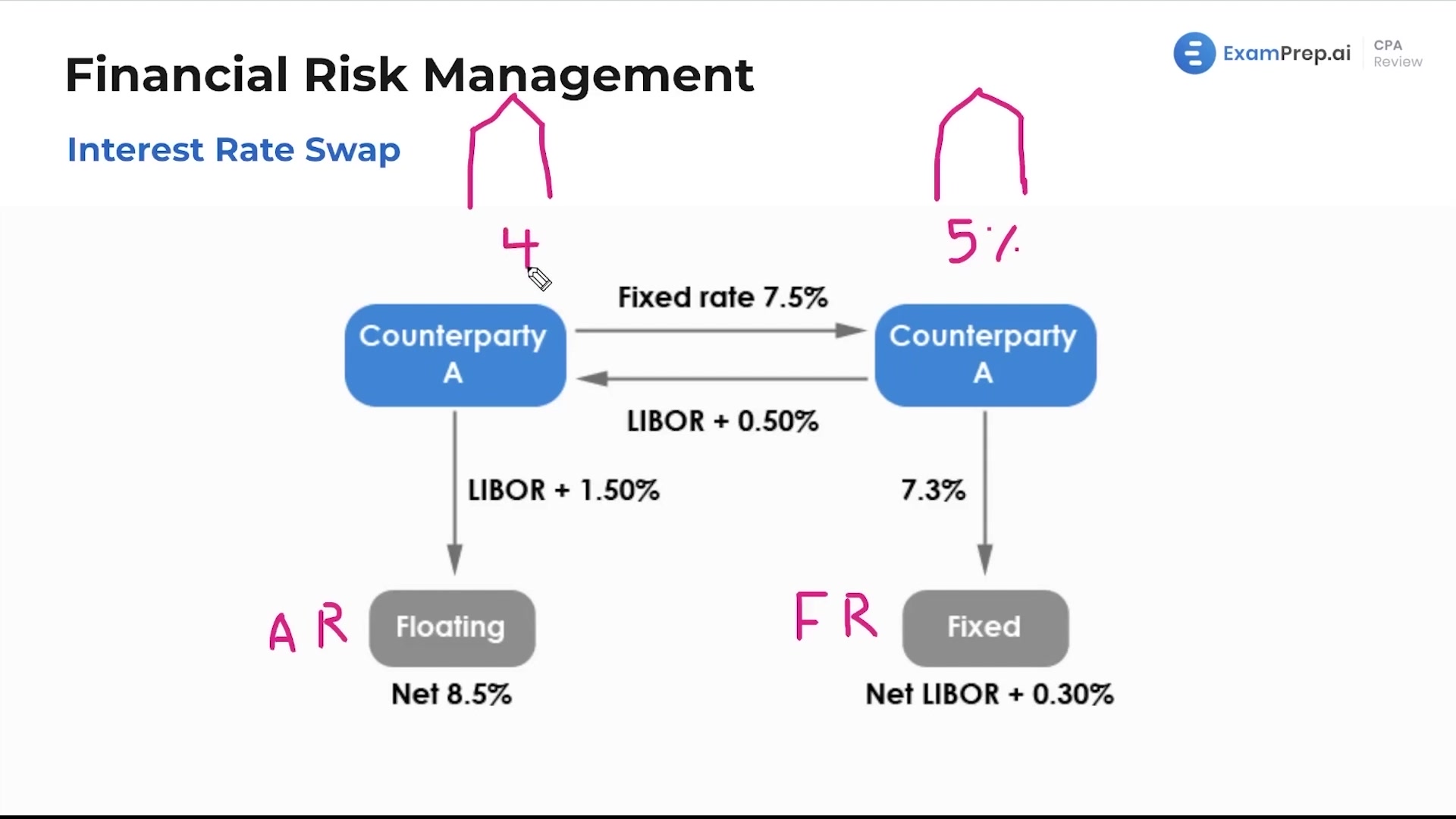

In this lesson, Nick Palazzolo, CPA, breaks down the complexities of interest rate swaps using an everyday analogy that hits close to home—literally. Nick cleverly compares interest rate swaps to neighbors at a barbecue discussion, where one has a fixed-rate mortgage and the other has an adjustable-rate mortgage. With a lively illustration of neighbors anticipating a rise and fall in interest rates, Nick explains how they might decide to 'swap' interest rates to hedge against future fluctuations. Using a potential move from 5% to either 10% or 1%, Nick demystifies the concept of interest rate swap and how it functions essentially as an insurance policy, emphasizing that while there can be winners and losers in this agreement, the core idea is to mitigate risk rather than predict outcomes.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free