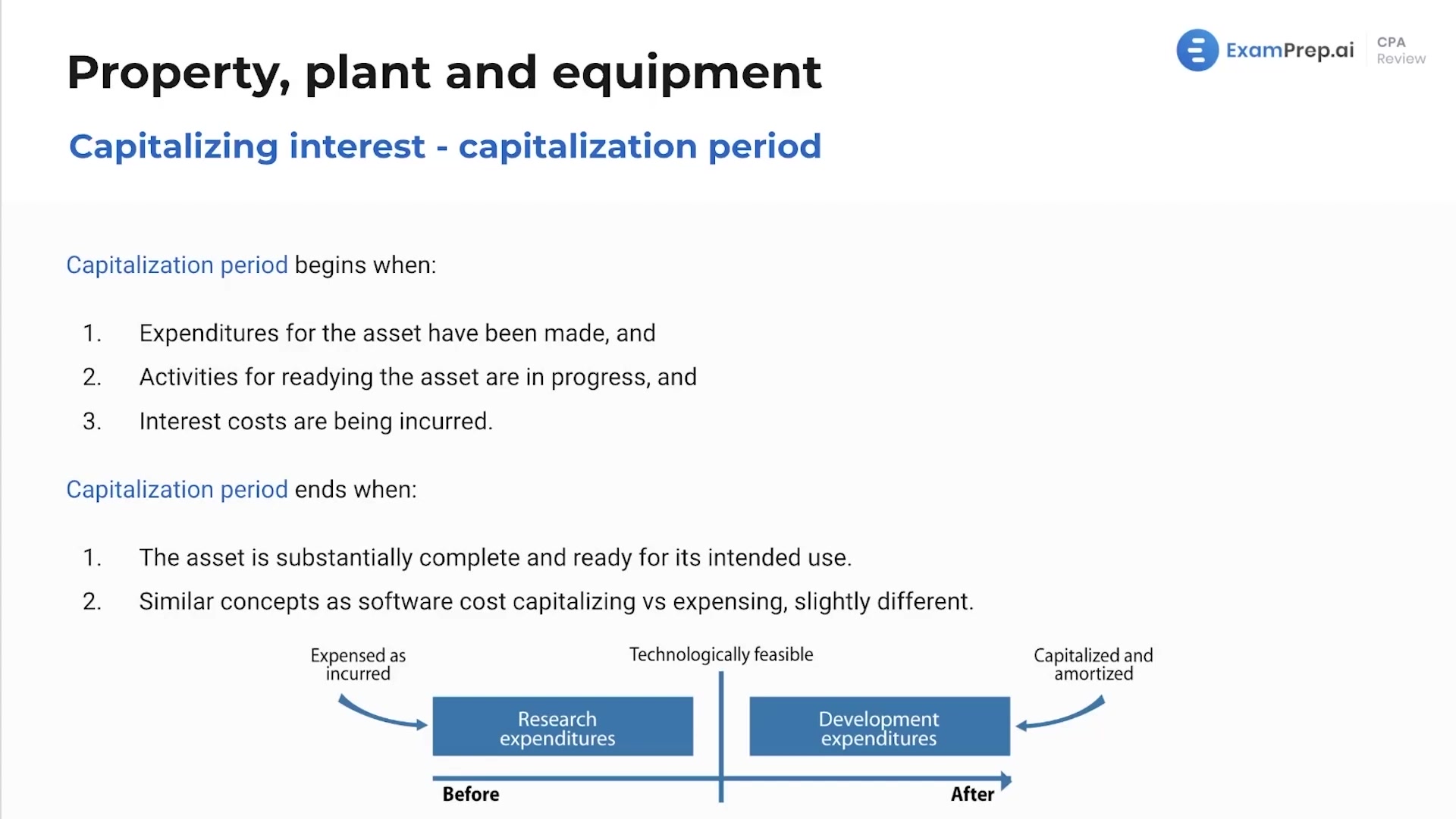

In this lesson, Nick Palazzolo, CPA, breaks down the concept of interest capitalization with a focus on understanding which assets can have their interest capitalized during construction or installation. He clarifies the period during which interest should be capitalized and demonstrates how to determine the amount that can be capitalized. Throughout the lesson, Nick offers insight into the nuances of this accounting procedure, outlining the instances when construction halts and the implications for interest capitalization. He also compares these principles to similar concepts in research and development and software costs, providing a cross-reference that enriches the learning experience. Additionally, Nick explains the decision-making process between actual and avoidable interest costs, ensuring a practical approach to mastering this aspect of accounting.

This video and the rest on this topic are available with any paid plan.

See Pricing